Arizona Form 165 Instructions 2021

Arizona Form 165 Instructions 2021 - Web arizona partnership income tax return instructions (165) department of revenue home us arizona agencies department of revenue arizona partnership income tax. Web arizona basis from form 165, page 1, line 6. • all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web use arizona form 165 and check the box labeled “amended” to file an amended return for all other changes to the partnership’s arizona income tax return for taxable year 2021. Sign it in a few clicks draw your signature, type it,. You can download or print. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Nonresident individuals should report the amounts in column (c). Web corporate payment type options include: If there is no net adjustment, the resident partner.

Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Web arizona partnership income tax return instructions (165) department of revenue home us arizona agencies department of revenue arizona partnership income tax. Nonresident individuals should report the amounts in column (c). Web 24 rows yearly partnership income tax return. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Corporate partners see form 120 or form 120a instructions for information on reporting the amount from. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Submit the 2021 arizona form 165pa to report a federal imputed underpayment for tax year 2021 or an aar filed. Web arizona form 2021 arizona partnership income tax return 165 for information or help, call one of the numbers listed: Web we last updated the arizona partnership income tax return in february 2023, so this is the latest version of form 165, fully updated for tax year 2022.

Payments, and, • use form 120ext only to apply for an extension of time to file forms 120, 120a, 120s, 99t, 99m, or 165. Web 24 rows yearly partnership income tax return. Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every. • all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web corporate payment type options include: Submit the 2021 arizona form 165pa to report a federal imputed underpayment for tax year 2021 or an aar filed. You can download or print. Web the bottom of arizona form 165pa. Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Web 8 rows form year form instructions publish date;

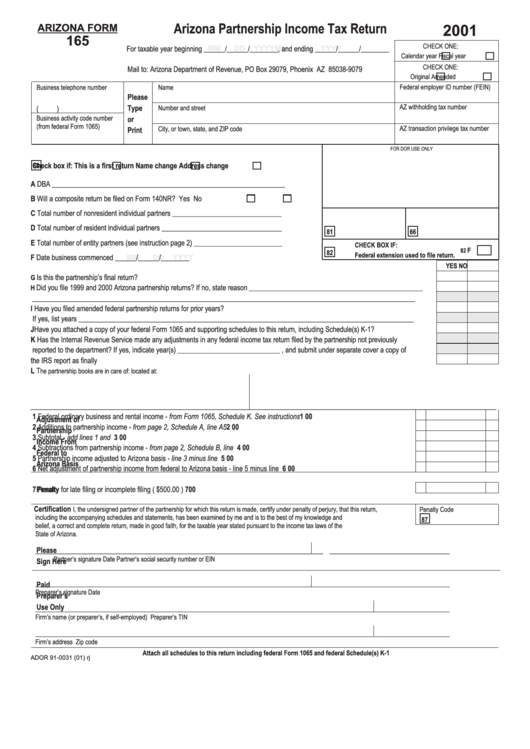

Arizona Form 165 Arizona Partnership Tax Return 2001

Web the bottom of arizona form 165pa. Web arizona basis from form 165, page 1, line 6. If there is no net adjustment, the resident partner. Line 29 or 41 note: Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the.

DD Form 165 Fill Out, Sign Online and Download Fillable PDF

Web the bottom of arizona form 165pa. Web corporate payment type options include: Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Starting with the 2020 tax. Web arizona form 2021 arizona partnership income tax return 165 for information or help, call.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web arizona basis from form 165, page 1, line 6. Web 8 rows form year form instructions publish date; Web use arizona form 165 and check the box labeled “amended” to file an amended return for all other changes to the partnership’s arizona income.

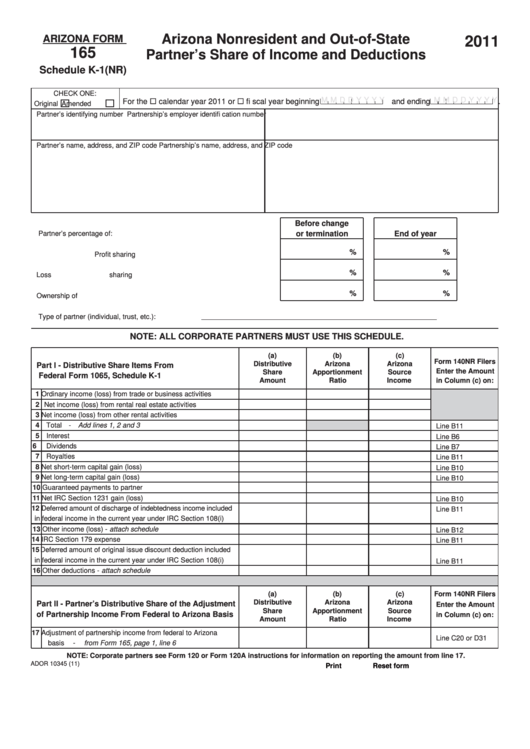

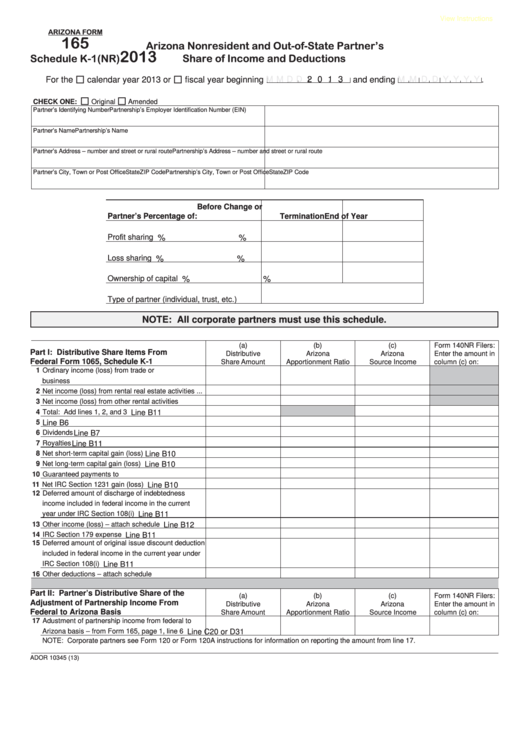

Fillable Arizona Form 165 Schedule K1(Nr) Arizona Nonresident And

Web arizona partnership income tax return instructions (165) department of revenue home us arizona agencies department of revenue arizona partnership income tax. Web use arizona form 165 and check the box labeled “amended” to file an amended return for all other changes to the partnership’s arizona income tax return for taxable year 2021. Web arizona basis from form 165, page.

Fillable Schedule K1(Nr) (Arizona Form 165) Arizona Nonresident And

If there is no net adjustment, the resident partner. You can download or print. Web we last updated the arizona partnership income tax return in february 2023, so this is the latest version of form 165, fully updated for tax year 2022. Line 29 or 41 note: Starting with the 2020 tax.

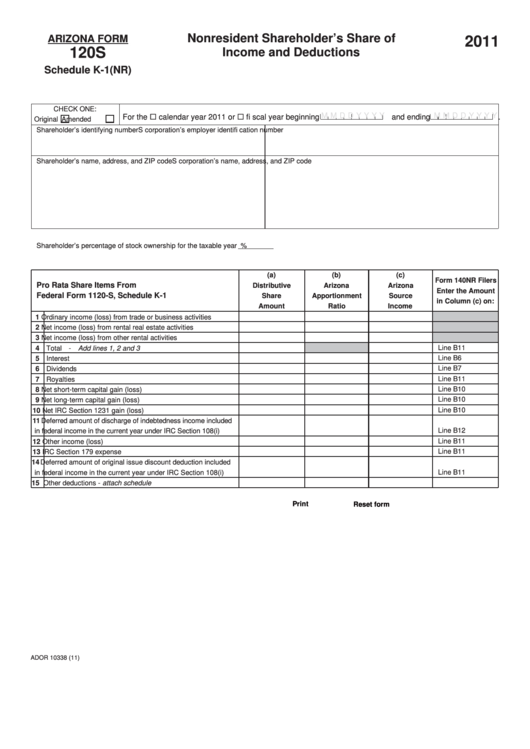

Fillable Arizona Form 120s Schedule K1(Nr) Nonresident Shareholder

Payments, and, • use form 120ext only to apply for an extension of time to file forms 120, 120a, 120s, 99t, 99m, or 165. Web the bottom of arizona form 165pa. Web arizona form 2021 arizona partnership income tax return 165 for information or help, call one of the numbers listed: Web corporate payment type options include: Web we last.

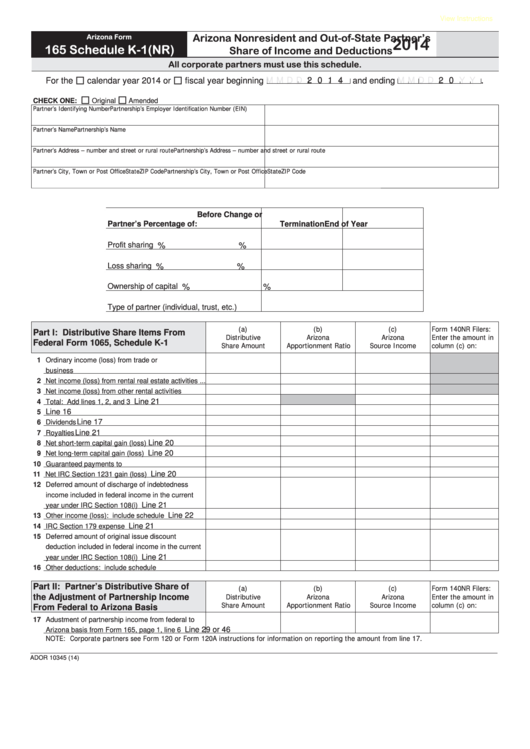

Fillable Arizona Form 165 Schedule K1(Nr) Arizona Nonresident And

If there is no net adjustment, the resident partner. Sign it in a few clicks draw your signature, type it,. Web corporate payment type options include: Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Web arizona basis.

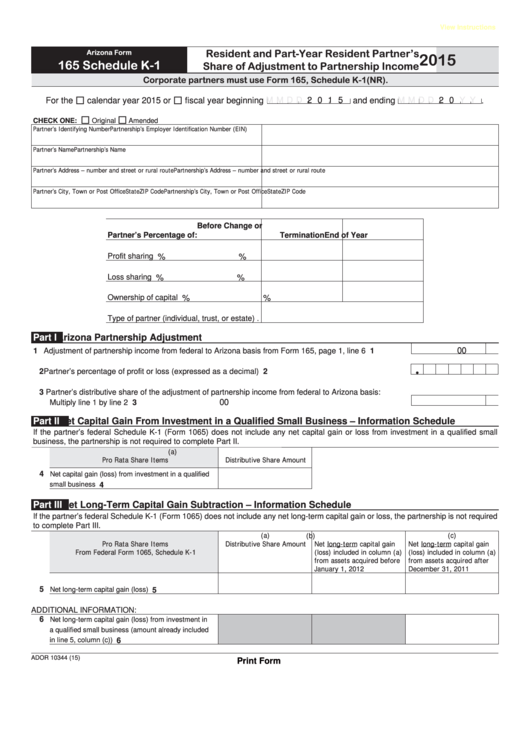

Fillable Arizona Form 165 (Schedule K1) Resident And PartYear

Nonresident individuals should report the amounts in column (c). Web arizona form 2021 arizona partnership income tax return 165 for information or help, call one of the numbers listed: Web corporate payment type options include: Web 24 rows yearly partnership income tax return. Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before.

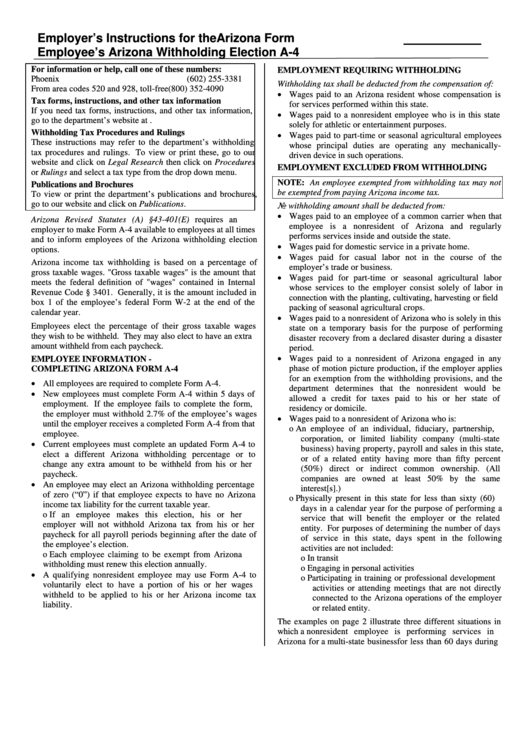

Arizona Form A4 Employer'S Instructions For The Employee'S Arizona

Web use arizona form 165 and check the box labeled “amended” to file an amended return for all other changes to the partnership’s arizona income tax return for taxable year 2021. Line 29 or 41 note: Payments, and, • use form 120ext only to apply for an extension of time to file forms 120, 120a, 120s, 99t, 99m, or 165..

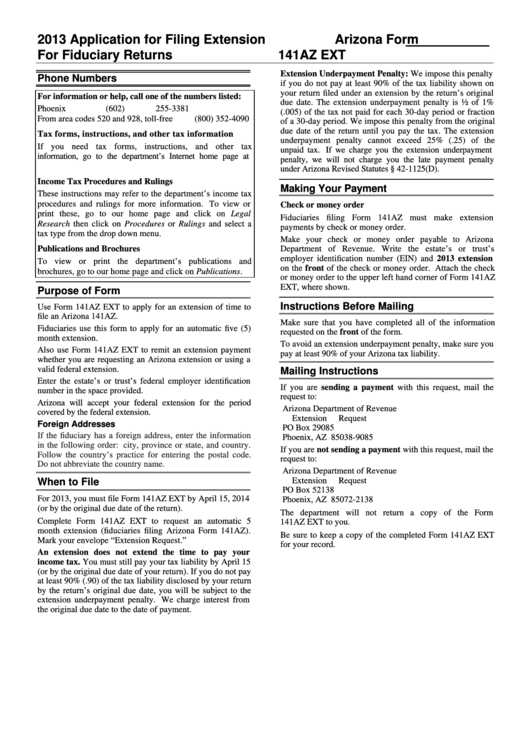

Instructions For Arizona Form 141az Ext 2013 printable pdf download

Line 29 or 41 note: Payments, and, • use form 120ext only to apply for an extension of time to file forms 120, 120a, 120s, 99t, 99m, or 165. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Web general instructions who.

Sign It In A Few Clicks Draw Your Signature, Type It,.

Starting with the 2020 tax. Web arizona form 2021 arizona partnership income tax return 165 for information or help, call one of the numbers listed: Web 8 rows form year form instructions publish date; Web use arizona form 165 and check the box labeled “amended” to file an amended return for all other changes to the partnership’s arizona income tax return for taxable year 2021.

Edit Your Form Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

You can download or print. Web arizona basis from form 165, page 1, line 6. Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every.

Web Arizona Partnership Income Tax Return Instructions (165) Department Of Revenue Home Us Arizona Agencies Department Of Revenue Arizona Partnership Income Tax.

Submit the 2021 arizona form 165pa to report a federal imputed underpayment for tax year 2021 or an aar filed. Corporate partners see form 120 or form 120a instructions for information on reporting the amount from. Nonresident individuals should report the amounts in column (c). • all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •.

Line 29 Or 41 Note:

Web 24 rows yearly partnership income tax return. Payments, and, • use form 120ext only to apply for an extension of time to file forms 120, 120a, 120s, 99t, 99m, or 165. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Web the bottom of arizona form 165pa.