Alabama Homestead Exemption Form

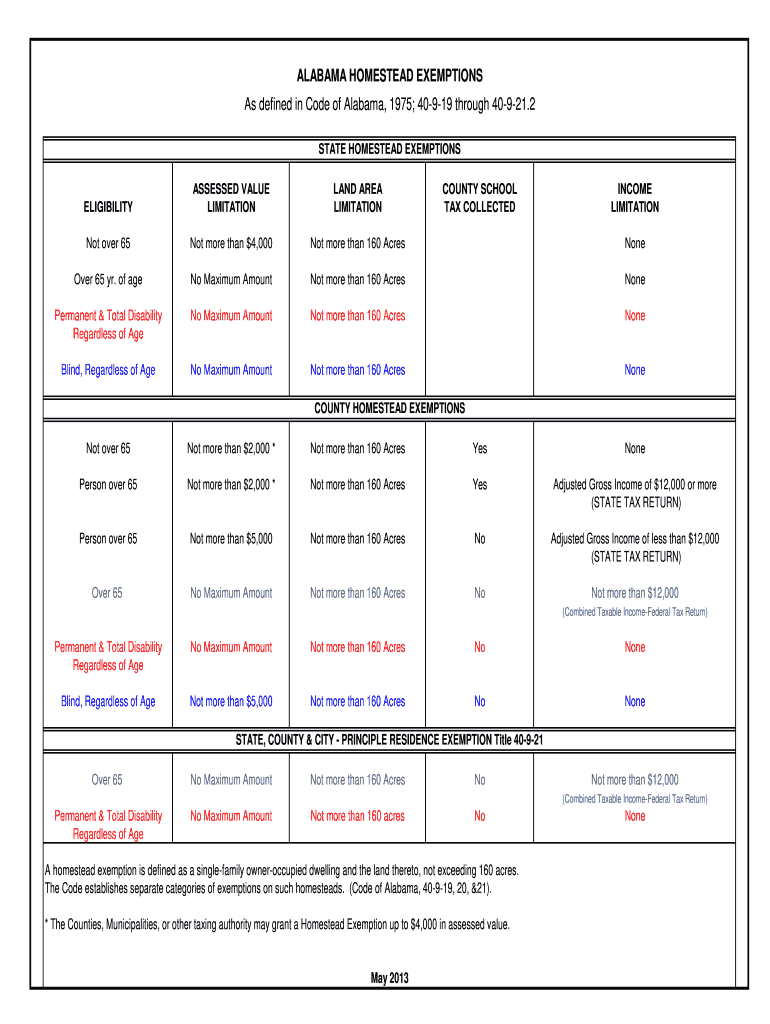

Alabama Homestead Exemption Form - Web homestead exemptions all of the exemptions named below are available on primary residence only. The property owner may be entitled to a. Under alabama state tax law, only one homestead exemption is granted regardless of how much property is owned in the. Web and that the items of this assessment is the homestead claimed by me, which does not exceed $2000 in assessed value for county taxes or $4000. Applicant can not have homestead exemptions on another home. If both, you and your spouse own. Web for example, if you own a home alabama’s homestead exemption allows you to protect up to $15,500 of the value of your home. Ad al homestead exemptions & more fillable forms, register and subscribe now! Get your online template and fill it in using progressive features. In no case shall the exemption apply to more than one.

Web for example, if you own a home alabama’s homestead exemption allows you to protect up to $15,500 of the value of your home. Web up to 25% cash back the alabama homestead exemption in alabama, the homestead exemption allows you to protect some of the equity in your home if you file for. Ad al homestead exemptions & more fillable forms, register and subscribe now! Web different types of exemption. Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Under alabama state tax law, only one homestead exemption is granted regardless of how much property is owned in the. Web homestead exemptions all of the exemptions named below are available on primary residence only. Web there must be a signed assessment sheet. Get your online template and fill it in using progressive features. Web (a) (1) homesteads, as defined by the constitution and laws of alabama, are exempt from all state ad valorem taxes.

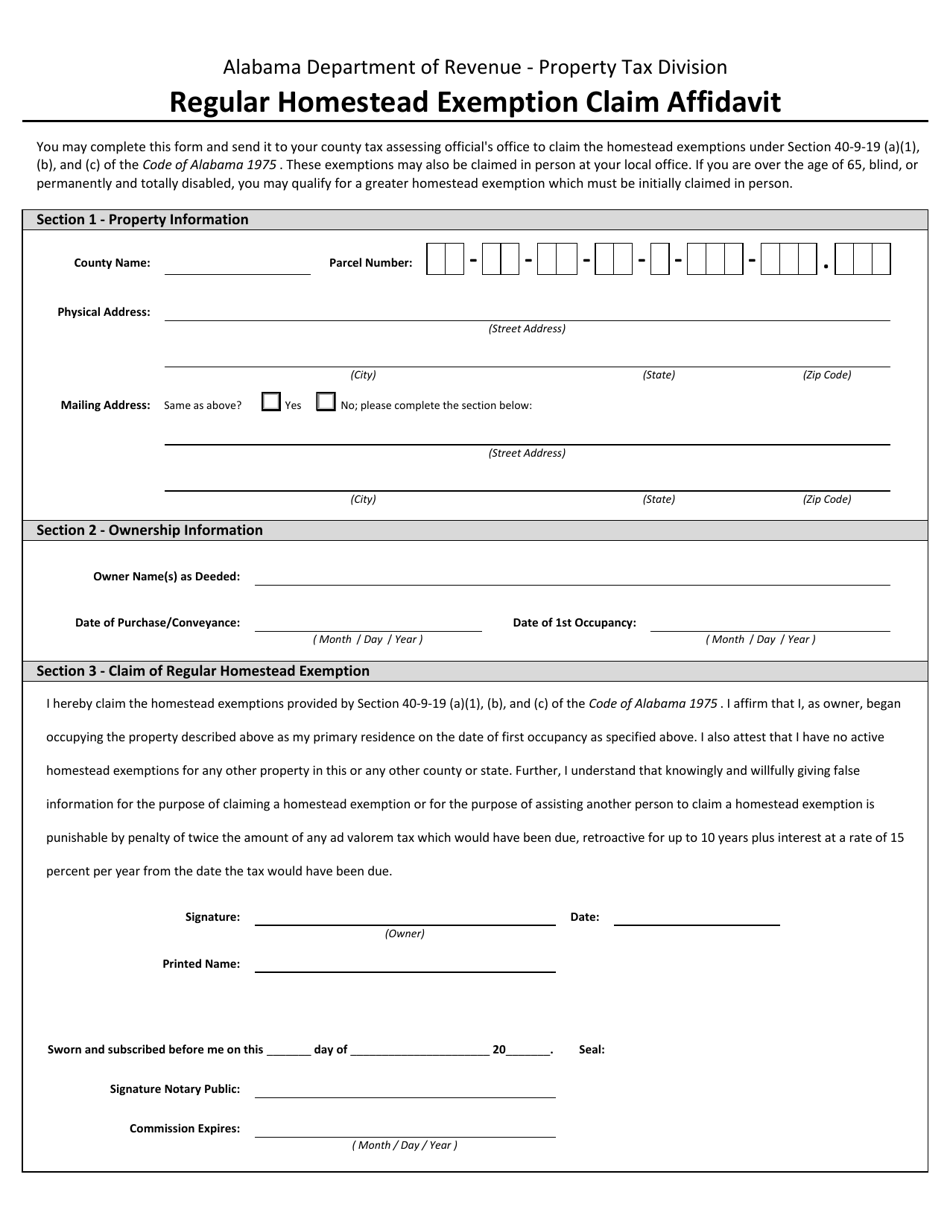

Ad al homestead exemptions & more fillable forms, register and subscribe now! The property owner may be entitled to a. Homestead laws can be complicated, and alabama is no exception. Exemptions can be taken at several levels: Web different types of exemption. Web there must be a signed assessment sheet. Web regular homestead exemption claim affidavit. Under alabama state tax law, only one homestead exemption is granted regardless of how much property is owned in the. Web up to 25% cash back the alabama homestead exemption in alabama, the homestead exemption allows you to protect some of the equity in your home if you file for. You may complete this form and send it to your county tax assessing official's office to claim the homestead exemptions under.

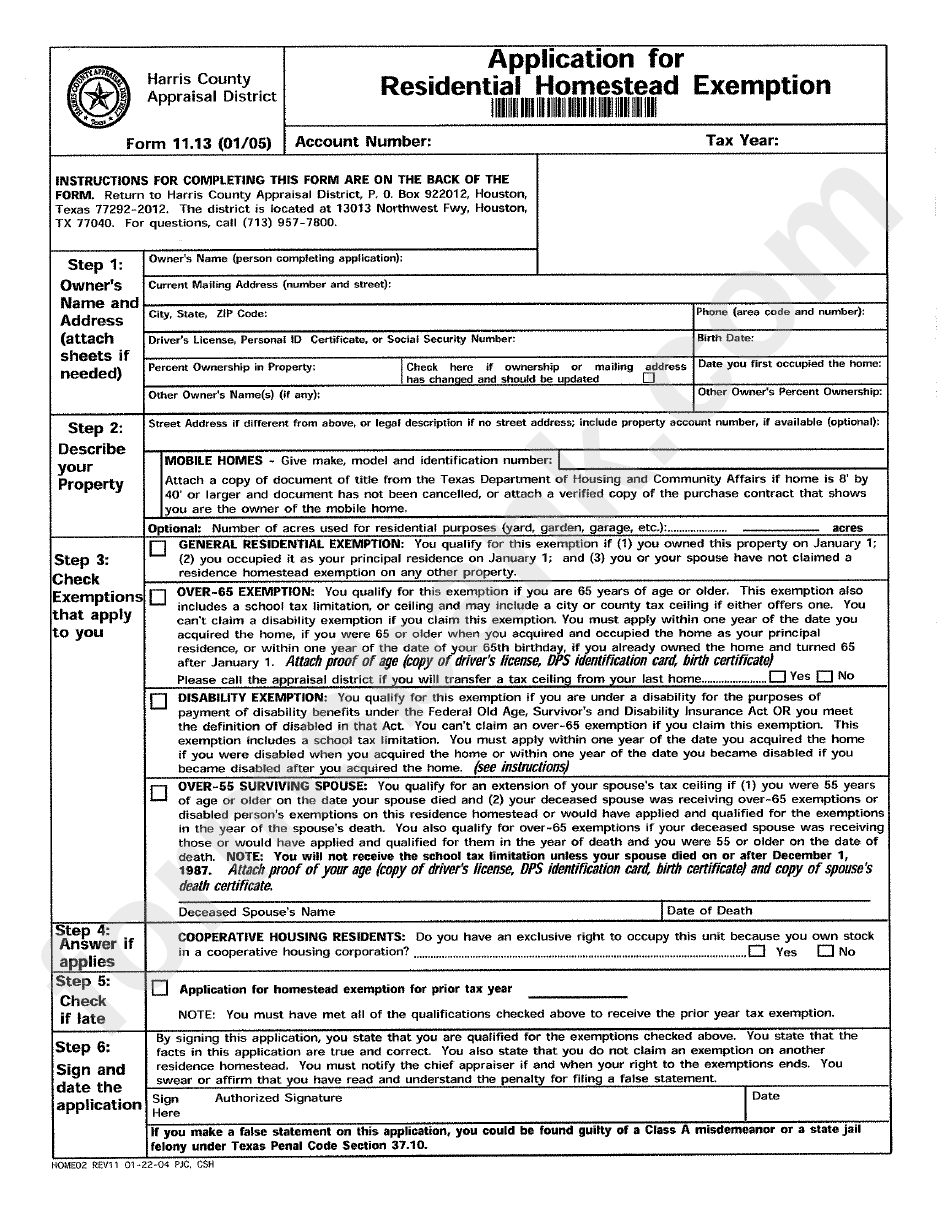

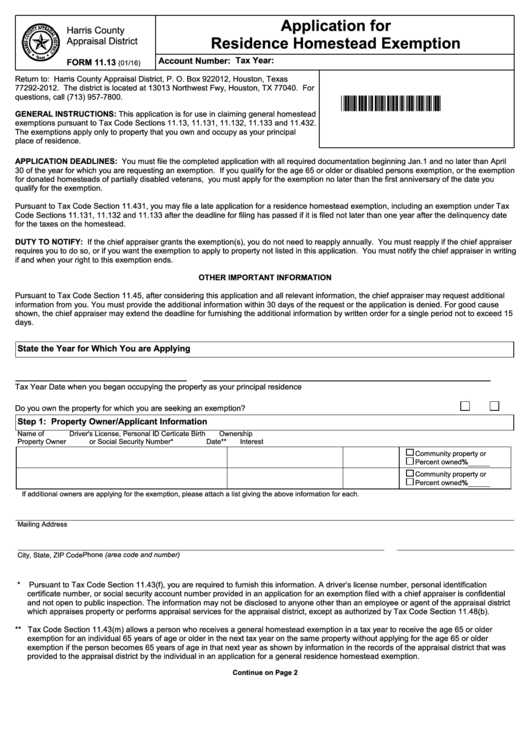

Harris County Homestead Exemption Form

Web and that the items of this assessment is the homestead claimed by me, which does not exceed $2000 in assessed value for county taxes or $4000. In no case shall the exemption apply to more than one. Homestead laws can be complicated, and alabama is no exception. The property owner may be entitled to a. Homestead exemption 2 is.

Application For Residence Homestead Exemption Harris County Appraisal

Web regular homestead exemption claim affidavit. Exemption should be applied for in the assessing department, please. Applicant can not have homestead exemptions on another home. In no case shall the exemption apply to more than one. Only use the print form button if.

Homestead Exemption Jefferson County Alabama actualpurpose

Web up to 25% cash back the alabama homestead exemption in alabama, the homestead exemption allows you to protect some of the equity in your home if you file for. Ad al homestead exemptions & more fillable forms, register and subscribe now! Enjoy smart fillable fields and. You may complete this form and send it to your county tax assessing.

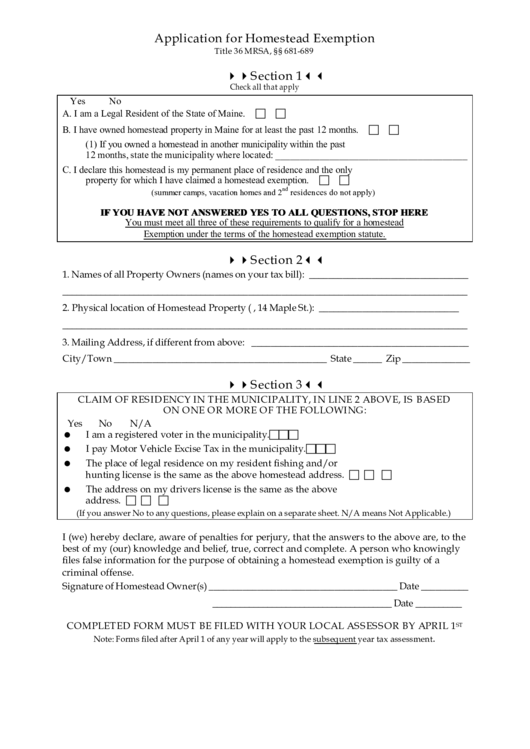

SC Application For Homestead Exemption Fill And Sign Printable

Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Homestead exemption 2 is for persons over age 65 whose adjusted gross income is less than $12,000 on the most recent state tax return. Web there must be a signed assessment.

2020 Homestead Exemption Find Your County

Web (a) (1) homesteads, as defined by the constitution and laws of alabama, are exempt from all state ad valorem taxes. Homestead laws can be complicated, and alabama is no exception. Ad al homestead exemptions & more fillable forms, register and subscribe now! Get your online template and fill it in using progressive features. Web to get started, open the.

Alabama Regular Homestead Exemption Claim Affidavit Download Fillable

Web 196 votes how to fill out and sign how to get homestead exemption online? Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web (a) (1) homesteads, as defined by the constitution and laws of alabama, are exempt from.

Alabama Homestead Exemption Fill Online, Printable, Fillable, Blank

Web (a) (1) homesteads, as defined by the constitution and laws of alabama, are exempt from all state ad valorem taxes. Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. Web different types of exemption. Exemption should.

Fillable Application For Homestead Exemption Template printable pdf

Web there must be a signed assessment sheet. Exemptions can be taken at several levels: Under alabama state tax law, only one homestead exemption is granted regardless of how much property is owned in the. Web (a) (1) homesteads, as defined by the constitution and laws of alabama, are exempt from all state ad valorem taxes. If both, you and.

BCAD Homestead Exemption Form Tax Exemption Real Estate Appraisal

You may complete this form and send it to your county tax assessing official's office to claim the homestead exemptions under. Web regular homestead exemption claim affidavit. In no case shall the exemption apply to more than one. Homestead exemption 2 is for persons over age 65 whose adjusted gross income is less than $12,000 on the most recent state.

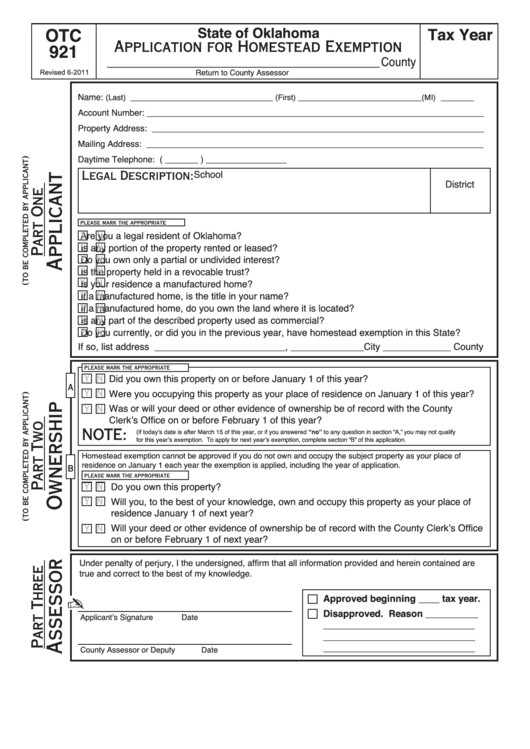

Fillable Form Otc 921 Application For Homestead Exemption printable

Web different types of exemption. Web and that the items of this assessment is the homestead claimed by me, which does not exceed $2000 in assessed value for county taxes or $4000. Exemption should be applied for in the assessing department, please. Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html.

Ad Al Homestead Exemptions & More Fillable Forms, Register And Subscribe Now!

Enjoy smart fillable fields and. Homestead exemption 2 is for persons over age 65 whose adjusted gross income is less than $12,000 on the most recent state tax return. Web different types of exemption. Web there must be a signed assessment sheet.

The Property Owner May Be Entitled To A.

In no case shall the exemption apply to more than one. Web and that the items of this assessment is the homestead claimed by me, which does not exceed $2000 in assessed value for county taxes or $4000. Ad al homestead exemptions & more fillable forms, register and subscribe now! If both, you and your spouse own.

Web Homestead Exemptions All Of The Exemptions Named Below Are Available On Primary Residence Only.

Homestead laws can be complicated, and alabama is no exception. The amount of the exemption is. You may complete this form and send it to your county tax assessing official's office to claim the homestead exemptions under. Web (a) (1) homesteads, as defined by the constitution and laws of alabama, are exempt from all state ad valorem taxes.

Get Your Online Template And Fill It In Using Progressive Features.

Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. Web for example, if you own a home alabama’s homestead exemption allows you to protect up to $15,500 of the value of your home. If you are uncertain as to. Web this form is intended to provide judgment debtors with notice of their right to claim an exemption from execution and should be used in accordance with rule 69, a.r.civ.p.,.