Accounting Chapter 13 Test A Answers

Accounting Chapter 13 Test A Answers - Comparison of a company financial condition and performance across time. The journal entry to record the insurance of the note will include a. Web chapter 13 solution for intermediate accounting by donald e. A debit to cash for $2,855. Web study with quizlet and memorize flashcards containing terms like the ss tax is paid by both the employer and employees., the fed. Web chapter 13 highlights we're unable to load study guides on this page. Determination of gain or loss, basis considerations, and nontaxable exchanges 1473. The form that is prepared and sent with the employer's check to. A debit to interest expense for $145. Ifrs questions are available at the end of this chapter.

A debit to interest expense for $145. Click the card to flip 👆 true 1 / 25 flashcards created by. Ifrs questions are available at the end of this chapter. The employees payroll taxes are operating expenses of the business. The journal entry to record the insurance of the note will include a. Web chapter 13 current liabilities and contingencies. Of the following items, the only one which should not be classified as a current liability is a. Warfield (16e) chapter 13 current liabilities and contingencies skip to document ask ai Web test bank chapter 13 property transactions: Unemployment tax rate is greater than the state unemployment.

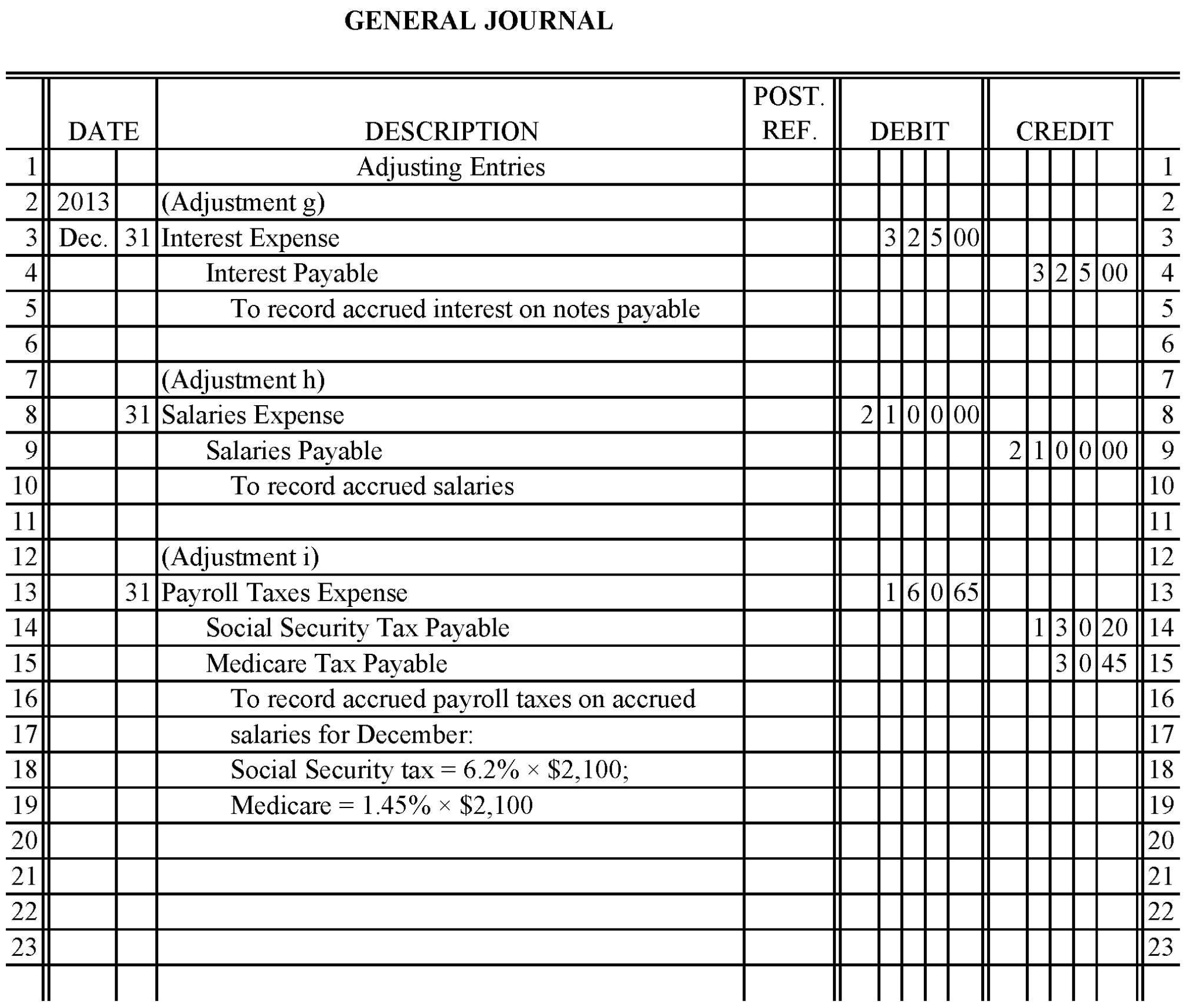

Web chapter 13 solution for intermediate accounting by donald e. The form that is prepared and sent with the employer's check to. A debit to interest expense for $145. Journalizing payroll transactions 1o2, 3,5. A credit to notes payable for $2,855. Web chapter 13 current liabilities and contingencies. Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Web study with quizlet and memorize flashcards containing terms like all the payroll information needed to prepare payroll and tax reports is found on, the payroll journal entry is based on the totals of the, the earnings. Web chapter 13 highlights we're unable to load study guides on this page. Click the card to flip 👆 true 1 / 25 flashcards created by.

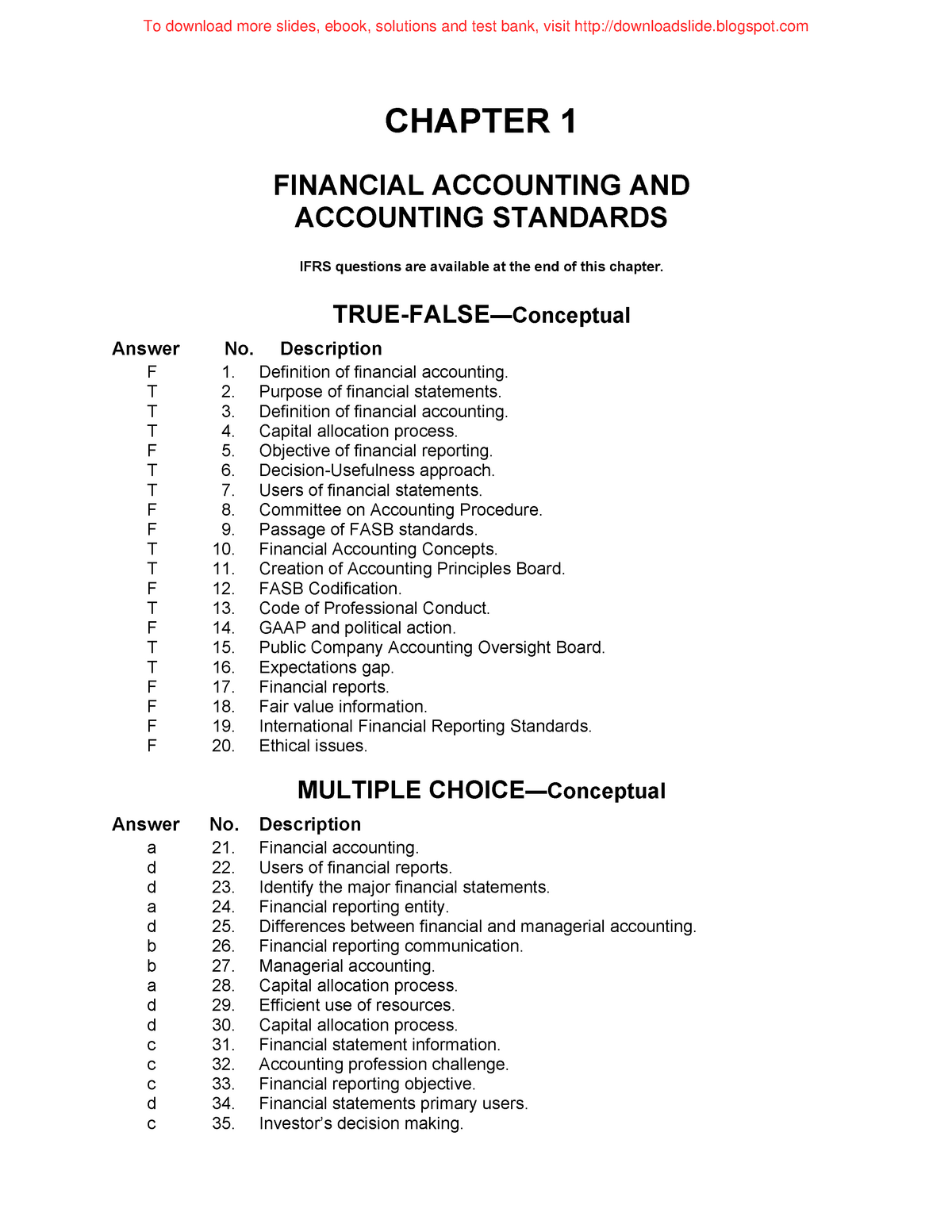

Chapter 1 Test Bank Financial Accounting MIS101 DU StuDocu

(d) transferred out to next department (100%) 55,000 normal lost. Warfield (16e) chapter 13 current liabilities and contingencies skip to document ask ai Learn vocabulary, terms, and more with flashcards, games, and other answers to cengage accounting homework answers to cengage accounting homework. Web chapter 13 highlights we're unable to load study guides on this page. Web access introduction to.

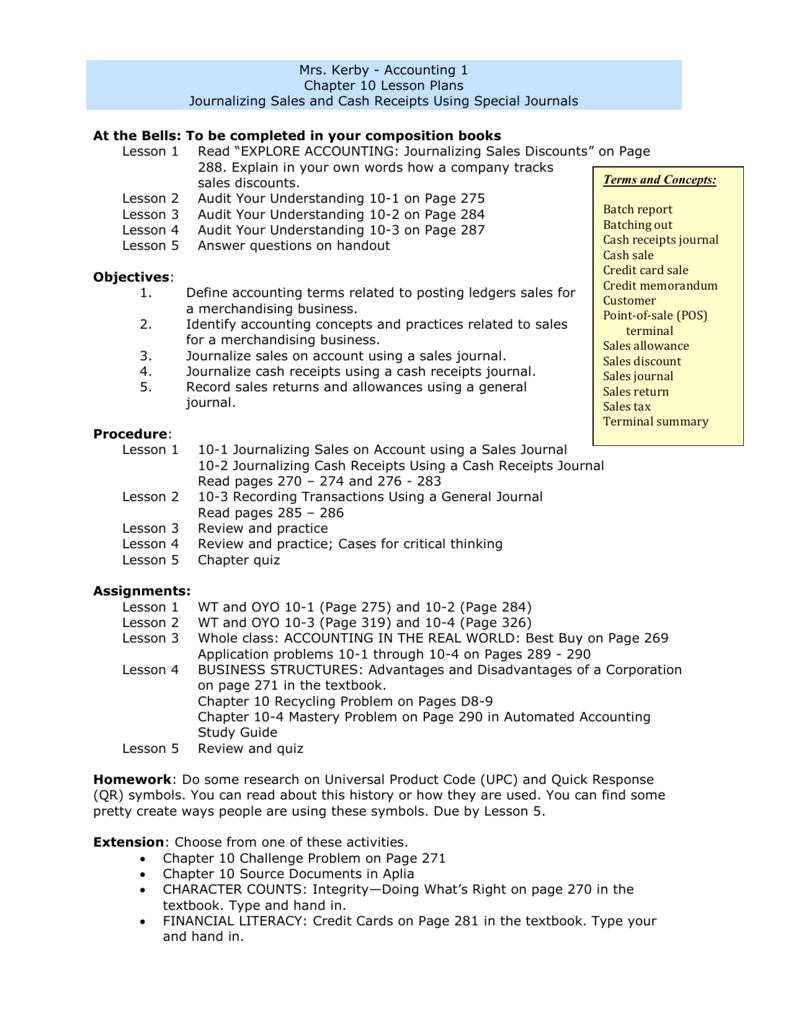

Glencoe Accounting Chapter 10 Answer Key Gamers Smart

Web study with quizlet and memorize flashcards containing terms like all the payroll information needed to prepare payroll and tax reports is found on, the payroll journal entry is based on the totals of the, the earnings. Web test bank chapter 13 property transactions: Web chapter 13 current liabilities and contingencies. This problem has been solved: Web 13th edition solutions.

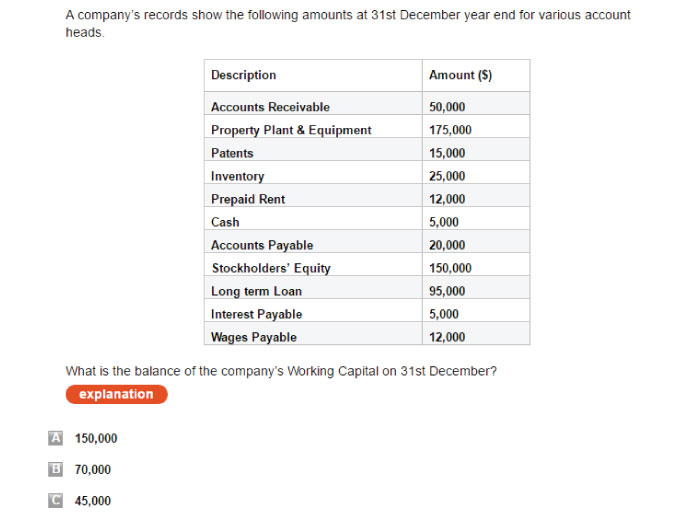

Accounts Receivable Test Prep Practice Tests

Web access introduction to managerial accounting 6th edition chapter 13 solutions now. Click the card to flip 👆 salaries expense is debited click the card to flip 👆 1 / 30 flashcards learn test match created. A debit to cash for $2,855. The journal entry to record the insurance of the note will include a. Realized gain or loss is

Accounting Chapter 10 Study Guide Answers Part 3 Study Poster

Web study with quizlet and memorize flashcards containing terms like the ss tax is paid by both the employer and employees., the fed. Comparison of a company financial condition and performance across time. Our solutions are written by chegg experts so you can be assured. (d) transferred out to next department (100%) 55,000 normal lost. The form that is prepared.

135 Mastery Accounting 1 YouTube

Web the present value of the note is $2,855. Web three tools of financial statement analysis are: Web chapter 13 solution for intermediate accounting by donald e. The form that is prepared and sent with the employer's check to. Web chapter 13 current liabilities and contingencies.

Ch03 Summary Financial Accounting IFRS, 3rd Edition CHAPTER 3

A credit to notes payable for $2,855. Web 13th edition solutions cost accounting (13th edition) % we have solutions for your book! Web three tools of financial statement analysis are: Ifrs questions are available at the end of this chapter. Comparison of a company financial condition and performance across time.

UpWork (oDesk) & Elance Accounting Principles Test Question & Answers

Click the card to flip 👆. The employees payroll taxes are operating expenses of the business. Web the present value of the note is $2,855. Realized gain or loss is Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter.

PPT Accounting Chapter 11 Test Review PowerPoint Presentation, free

Web test bank chapter 13 property transactions: Web 13th edition solutions cost accounting (13th edition) % we have solutions for your book! Click the card to flip 👆 true 1 / 25 flashcards created by. Of the following items, the only one which should not be classified as a current liability is a. The employees payroll taxes are operating expenses.

Accounting Chapter 12 Study Guide True And False Study Poster

Determination of gain or loss, basis considerations, and nontaxable exchanges 1473. Click the card to flip 👆 salaries expense is debited click the card to flip 👆 1 / 30 flashcards learn test match created. Click the card to flip 👆. This problem has been solved: Web chapter 13 highlights we're unable to load study guides on this page.

Solved Test Chapter 13 Test O C. 2

Click the card to flip 👆 salaries expense is debited click the card to flip 👆 1 / 30 flashcards learn test match created. Comparison of a company financial condition and performance across time. (d) transferred out to next department (100%) 55,000 normal lost. Learn vocabulary, terms, and more with flashcards, games, and other answers to cengage accounting homework answers.

Realized Gain Or Loss Is

Our solutions are written by chegg experts so you can be assured. Of the following items, the only one which should not be classified as a current liability is a. Determination of gain or loss, basis considerations, and nontaxable exchanges 1473. A debit to cash for $2,855.

A Debit To Interest Expense For $145.

Journalizing payroll transactions 1o2, 3,5. Click the card to flip 👆 true 1 / 25 flashcards created by. Web chapter 13 highlights we're unable to load study guides on this page. Web chapter 13 solution for intermediate accounting by donald e.

Please Check Your Connection And Try Again.

Ifrs questions are available at the end of this chapter. (d) transferred out to next department (100%) 55,000 normal lost. The form that is prepared and sent with the employer's check to. Click the card to flip 👆 salaries expense is debited click the card to flip 👆 1 / 30 flashcards learn test match created.

Web Three Tools Of Financial Statement Analysis Are:

This problem has been solved: Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Web 13th edition solutions cost accounting (13th edition) % we have solutions for your book! Learn vocabulary, terms, and more with flashcards, games, and other answers to cengage accounting homework answers to cengage accounting homework.