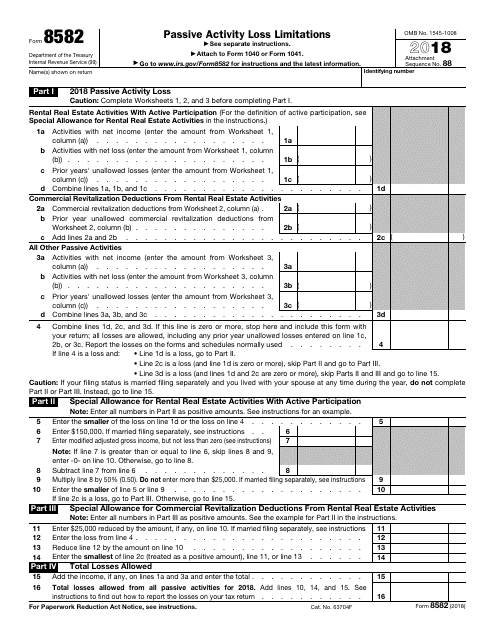

8582 Tax Form

8582 Tax Form - Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Ad access irs tax forms. This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income. Complete, edit or print tax forms instantly. Go to www.irs.gov/form8582 for instructions and the latest information. Edit, sign and print tax forms on any device with uslegalforms. Noncorporate taxpayers use form 8582 to: Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed pals. 858 name(s) shown on return identifying number Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions.

Edit, sign and print tax forms on any device with uslegalforms. Figure the amount of any passive activity loss (pal) for the current tax year. Web turbotax live en español. Go to www.irs.gov/form8582 for instructions and the latest information. Tax law & stimulus updates. Go to www.irs.gov/form8582 for instructions and the latest information. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Report the application of prior year unallowed pals. Complete, edit or print tax forms instantly. This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income.

Go to www.irs.gov/form8582 for instructions and the latest information. Complete, edit or print tax forms instantly. Tax law & stimulus updates. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Web turbotax live en español. Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. This article will walk you through what you need to know about irs form 8582, including: Noncorporate taxpayers use form 8582 to: 858 name(s) shown on return identifying number Report the application of prior year unallowed pals.

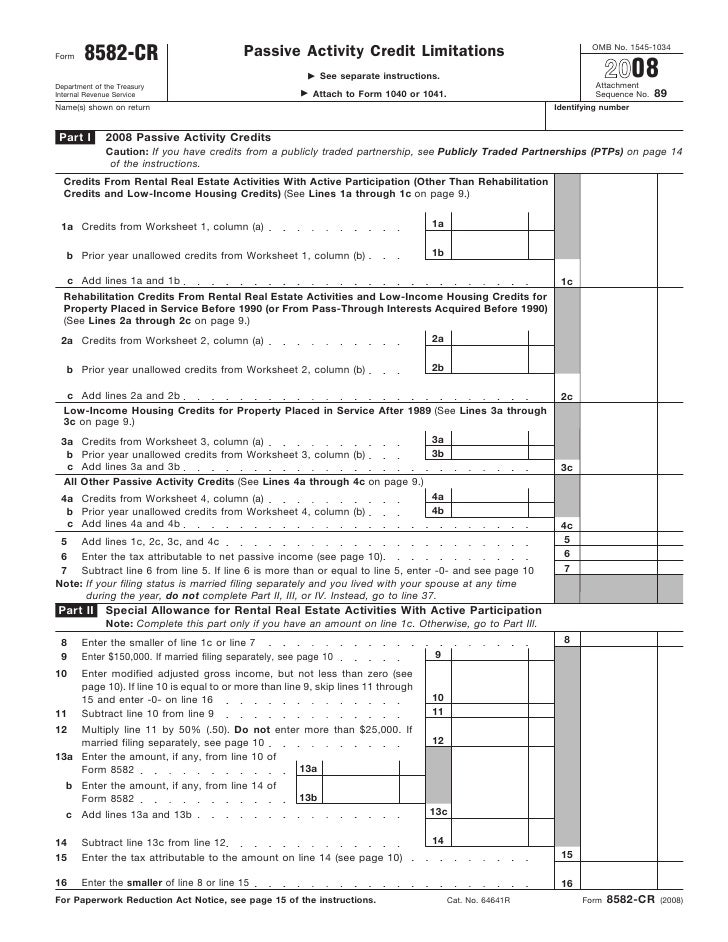

Form 8582CR Passive Activity Credit Limitations

858 name(s) shown on return identifying number Go to www.irs.gov/form8582 for instructions and the latest information. Web turbotax live en español. Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions. Tax law & stimulus updates.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Go to www.irs.gov/form8582 for instructions and the latest information. You can print other federal tax forms here. Noncorporate taxpayers use form 8582 to: Figure the amount of any passive activity loss (pal) for the current tax year. If you actively participated in a passive rental real estate activity, you may be able to deduct up to $25,000 of loss from.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions. This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income. Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. You can print.

2B. Professor Patricia (Patty) Pâté is retired from

Web turbotax live en español. A passive activity loss occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Go to www.irs.gov/form8582 for instructions and the latest information. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed pals. Web form 8582 is used by.

IRS Form 8582 Download Fillable PDF or Fill Online Passive Activity

Figure the amount of any passive activity loss (pal) for the current tax year. A passive activity loss occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. A pal occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total.

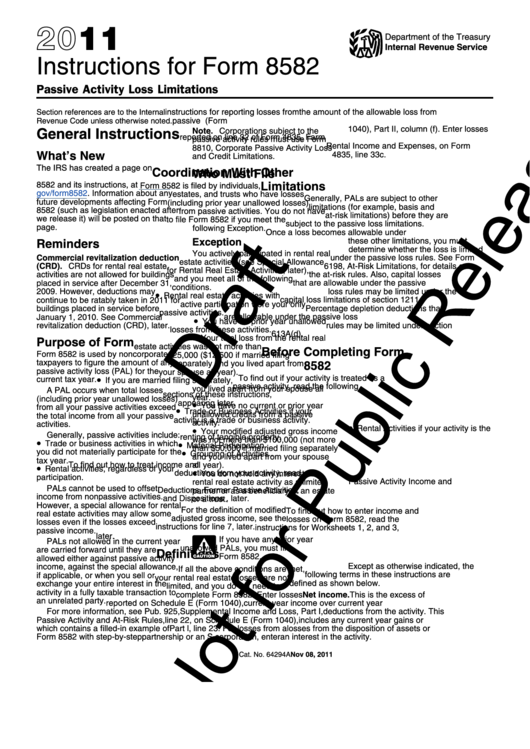

Instructions For Form 8582 Draft 2011 printable pdf download

Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. If you actively participated in a passive rental real estate activity, you may be able.

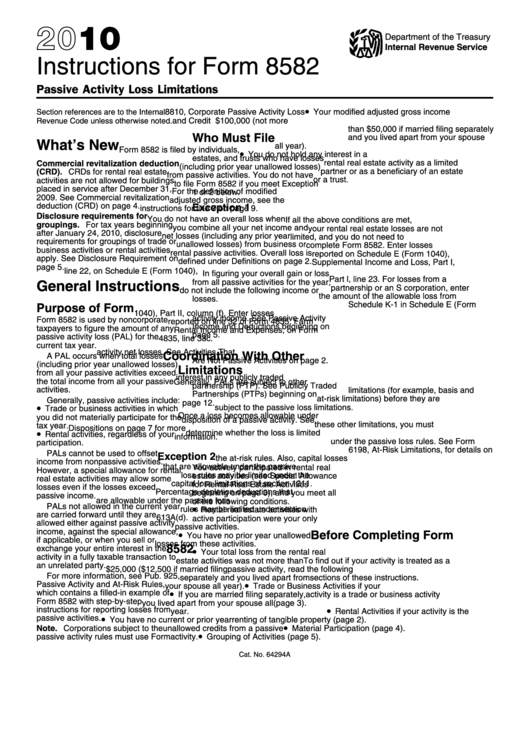

Instructions For Form 8582 2010 printable pdf download

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Complete, edit or print tax forms instantly. Web about form 8582, passive activity loss limitations. 858 name(s) shown on return identifying number You can print other federal tax forms here.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Complete, edit or print tax forms instantly. Go to www.irs.gov/form8582 for instructions and the latest information. Web about form 8582, passive activity loss limitations. You can print other federal tax forms here. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year.

Instructions for Form 8582CR (01/2012) Internal Revenue Service

Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Complete, edit or print tax forms instantly. Figure the amount of any passive activity loss (pal) for the current tax year. Web form 8582 department of the treasury internal revenue service passive activity.

Edit, Sign And Print Tax Forms On Any Device With Uslegalforms.

Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Complete, edit or print tax forms instantly. Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. Figure the amount of any passive activity loss (pal) for the current tax year.

Complete, Edit Or Print Tax Forms Instantly.

Go to www.irs.gov/form8582 for instructions and the latest information. Report the application of prior year unallowed pals. If you actively participated in a passive rental real estate activity, you may be able to deduct up to $25,000 of loss from the activity from your nonpassive income. 858 name(s) shown on return identifying number

You Can Print Other Federal Tax Forms Here.

Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Web turbotax live en español. A passive activity loss occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income.

Web Form 8582 Department Of The Treasury Internal Revenue Service Passive Activity Loss Limitations See Separate Instructions.

Go to www.irs.gov/form8582 for instructions and the latest information. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed pals. Tax law & stimulus updates. This article will walk you through what you need to know about irs form 8582, including: