8300 Form Rules

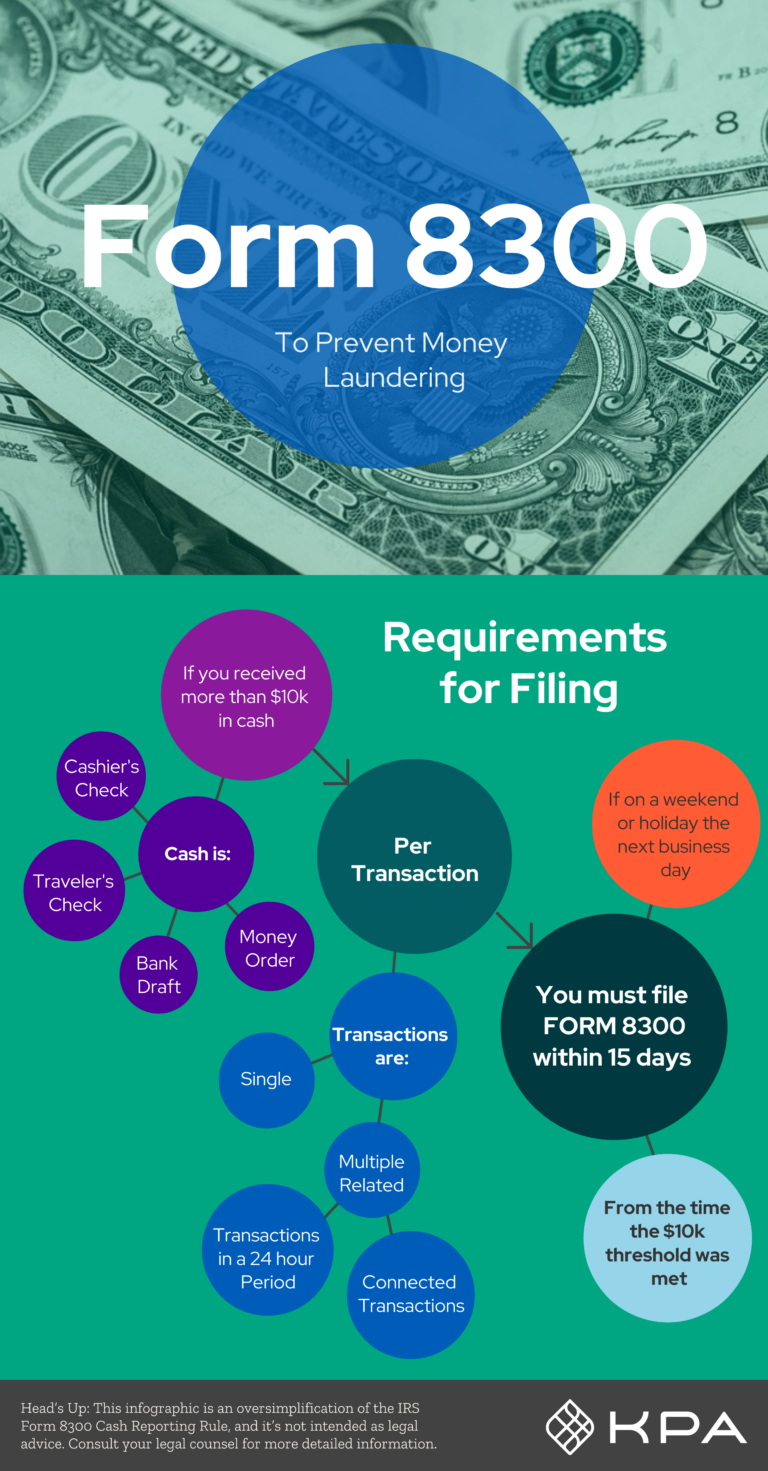

8300 Form Rules - When filing electronically, it is important to know that completing only fields designated as. Form 8300 is a document filed with the irs when an individual or an entity receives a cash payment of over $10,000. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more. In the case of related transactions or multiple cash payments which relate to a. If purchases are more than 24 hours apart and not connected in any way. Web you must file form 8300 within 15 days after the date the cash transaction occurred. Web transaction that is reportable on form 8300 or on fincen report 112, and discloses all the information necessary to complete part ii of form 8300 or fincen report 112 to the. Web a trade or business that receives more than $10,000 in related transactions must file form 8300. The reporting obligation cannot be avoided by separating a. Web a clerk of a criminal court must file a form 8300 when cash bail of more than $10,000 is paid for an individual that was arrested for:

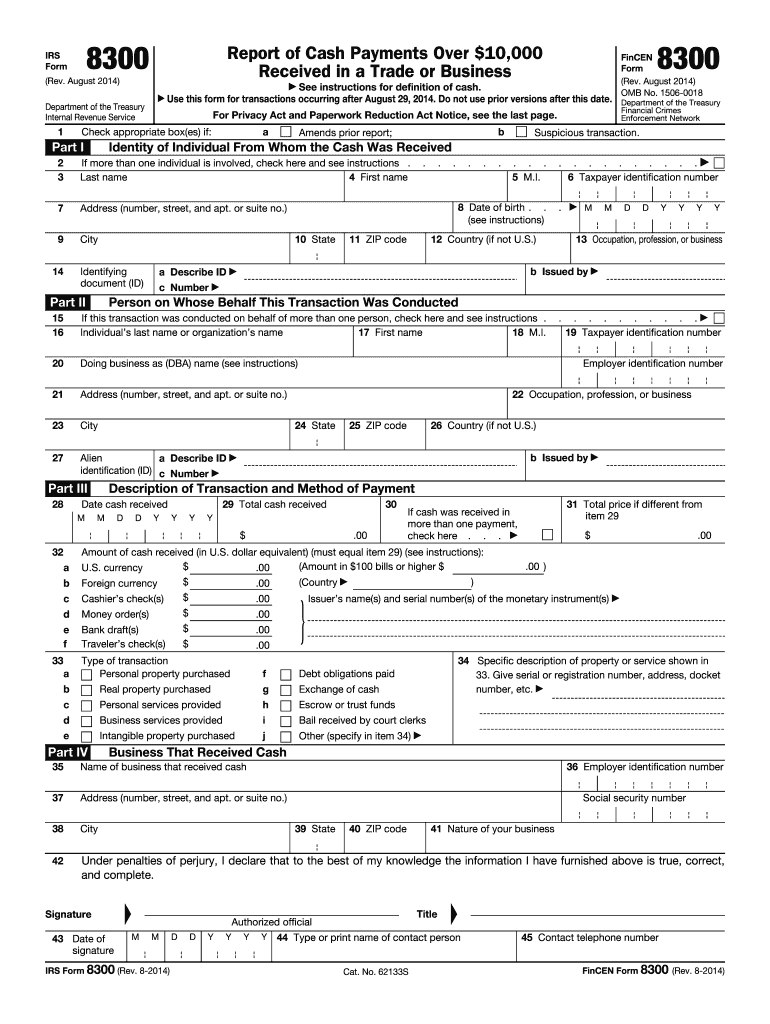

Web form 8300, report of cash payments over $10,000 received in a trade or business. Form 8300 is a document filed with the irs when an individual or an entity receives a cash payment of over $10,000. Web once a business receives more than $10,000 in cash, as defined, form 8300 must be filed within 15 days. Web what is form 8300? Web your auto dealership should be using an 8300 form to report cash payments over $10,000 to the irs. The reporting obligation cannot be avoided by separating a. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Web about form 8300, report of cash payments over $10,000 received in a trade or business. In two or more related payments within 24 hours. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more.

As of july 1, 2022, form 5300 applications must be submitted electronically through pay.gov. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Web the help desk is available monday through friday from 8 a.m. Transactions that require form 8300 include, but are not limited to: The reporting obligation cannot be avoided by separating a. Web once a business receives more than $10,000 in cash, as defined, form 8300 must be filed within 15 days. Web generally, form 8300 must be filed with the irs by the 15th day after the date the cash is received. Web what is form 8300? In the case of related transactions or multiple cash payments which relate to a. It is voluntary but highly encouraged.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Web form 8300, report of cash payments over $10,000 received in a trade or business. Each person engaged in a trade or business who, in the course..

Irs 8300 Form Fill Out and Sign Printable PDF Template signNow

Form 8300 is a document filed with the irs when an individual or an entity receives a cash payment of over $10,000. Web if you or your business has received a cash payment of over $10,000, the federal law requires that you file form 8300 within a span of 15 days after receiving the. The reporting obligation cannot be avoided.

The IRS Form 8300 and How it Works

Besides filing form 8300, you also need to provide a written statement to each party. While the form 8300 instructions mention. Web form 8300 rules dictate that you must also report multiple payments within a single year that amount to more than $10,000. As of july 1, 2022, form 5300 applications must be submitted electronically through pay.gov. Web applications may.

IRS Form 8300 It's Your Yale

Each person engaged in a trade or business who, in the course. Web your auto dealership should be using an 8300 form to report cash payments over $10,000 to the irs. Web for transactions under the reporting threshold, you can file form 8300, if the transaction appears suspicious. While the form 8300 instructions mention. Web each person engaged in a.

Filing Form 8300 for 2020 YouTube

Web a clerk of a criminal court must file a form 8300 when cash bail of more than $10,000 is paid for an individual that was arrested for: Besides filing form 8300, you also need to provide a written statement to each party. While the form 8300 instructions mention. It is voluntary but highly encouraged. Web each person engaged in.

Form 8300 Explanation And Reference Guide

In two or more related payments within 24 hours. Web a clerk of a criminal court must file a form 8300 when cash bail of more than $10,000 is paid for an individual that was arrested for: Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Dollars

When you’re running an auto dealership, you have a lot on your. Each person engaged in a trade or business who, in the course. Web you must file form 8300 within 15 days after the date the cash transaction occurred. While the form 8300 instructions mention. Web form 8300, report of cash payments over $10,000 received in a trade or.

IRS Form 8300 Reporting Cash Sales Over 10,000

Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. While the form 8300 instructions mention. Web generally, form 8300 must be filed with the irs by the 15th day after the date the cash is received..

Form 8300 Do You Have Another IRS Issue? ACCCE

Web your auto dealership should be using an 8300 form to report cash payments over $10,000 to the irs. When you’re running an auto dealership, you have a lot on your. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in.

Form 8300 Cheat Sheet When Should I Report Suspicious Activity? KPA

Web what is form 8300? Besides filing form 8300, you also need to provide a written statement to each party. Web a trade or business that receives more than $10,000 in related transactions must file form 8300. Web for transactions under the reporting threshold, you can file form 8300, if the transaction appears suspicious. Each person engaged in a trade.

Any Federal Offense Involving A Controlled.

Web form 8300, report of cash payments over $10,000 received in a trade or business. Web for transactions under the reporting threshold, you can file form 8300, if the transaction appears suspicious. Web what is form 8300? Web generally, form 8300 must be filed with the irs by the 15th day after the date the cash is received.

Besides Filing Form 8300, You Also Need To Provide A Written Statement To Each Party.

When you’re running an auto dealership, you have a lot on your. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more. If purchases are more than 24 hours apart and not connected in any way. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related.

Web Applications May Be Submitted As Of June 1, 2022, Electronically Via Pay.gov.

It is voluntary but highly encouraged. Web transaction that is reportable on form 8300 or on fincen report 112, and discloses all the information necessary to complete part ii of form 8300 or fincen report 112 to the. In two or more related payments within 24 hours. Web form 8300 rules dictate that you must also report multiple payments within a single year that amount to more than $10,000.

While The Form 8300 Instructions Mention.

Web once a business receives more than $10,000 in cash, as defined, form 8300 must be filed within 15 days. The reporting obligation cannot be avoided by separating a. Web a clerk of a criminal court must file a form 8300 when cash bail of more than $10,000 is paid for an individual that was arrested for: Form 8300 is a document filed with the irs when an individual or an entity receives a cash payment of over $10,000.