4136 Tax Form

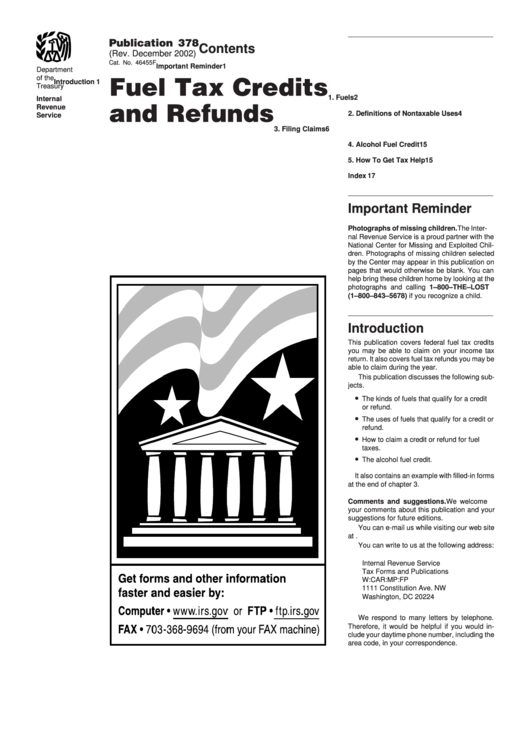

4136 Tax Form - Type form 4136 in search in the upper right click jump to form 4136 say yes on credit for nontaxable fuel usage on how you. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Attach this form to your income tax return. Ad sovos combines tax automation with a human touch. Web correction to form 4136 for tax year 2022 current year prior year accessible ebooks browser friendly post release changes to forms order forms and. Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Web however, if you operate a business that consumes a significant amount of fuel, you may be eligible for a federal fuel tax credit under certain circumstances by filing. Web show sources > form 4136 is a federal other form. Web what is the form 4136 used for? Web form 4506 (novmeber 2021) department of the treasury internal revenue service.

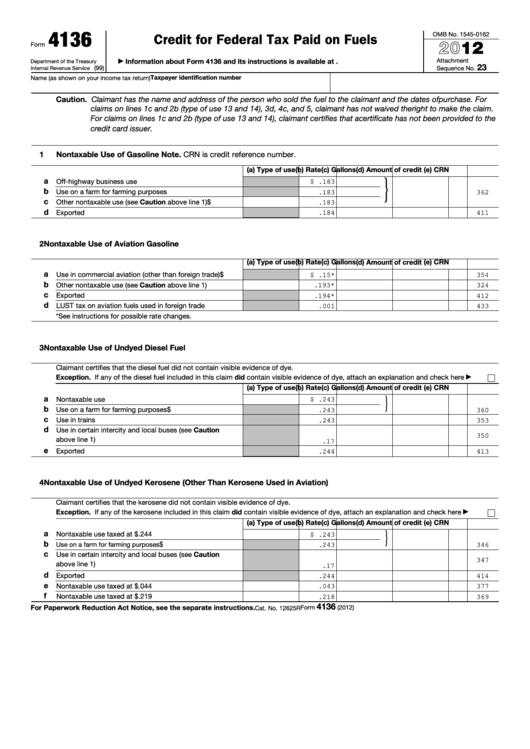

Reach out to learn how we can help you! Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels see the separate instructions. Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. Web however, if you operate a business that consumes a significant amount of fuel, you may be eligible for a federal fuel tax credit under certain circumstances by filing. Web correction to form 4136 for tax year 2022 current year prior year accessible ebooks browser friendly post release changes to forms order forms and. Ad download or email irs 4136 & more fillable forms, register and subscribe now! 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed diesel fuel registration no. Everyone pays tax when purchasing most types of fuels. Request for copy of tax return. Web what is the form 4136 used for?

Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. Reach out to learn how we can help you! Ad download or email irs 4136 & more fillable forms, register and subscribe now! Attach this form to your income tax return. Everyone pays tax when purchasing most types of fuels. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Type form 4136 in search in the upper right click jump to form 4136 say yes on credit for nontaxable fuel usage on how you. The biodiesel or renewable diesel mixture credit. Do not sign this form unless all applicable lines have. Web show sources > form 4136 is a federal other form.

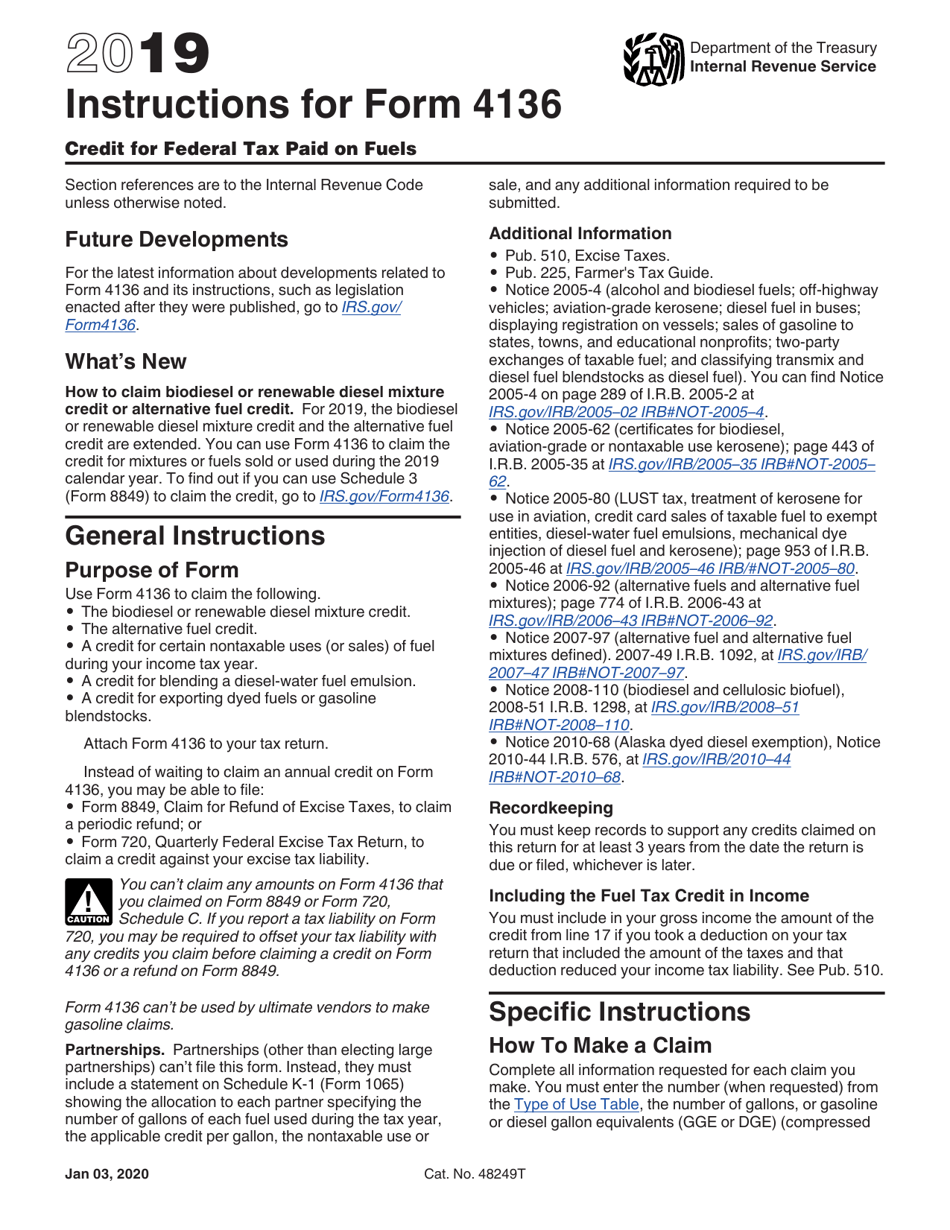

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. However, the federal government allows people who use certain fuels in certain ways to. Web to get form 4136 to populate correctly: Web correction to form 4136 for tax year 2022 current year prior year accessible ebooks.

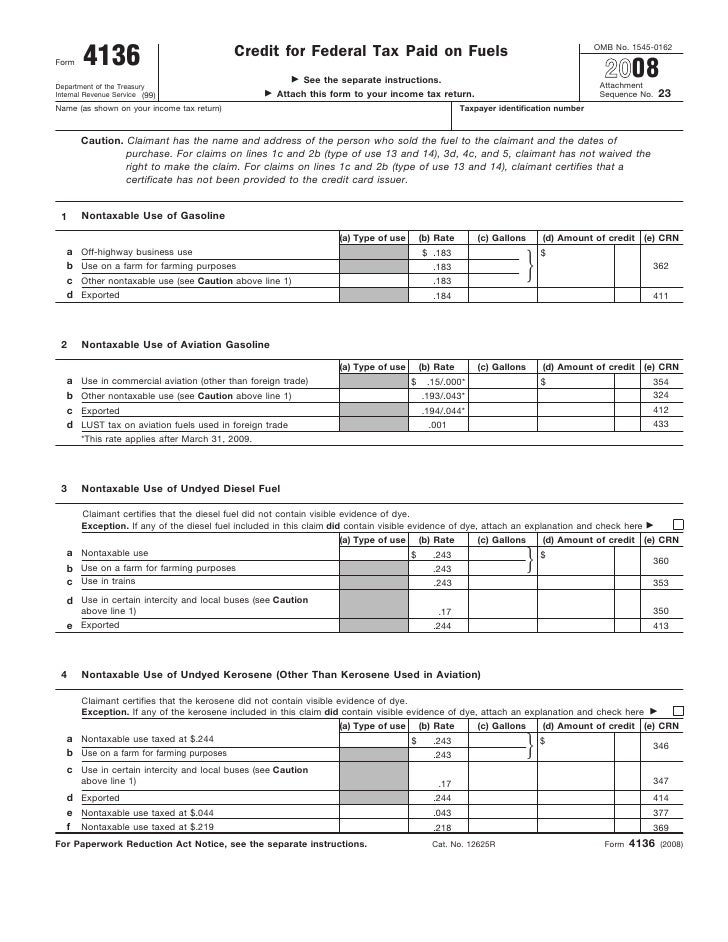

Form 4136Credit for Federal Tax Paid on Fuel

Everyone pays tax when purchasing most types of fuels. Web what is the form 4136 used for? Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. However, the federal government allows people who use certain fuels in certain ways to. Web.

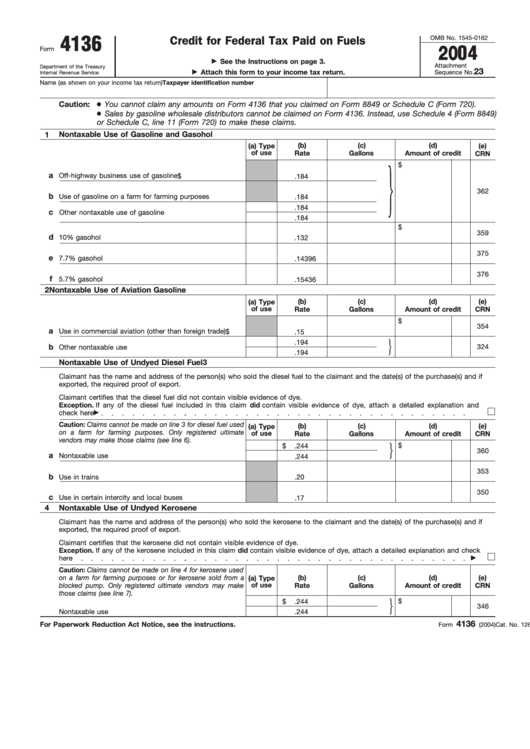

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Reach out to learn how we can help you! However, the federal government allows people who use certain fuels in certain ways to. Request for copy of tax return. The credits available on form 4136 are: Web show sources > form 4136 is a federal other form.

Fillable Form 4136 Credit For Federal Tax Paid On Fuels printable pdf

Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed diesel fuel registration no. Ad download or email irs 4136 & more fillable forms, register and subscribe now! Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. Attach this form.

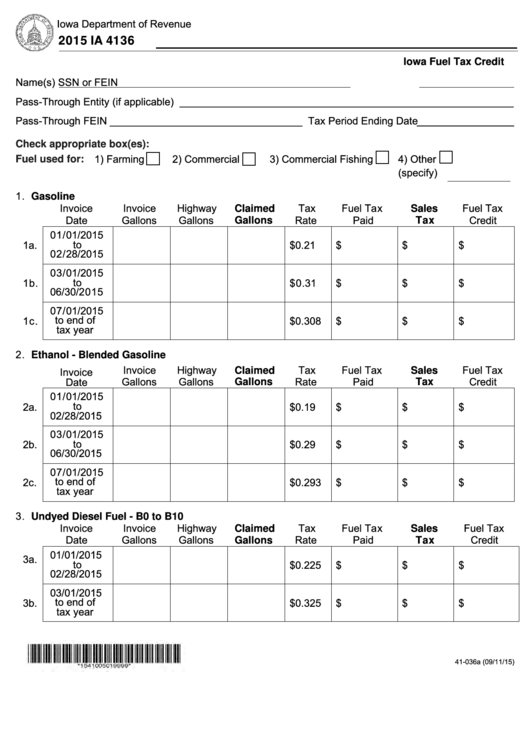

Fillable Form Ia 4136 Iowa Fuel Tax Credit 2015 printable pdf download

Everyone pays tax when purchasing most types of fuels. Web credit for federal tax paid on fuels 4136 caution: The credits available on form 4136 are: Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest. Reach out to learn how we can help you!

Fuel Tax Credit Eligibility, Form 4136 & How to Claim

Web credit for federal tax paid on fuels 4136 caution: Attach this form to your income tax return. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Web however, if you operate a business that consumes a significant amount of fuel,.

Fillable Form 4136 Credit For Federal Tax Paid On Fuels 2012

Web credit for federal tax paid on fuels 4136 caution: Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest. Web however, if you operate a business that consumes a significant amount of fuel, you may be eligible for a federal fuel tax credit under.

Form 4136 Credit For Federal Tax Paid On Fuels 2002 printable pdf

Web show sources > form 4136 is a federal other form. However, the federal government allows people who use certain fuels in certain ways to. 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed diesel fuel registration no. Ad sovos combines tax automation with a human touch. Ad download or email.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. Web however, if you operate a business that consumes a significant amount of fuel, you may be eligible for a federal fuel tax credit under certain circumstances by filing. Request for copy of tax return. Ad download or email.

Type Form 4136 In Search In The Upper Right Click Jump To Form 4136 Say Yes On Credit For Nontaxable Fuel Usage On How You.

Download or email irs 4136 & more fillable forms, register and subscribe now! Web credit for federal tax paid on fuels 4136 caution: Ad download or email irs 4136 & more fillable forms, register and subscribe now! Ad sovos combines tax automation with a human touch.

The Biodiesel Or Renewable Diesel Mixture Credit.

Everyone pays tax when purchasing most types of fuels. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed diesel fuel registration no.

Reach Out To Learn How We Can Help You!

Request for copy of tax return. Web what is the form 4136 used for? Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Do not sign this form unless all applicable lines have.

Web Use Form 4136 To Claim A Credit For Federal Taxes Paid On Certain Fuels.

However, the federal government allows people who use certain fuels in certain ways to. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest. Attach this form to your income tax return. Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase.