401K Contribution Tax Form

401K Contribution Tax Form - Web find general information about 401(k) plans, the tax advantages of sponsoring the plan and the types of plans available. Web higher earners maximizing savings ahead of retirement may soon lose a tax break, thanks to 401 (k) changes enacted last year. Web for 2022, the 401(k) contribution limit is $20,500, and the 401(k) contribution limit in 2023 is $22,500. Web a 401 (k) plan is a qualified deferred compensation plan. Web the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $20,500, up. Web traditional 401 (k) withdrawals are taxed at an individual's current income tax rate. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. If you’re 50 or older, you can funnel. Final day for 401(k) contribution is april 15th, 2024. This tax form for 401 (k) distribution is sent when you’ve made a.

Web updated july 21, 2022. Web a 401 (k) plan is a qualified deferred compensation plan. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. Web depending on the number and type of participants covered, most 401 (k) plans must file one of the two following forms: Final day for 401(k) contribution is april 15th, 2024. If you're eligible under the plan, you generally can elect to have your employer contribute a portion of. Web traditional 401 (k) withdrawals are taxed at an individual's current income tax rate. Web find general information about 401(k) plans, the tax advantages of sponsoring the plan and the types of plans available. Web for 2022, the 401(k) contribution limit is $20,500, and the 401(k) contribution limit in 2023 is $22,500. Web the irs on friday said it is boosting the 2023 contribution limits for 401 (k)s by a record $2,000 due to the high pace of inflation, which will allow workers to sock.

Roth ira withdrawal rules are also more flexible. Web a 401 (k) plan is a qualified deferred compensation plan. In general, roth 401 (k) withdrawals are not taxable provided the account was. Web higher earners maximizing savings ahead of retirement may soon lose a tax break, thanks to 401 (k) changes enacted last year. If you’re 50 or older, you can funnel. Web for 2022, the 401(k) contribution limit is $20,500, and the 401(k) contribution limit in 2023 is $22,500. This tax form for 401 (k) distribution is sent when you’ve made a. In addition, individuals 50 years old or older are. Web traditional 401 (k) withdrawals are taxed at an individual's current income tax rate. Web the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $20,500, up.

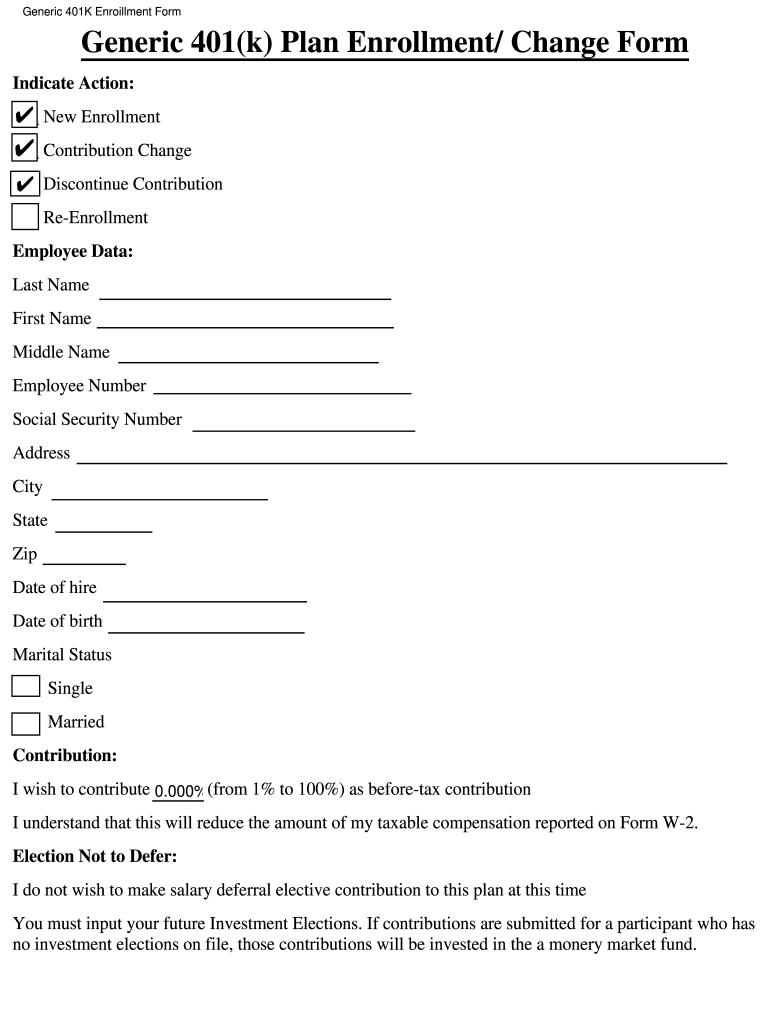

401k Enrollment Form Fill Online, Printable, Fillable, Blank pdfFiller

A 401(k) plan is a qualified plan. Web a 401 (k) plan is a qualified deferred compensation plan. In general, roth 401 (k) withdrawals are not taxable provided the account was. Web updated july 21, 2022. Web filing 401k contributions on form 1040 i filed my taxes already, but after double checking i believe i listed the wrong amount on.

2014 Form IRS 8606 Fill Online, Printable, Fillable, Blank pdfFiller

Web this tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution. Roth ira withdrawal rules are also more flexible. In general, roth 401 (k) withdrawals are not taxable provided the account was. Web the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift.

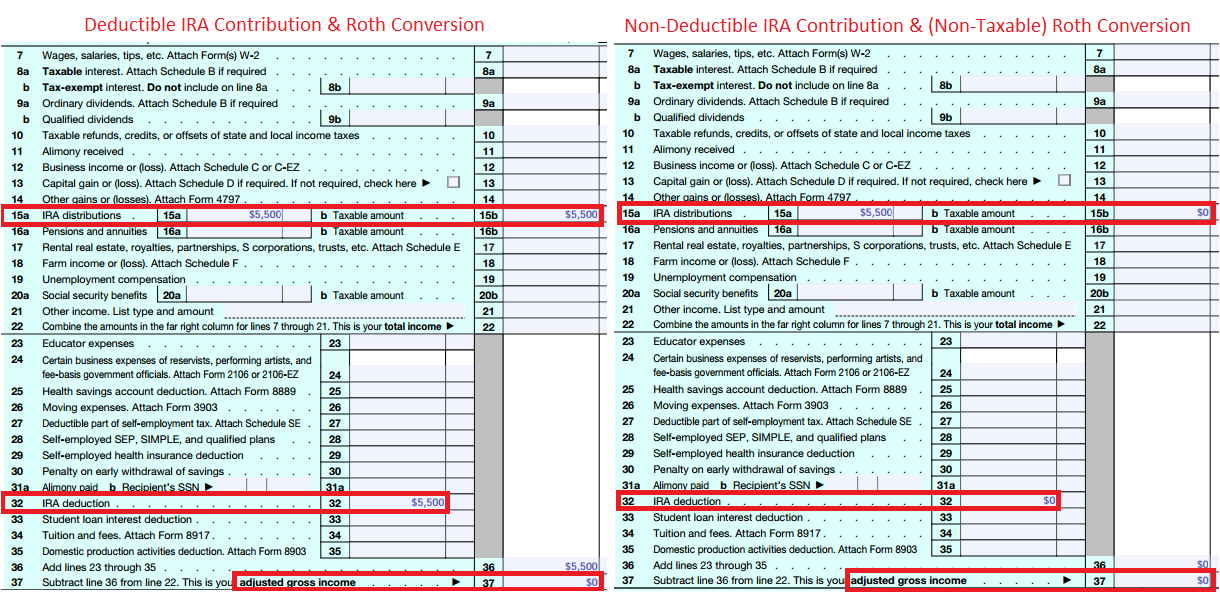

How Much Of My Ira Contribution Is Tax Deductible Tax Walls

401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. Web a 401 (k) plan is a qualified deferred compensation plan. Web this tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution. This tax form for 401.

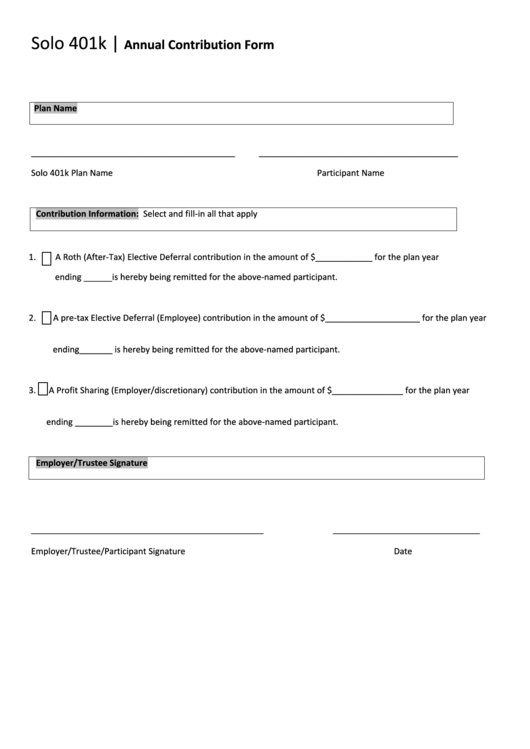

Solo 401k Annual Contribution Form My Solo 401k printable pdf download

Web traditional 401 (k) withdrawals are taxed at an individual's current income tax rate. In general, roth 401 (k) withdrawals are not taxable provided the account was. In addition, individuals 50 years old or older are. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to..

What to do if you have to take an early withdrawal from your Solo 401k

401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. Web find general information about 401(k) plans, the tax advantages of sponsoring the plan and the types of plans available. In general, roth 401 (k) withdrawals are not taxable provided the account was. Web depending on.

401k Maximum Contribution Limit Finally Increases For 2019

Form 5500, annual return/report of employee. Web a 401 (k) plan is a qualified deferred compensation plan. Web depending on the number and type of participants covered, most 401 (k) plans must file one of the two following forms: Web this tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution. Web.

401k Rollover Tax Form Universal Network

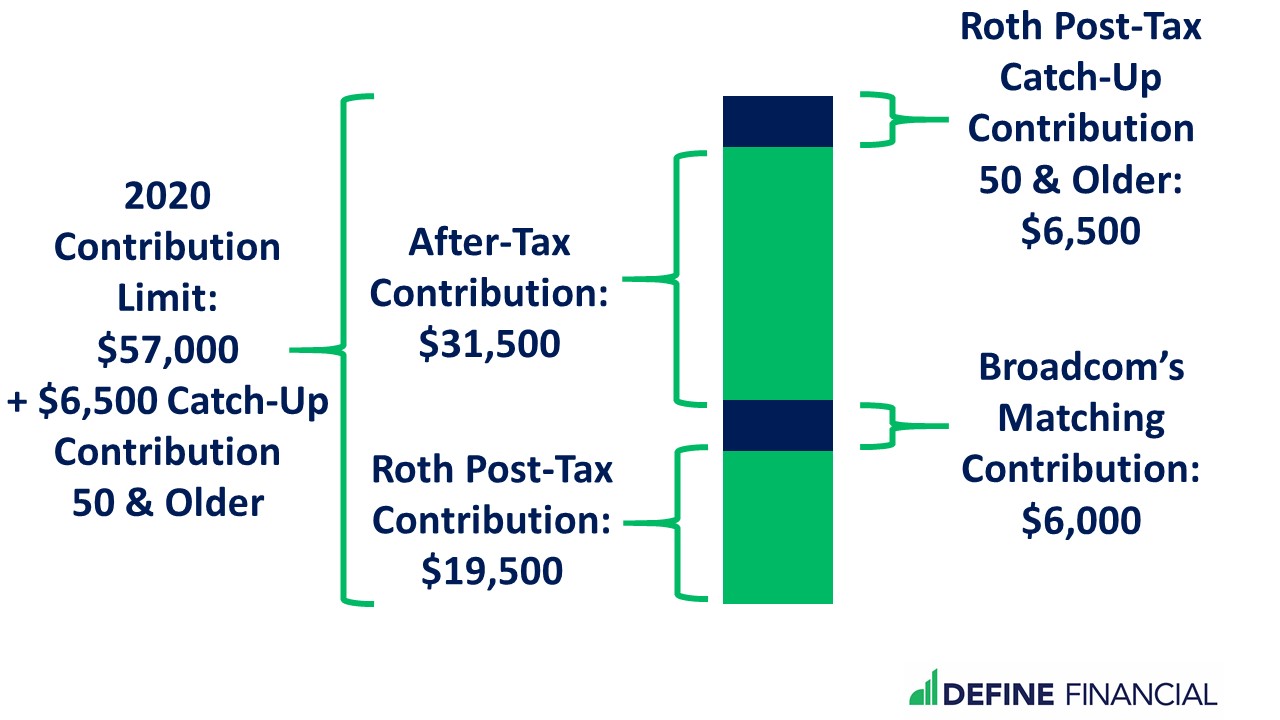

Web for 2022, the 401(k) contribution limit is $20,500, and the 401(k) contribution limit in 2023 is $22,500. Web the irs on friday said it is boosting the 2023 contribution limits for 401 (k)s by a record $2,000 due to the high pace of inflation, which will allow workers to sock. If you’re 50 or older, you can funnel. Form.

2018 401k Contribution Limits Rise HRWatchdog

Form 5500, annual return/report of employee. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. Web updated july 21, 2022. Web filing 401k contributions on form 1040 i filed my taxes already, but after double checking i believe i listed the wrong amount on box.

What’s the Maximum 401k Contribution Limit in 2022? (2023)

Web this tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution. This tax form for 401 (k) distribution is sent when you’ve made a. Web depending on the number and type of participants covered, most 401 (k) plans must file one of the two following forms: If you’re 50 or older,.

How to Get the Most from 401(k), ESPP & RSUs

Web depending on the number and type of participants covered, most 401 (k) plans must file one of the two following forms: Web updated july 21, 2022. Form 5500, annual return/report of employee. Web filing 401k contributions on form 1040 i filed my taxes already, but after double checking i believe i listed the wrong amount on box 32 of.

Web Traditional 401 (K) Withdrawals Are Taxed At An Individual's Current Income Tax Rate.

This tax form for 401 (k) distribution is sent when you’ve made a. Web higher earners maximizing savings ahead of retirement may soon lose a tax break, thanks to 401 (k) changes enacted last year. Web for 2022, the 401(k) contribution limit is $20,500, and the 401(k) contribution limit in 2023 is $22,500. Final day for 401(k) contribution is april 15th, 2024.

Web Filing 401K Contributions On Form 1040 I Filed My Taxes Already, But After Double Checking I Believe I Listed The Wrong Amount On Box 32 Of Form 1040 Regarding.

In addition, individuals 50 years old or older are. A 401(k) plan is a qualified plan. Roth ira withdrawal rules are also more flexible. If you're eligible under the plan, you generally can elect to have your employer contribute a portion of.

Web Updated July 21, 2022.

Web the irs on friday said it is boosting the 2023 contribution limits for 401 (k)s by a record $2,000 due to the high pace of inflation, which will allow workers to sock. Web depending on the number and type of participants covered, most 401 (k) plans must file one of the two following forms: Form 5500, annual return/report of employee. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to.

Web Find General Information About 401(K) Plans, The Tax Advantages Of Sponsoring The Plan And The Types Of Plans Available.

In general, roth 401 (k) withdrawals are not taxable provided the account was. Web this tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution. Web a 401 (k) plan is a qualified deferred compensation plan. Web the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $20,500, up.