338 H 10 Election Form

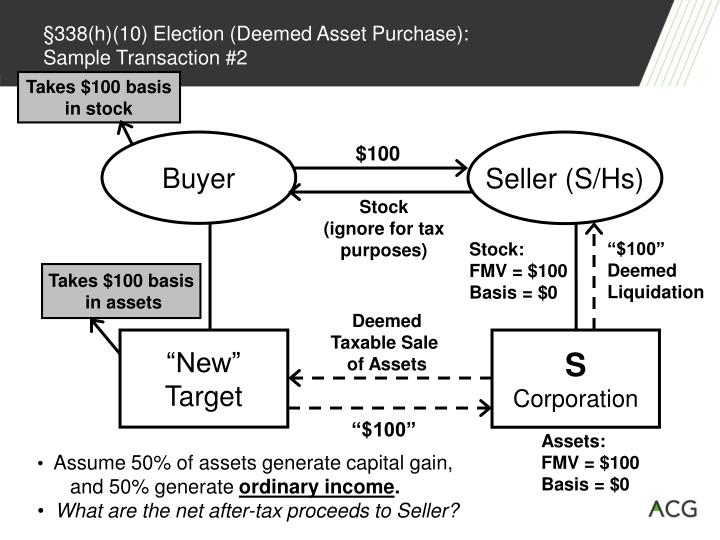

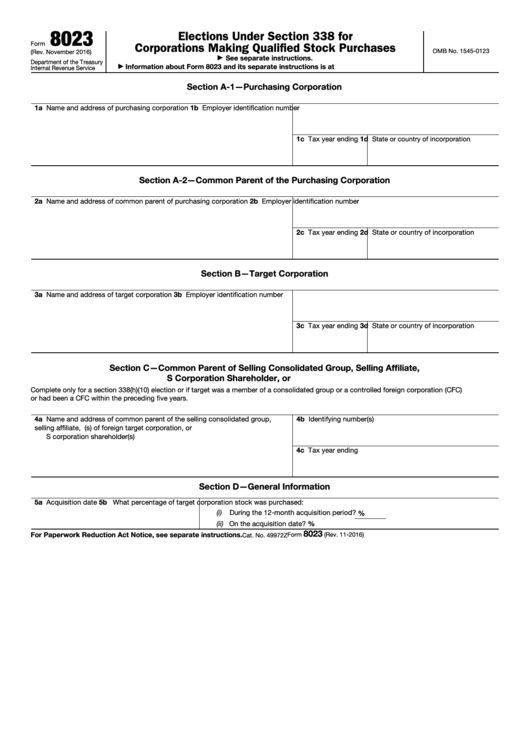

338 H 10 Election Form - Web purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock purchase (qsp) of the target corporation. Web section 338 (h) (10) election scenario 1 you’ve found a great company whose acquisition you believe would advance your objectives. Web section 338 (h) (10) elections are available only for targets who are s corporations or members of an affiliated group of corporations (whether or not they file a consolidated federal income tax return). Web for elections under sections 338(g) and 338(h)(10) both the old target and the new target must file form 8883. Old target is treated as transferring all of its assets to an unrelated person in exchange for consideration that includes the discharge of its liabilities. About form 8023, elections under section 338 for corporations making qualified stock purchases | internal revenue service When and how to file generally, attach form 8883 to the return on which the effects of the section 338 deemed sale and purchase of the target's assets are required to be reported. Web a section 338(h)(10) election is made jointly by purchaser and seller on form 8023. Web if the target is an s corporation, a section 338(h)(10) election must be made by all of the shareholders of the target, including shareholders who do not sell target stock in the qsp. Its stock is valued at $1.5 million.

Its stock is valued at $1.5 million. But then upon discussion with the target company, and you discover that the company’s tax basis in its assets is only $500,000. Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am authorized to make the section 338(h)(10) election on line 6 on behalf of the common parent of the selling consolidated group or on behalf of the selling affiliate. Old target is treated as transferring all of its assets to an unrelated person in exchange for consideration that includes the discharge of its liabilities. You’re faced with a new dilemma. When and where to file file form 8023 by the 15th day of the 9th month after the acquisition date to make a section 338 election for the target corporation. This deemed sale occurs while old target is still a member of seller's consolidated group. When and how to file generally, attach form 8883 to the return on which the effects of the section 338 deemed sale and purchase of the target's assets are required to be reported. Web a section 338(h)(10) election is made jointly by purchaser and seller on form 8023. About form 8023, elections under section 338 for corporations making qualified stock purchases | internal revenue service

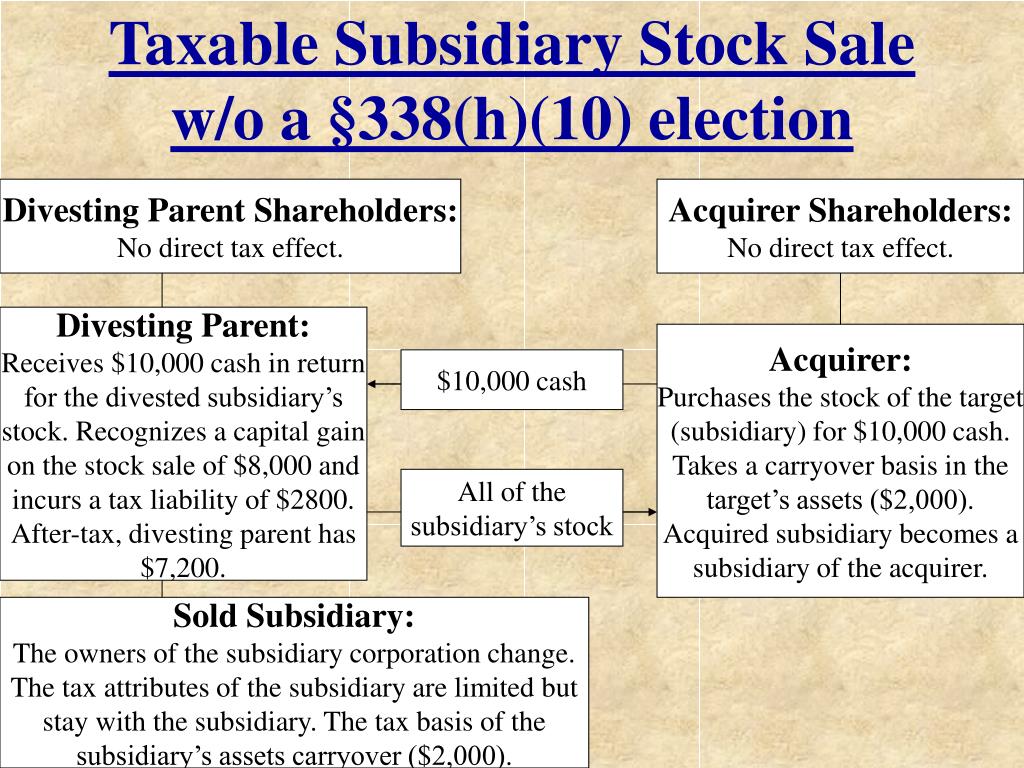

Web a 338 (h) (10) election allows a buyer of stock of an s corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100% of the assets of the. Web section 338 (h) (10) elections are available only for targets who are s corporations or members of an affiliated group of corporations (whether or not they file a consolidated federal income tax return). About form 8023, elections under section 338 for corporations making qualified stock purchases | internal revenue service Web if the target is an s corporation, a section 338(h)(10) election must be made by all of the shareholders of the target, including shareholders who do not sell target stock in the qsp. Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am authorized to make the section 338(h)(10) election on line 6 on behalf of the common parent of the selling consolidated group or on behalf of the selling affiliate. Its stock is valued at $1.5 million. This deemed sale occurs while old target is still a member of seller's consolidated group. You’re faced with a new dilemma. Old target is treated as transferring all of its assets to an unrelated person in exchange for consideration that includes the discharge of its liabilities. But then upon discussion with the target company, and you discover that the company’s tax basis in its assets is only $500,000.

PPT TAX ISSUES TO CONSIDER IN COMMON ACQUISITION SCENARIOS PowerPoint

Web section 338 (h) (10) election scenario 1 you’ve found a great company whose acquisition you believe would advance your objectives. Web a section 338(h)(10) election is made jointly by purchaser and seller on form 8023. About form 8023, elections under section 338 for corporations making qualified stock purchases | internal revenue service Web if the target is an s.

Fillable Form 8023 Elections Under Section 338 For Corporations

Web section 338 (h) (10) election scenario 1 you’ve found a great company whose acquisition you believe would advance your objectives. Web information about form 8883, asset allocation statement under section 338, including recent updates, related forms and instructions on how to file. Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state.

Understanding the Section 338(h)(10) Election YouTube

Its stock is valued at $1.5 million. Web a 338 (h) (10) election allows a buyer of stock of an s corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100% of the assets of the. Web for elections under sections 338(g) and 338(h)(10) both the old target and the new target must.

Section 338(h)(10) election Archives Calder Capital, LLC

Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am authorized to make the section 338(h)(10) election on line 6 on behalf of the common parent of the selling consolidated group or on behalf of the selling affiliate. Web for elections under sections 338(g) and 338(h)(10) both the.

Tax and Corporate Law on Sales and Purchases of Businesses

Its stock is valued at $1.5 million. Form 8883 is used to report information about transactions involving the deemed sale of. Web purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock purchase (qsp) of the target corporation. Web consolidated selling group or selling affiliate signature (section 338(h)(10) election).

Section 338 H 10 Election designditliv

You’re faced with a new dilemma. Web purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock purchase (qsp) of the target corporation. Web section 338 (h) (10) election scenario 1 you’ve found a great company whose acquisition you believe would advance your objectives. Web consolidated selling group or.

Ulfberht! Alexander Arms' .338 Lapua Magnum 10 shot folding stock

But then upon discussion with the target company, and you discover that the company’s tax basis in its assets is only $500,000. Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am authorized to make the section 338(h)(10) election on line 6 on behalf of the common parent.

or 338(h)(10) Election? Choose the LessRestrictive Option

This deemed sale occurs while old target is still a member of seller's consolidated group. Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am authorized to make the section 338(h)(10) election on line 6 on behalf of the common parent of the selling consolidated group or on.

GT’s Quick Guide to Section 338(h)(10) Elections Insights Greenberg

Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am authorized to make the section 338(h)(10) election on line 6 on behalf of the common parent of the selling consolidated group or on behalf of the selling affiliate. Web if the target is an s corporation, a section.

What Is A 338(H)(10) Election And Why It Is Important To Me?

About form 8023, elections under section 338 for corporations making qualified stock purchases | internal revenue service You’re faced with a new dilemma. This deemed sale occurs while old target is still a member of seller's consolidated group. Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am.

Old Target Is Treated As Transferring All Of Its Assets To An Unrelated Person In Exchange For Consideration That Includes The Discharge Of Its Liabilities.

Web section 338 (h) (10) election scenario 1 you’ve found a great company whose acquisition you believe would advance your objectives. Web a section 338(h)(10) election is made jointly by purchaser and seller on form 8023. When and where to file file form 8023 by the 15th day of the 9th month after the acquisition date to make a section 338 election for the target corporation. Form 8883 is used to report information about transactions involving the deemed sale of.

This Deemed Sale Occurs While Old Target Is Still A Member Of Seller's Consolidated Group.

About form 8023, elections under section 338 for corporations making qualified stock purchases | internal revenue service Its stock is valued at $1.5 million. Web a 338 (h) (10) election allows a buyer of stock of an s corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100% of the assets of the. When and how to file generally, attach form 8883 to the return on which the effects of the section 338 deemed sale and purchase of the target's assets are required to be reported.

Web Section 338 (H) (10) Elections Are Available Only For Targets Who Are S Corporations Or Members Of An Affiliated Group Of Corporations (Whether Or Not They File A Consolidated Federal Income Tax Return).

Web if the target is an s corporation, a section 338(h)(10) election must be made by all of the shareholders of the target, including shareholders who do not sell target stock in the qsp. Web for elections under sections 338(g) and 338(h)(10) both the old target and the new target must file form 8883. But then upon discussion with the target company, and you discover that the company’s tax basis in its assets is only $500,000. Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am authorized to make the section 338(h)(10) election on line 6 on behalf of the common parent of the selling consolidated group or on behalf of the selling affiliate.

Web Information About Form 8883, Asset Allocation Statement Under Section 338, Including Recent Updates, Related Forms And Instructions On How To File.

Web purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock purchase (qsp) of the target corporation. You’re faced with a new dilemma.