2022 Form M-4868

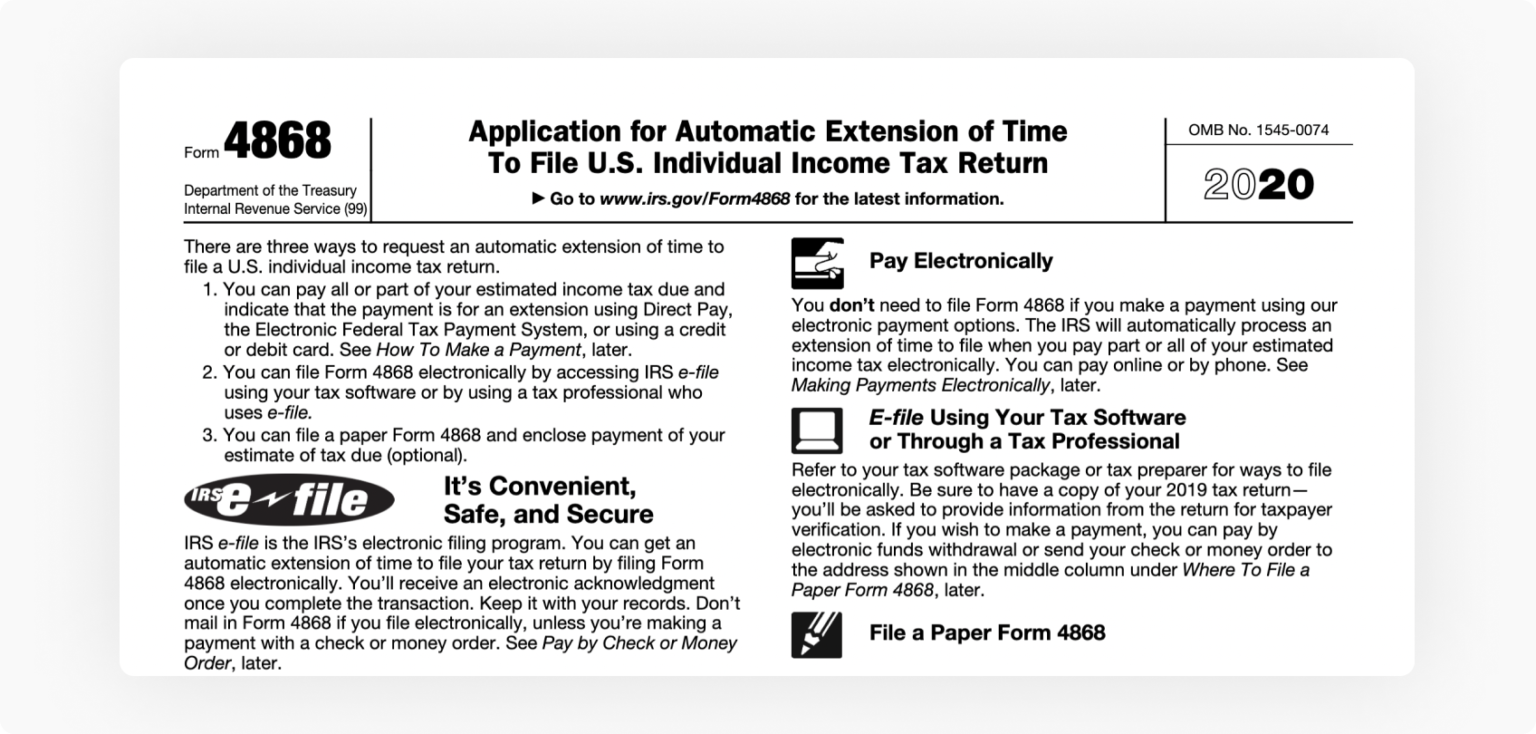

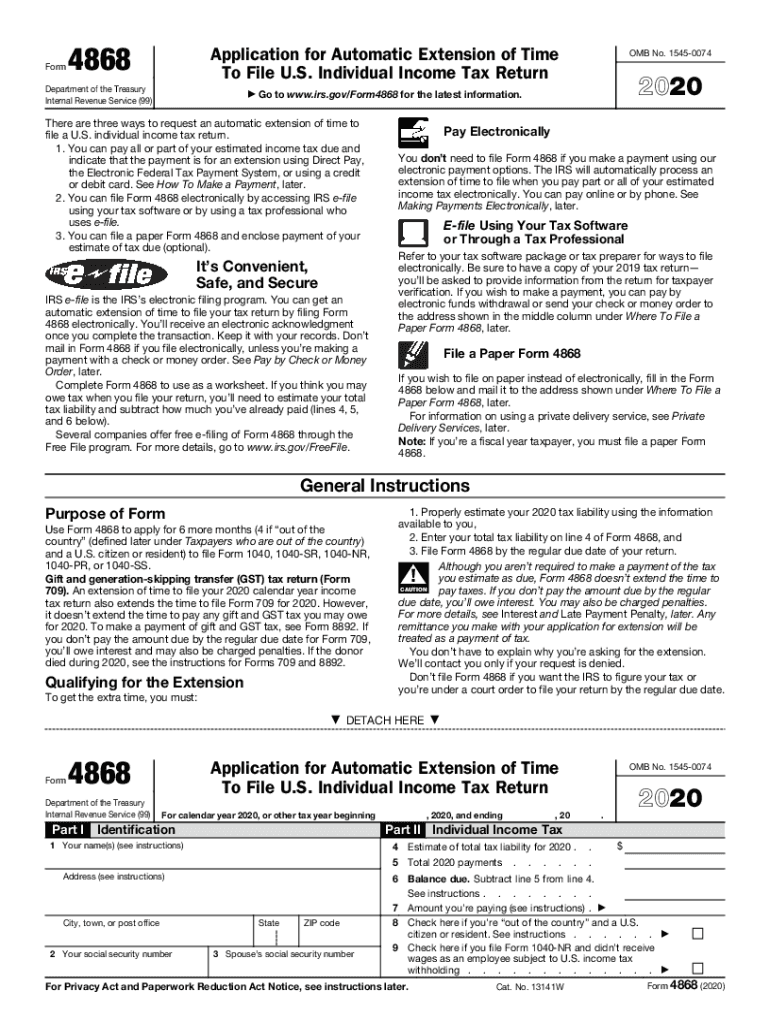

2022 Form M-4868 - Get everything done in minutes. Individual income tax return,” is a form that taxpayers can file with the irs if. Web 2022 there are three ways to request an automatic extension of time to file a u.s. Web irs tax form 4868 for 2022 allows taxpayers an additional six months to file their federal income tax returns, changing the deadline from april 15th to october 15th. This form is for income earned in tax year 2022, with tax returns. Learn more about filing an extension. Web estimate the amount of taxes you will owe for the year. Web form 4868, application for automatic extension of time to file u.s. Web up to $40 cash back irs form 4868 automatic extension 2016. Anyone that misses the deadline to file should make payment of any tax due via a return payment.

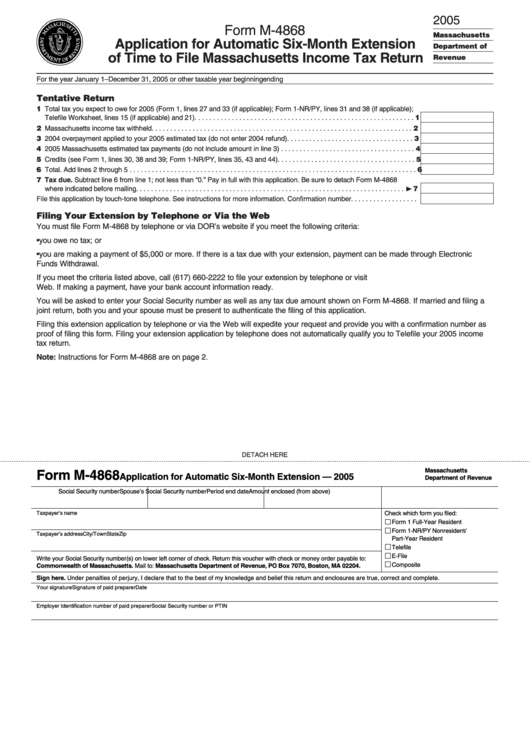

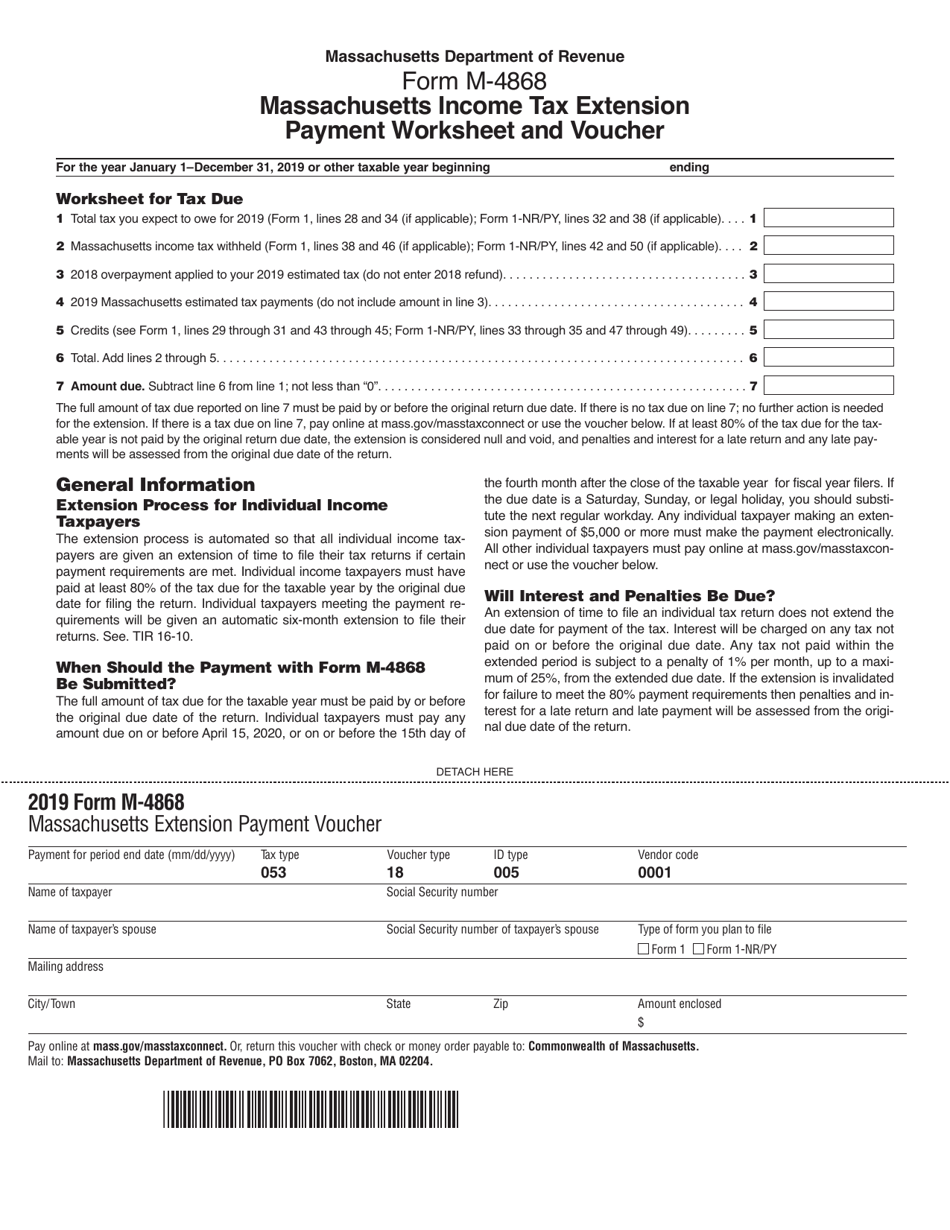

Massachusetts income tax extension payment worksheet and voucher (english, pdf 283.39 kb) open pdf file,. Massachusetts state tax return due date is extended to may 17. This form is for income earned in tax year 2022, with tax returns. Web form 4868, application for automatic extension of time to file u.s. After the form is fully gone, media completed. Anyone that misses the deadline to file should make payment of any tax due via a return payment. The actual due date to file. Web up to $40 cash back irs form 4868 automatic extension 2016. Individual income tax return individual tax filers, regardless of income, can use irs. Get everything done in minutes.

You can pay all or part of your estimated income tax due and. Deliver the particular prepared document by way of. Learn more about filing an extension. Massachusetts state tax return due date is extended to may 17. Individual income tax return,” is a form that taxpayers can file with the irs if. The actual due date to file. An extension for federal income tax returns due. Massachusetts income tax extension payment worksheet and voucher (english, pdf 283.39 kb) open pdf file,. Anyone that misses the deadline to file should make payment of any tax due via a return payment. Web form 4868, application for automatic extension of time to file u.s.

Form M4868 Application For Automatic SixMonth Extension Of Time To

Massachusetts income tax extension payment worksheet and voucher (english, pdf 283.39 kb) open pdf file,. After the form is fully gone, media completed. Deliver the particular prepared document by way of. Web 2022 there are three ways to request an automatic extension of time to file a u.s. Web place an electronic digital unique in your 2023 irs 4868 by.

Extension Form 4868 Blog ExpressExtension Extensions Made Easy

Web place an electronic digital unique in your 2023 irs 4868 by using sign device. Web irs tax form 4868 for 2022 allows taxpayers an additional six months to file their federal income tax returns, changing the deadline from april 15th to october 15th. The full amount of tax due for the taxable year must be paid by or before.

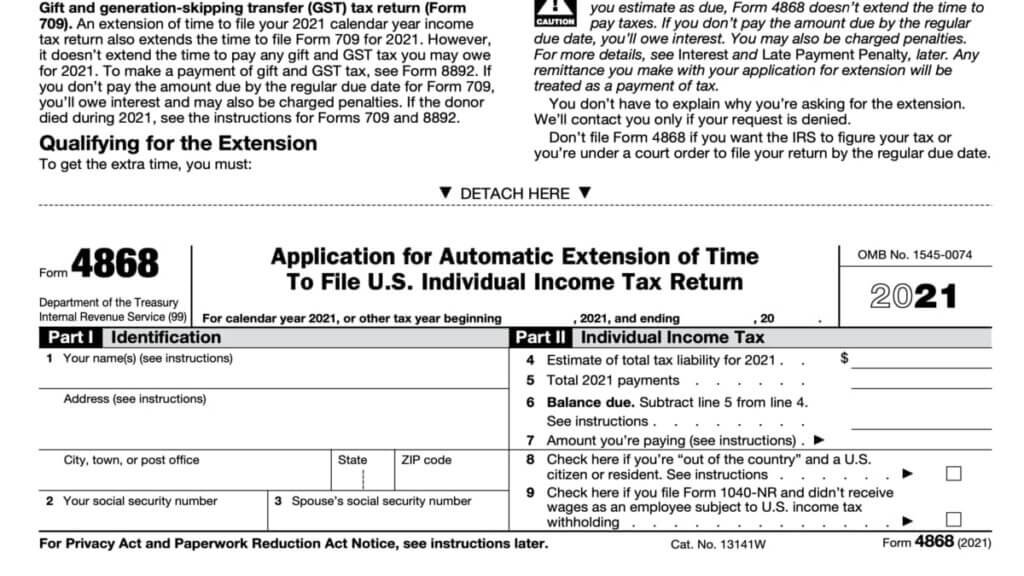

4868 Form 2022

Web form 4868, application for automatic extension of time to file u.s. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Get everything done in minutes. This form may also be used to extend the. The actual due date to file.

How to File a Personal Tax Extension in the US in 8 Easy Steps?

You can pay all or part of your estimated income tax due and. Web 2022 there are three ways to request an automatic extension of time to file a u.s. Massachusetts income tax extension payment worksheet and voucher (english, pdf 283.39 kb) open pdf file,. Learn more about filing an extension. Massachusetts state tax return due date is extended to.

Form M4868 Download Printable PDF or Fill Online Massachusetts

Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Web form 4868, application for automatic extension of time to file u.s. Web 2022 there are three ways to request an automatic extension of time to file a u.s. After the form is fully gone, media completed. Web place an electronic digital.

irsform4868applicationforautomaticextensionoftimetofile

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Individual income tax return individual tax filers, regardless of income, can use irs. Web irs tax form 4868 for 2022 allows taxpayers an additional six months to file their federal income tax returns, changing the deadline from april 15th to october.

Irs Tax Extension 2021 Form

Massachusetts income tax extension payment worksheet and voucher (english, pdf 283.39 kb) open pdf file,. Learn more about filing an extension. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). You can pay all or part of your estimated income tax due and. After the form is fully gone, media completed.

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

After the form is fully gone, media completed. Learn more about filing an extension. This form is for income earned in tax year 2022, with tax returns. Deliver the particular prepared document by way of. Anyone that misses the deadline to file should make payment of any tax due via a return payment.

Form 4868 Fill Out and Sign Printable PDF Template signNow

Individual income tax return,” is a form that taxpayers can file with the irs if. You can pay all or part of your estimated income tax due and. Web place an electronic digital unique in your 2023 irs 4868 by using sign device. Anyone that misses the deadline to file should make payment of any tax due via a return.

IRS Form 4868 How to get a tax extension in 2022? Marca

Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Web form 4868, also known as an “application for automatic extension of time to file u.s. Get everything done in minutes. Web up to $40 cash back irs form 4868 automatic extension 2016. The full amount of tax due for the taxable.

Web Up To $40 Cash Back Irs Form 4868 Automatic Extension 2016.

Web place an electronic digital unique in your 2023 irs 4868 by using sign device. Massachusetts income tax extension payment worksheet and voucher (english, pdf 283.39 kb) open pdf file,. You can pay all or part of your estimated income tax due and. The full amount of tax due for the taxable year must be paid by or before the original due date of the return.

Individual Income Tax Return,” Is A Form That Taxpayers Can File With The Irs If.

An extension for federal income tax returns due. This form is for income earned in tax year 2022, with tax returns. This form may also be used to extend the. We are not affiliated with any brand or entity on this form get the free form m 4868 instructions 2020.

Deliver The Particular Prepared Document By Way Of.

Web form 4868, application for automatic extension of time to file u.s. Web 2022 there are three ways to request an automatic extension of time to file a u.s. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web estimate the amount of taxes you will owe for the year.

Massachusetts State Tax Return Due Date Is Extended To May 17.

Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web irs tax form 4868 for 2022 allows taxpayers an additional six months to file their federal income tax returns, changing the deadline from april 15th to october 15th. Learn more about filing an extension.