2022 Form 5498

2022 Form 5498 - File this form for each. Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. Web form 5498 is used to report certain changes made to your account during the tax year. This can include the following types of transactions: Ad download or email irs 5498 & more fillable forms, register and subscribe now! Any state or its agency or. Solved•by turbotax•24127•updated april 05, 2023 you don't need to enter information from your. Reports total contributions received into your hsa in 2022. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including.

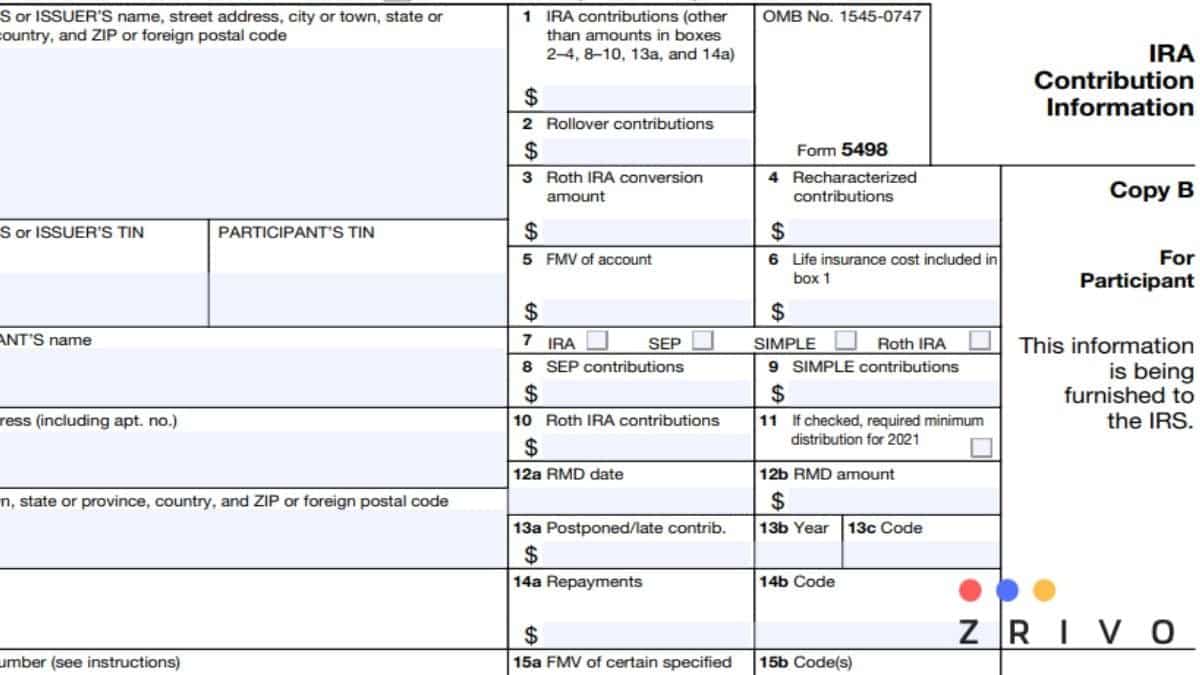

Paper filing may 31,2022 recipient copy: Reports total contributions received into your hsa in 2022. Web form 5498 reports your total annual contributions to an ira account and identifies the type of retirement account you have, such as a traditional ira, roth ira,. Box 1 shows the amount you. Web form 5498 reports various types of ira contributions you make and other account information in the reporting boxes of the form. What do i do with form 5498? Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Solved•by turbotax•24127•updated april 05, 2023 you don't need to enter information from your. Any state or its agency or.

Reports total contributions received into your hsa in 2022. What do i do with form 5498? Web form 5498 reports your total annual contributions to an ira account and identifies the type of retirement account you have, such as a traditional ira, roth ira,. Complete, edit or print tax forms instantly. Web form 5498 is used to report certain changes made to your account during the tax year. Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. For retirement account contributions 3 min read april 20, 2021 contributing to your ira means you’re putting savings toward your retirement. Web what do i do with form 5498? Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. This can include the following types of transactions:

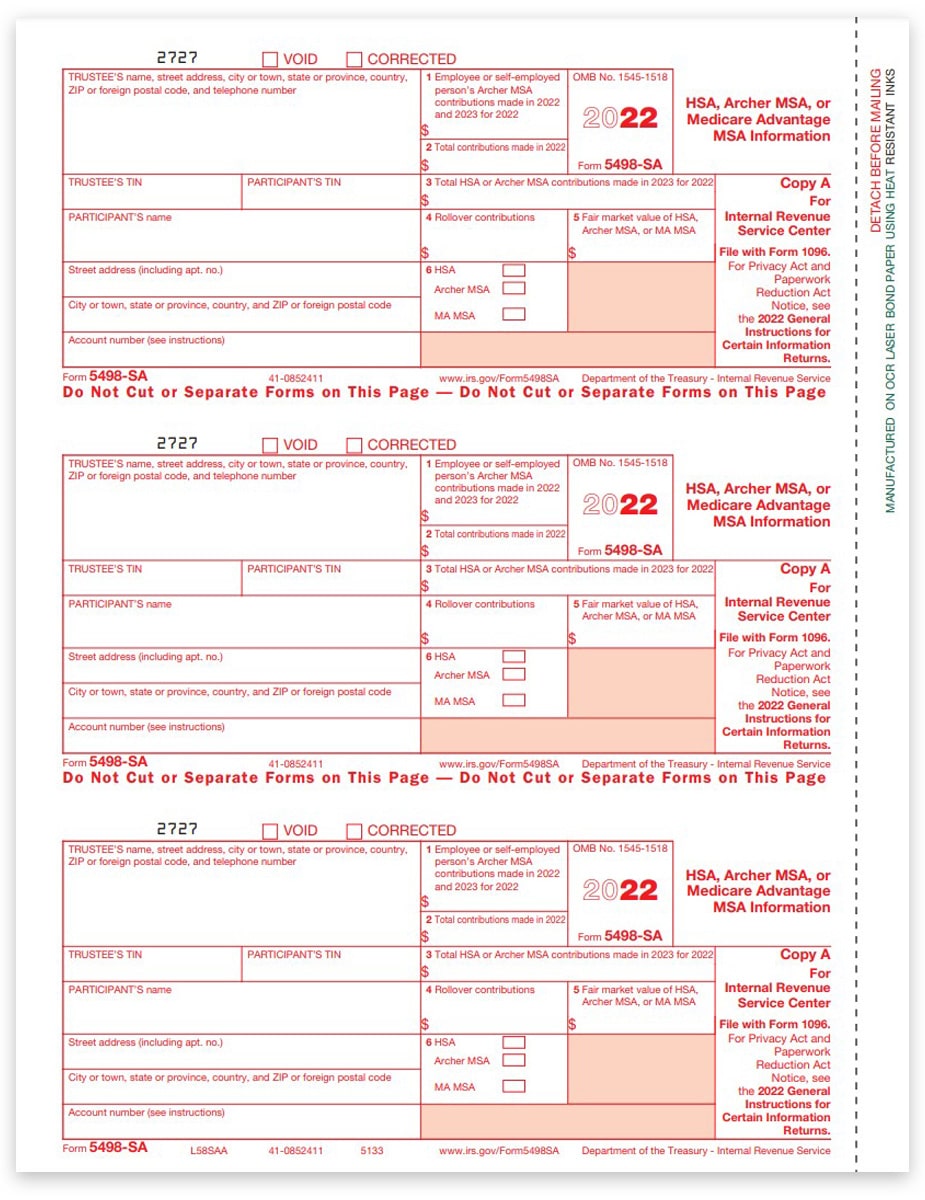

5498SA Tax Forms, IRS Copy A for HSA / MSA DiscountTaxForms

Solved•by turbotax•24127•updated april 05, 2023 you don't need to enter information from your. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web form 5498 is used to report certain changes made to your account during the tax year. File this.

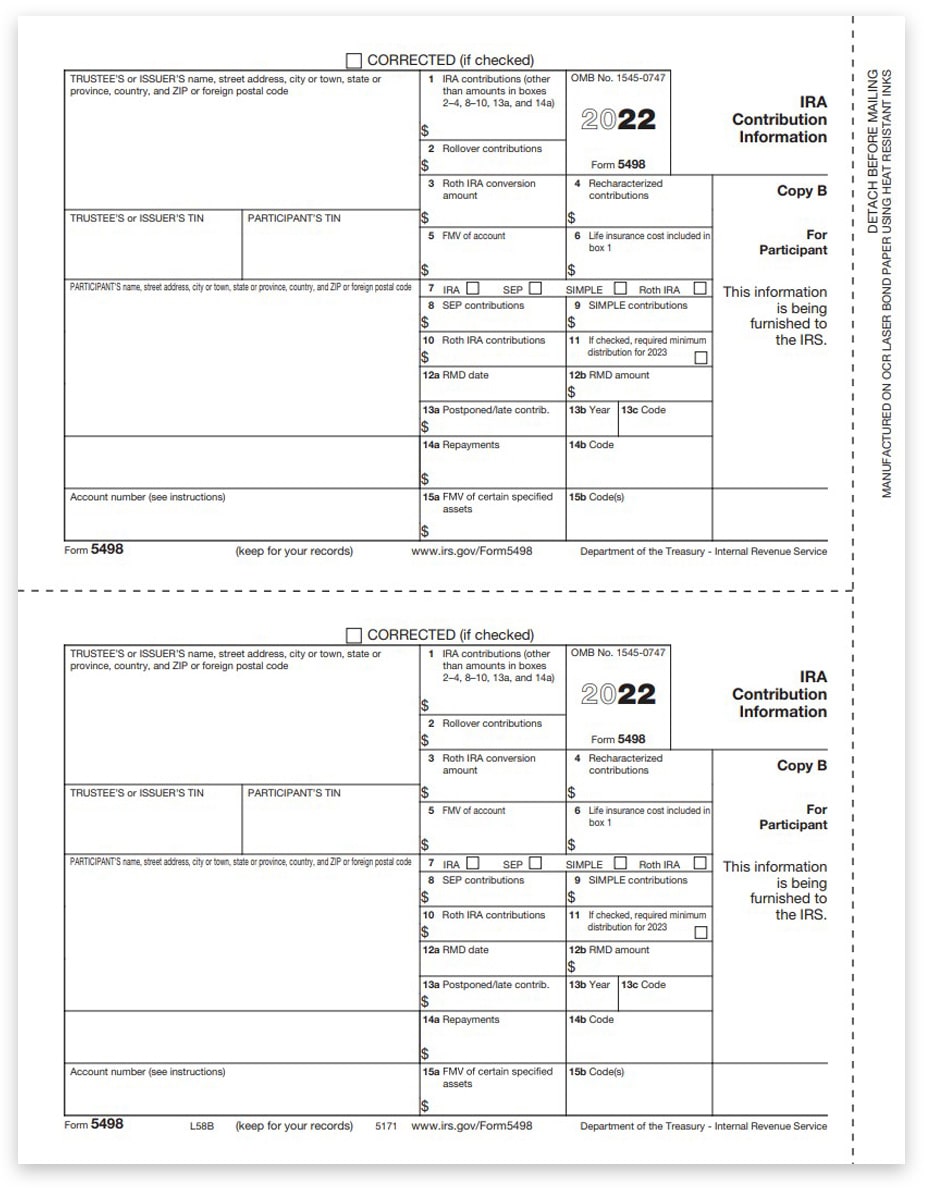

5498 Tax Forms for IRA Contributions, Participant Copy B

Box 1 shows the amount you. Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. Web form 5498 reports various types of ira contributions you make and other account information in the reporting boxes of the form. File this form.

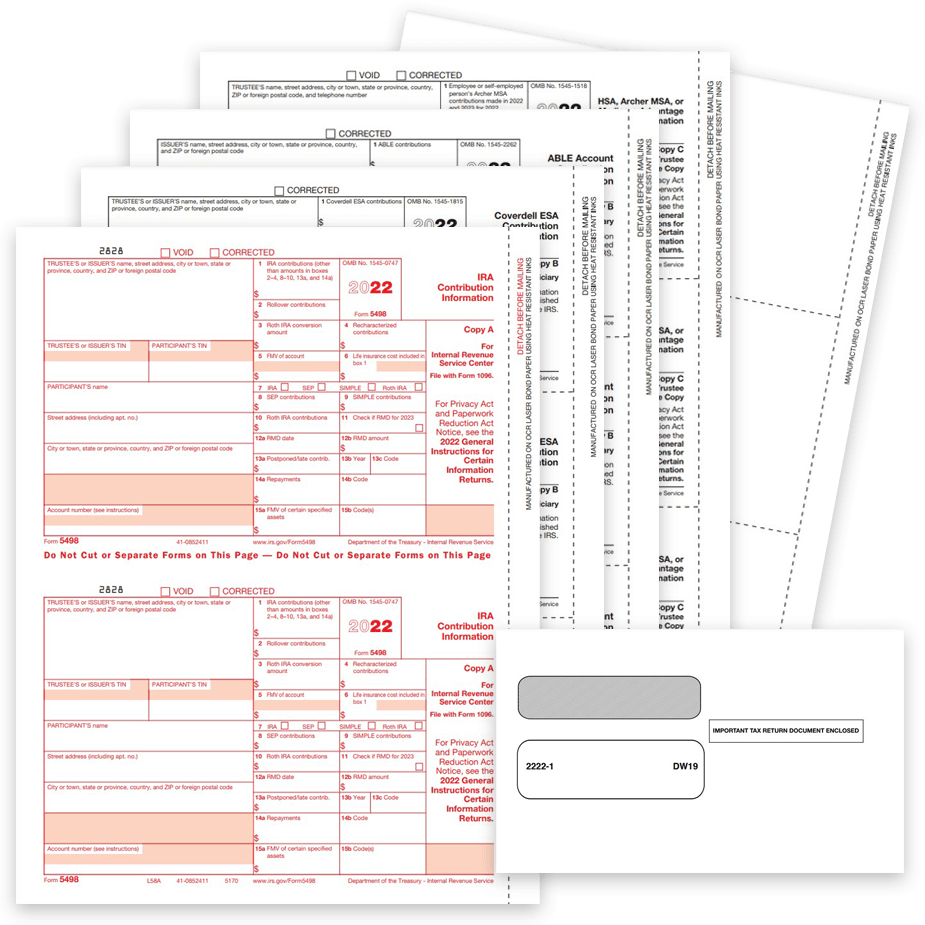

5498 Tax Forms and Envelopes for 2022

(only for fmv & rmd) january 31,2022 recipient copy: Web form 5498 deadline; Ad download or email irs 5498 & more fillable forms, register and subscribe now! Reports total contributions received into your hsa in 2022. This can include the following types of transactions:

Form 5498 Fill Out and Sign Printable PDF Template signNow

Solved•by turbotax•24127•updated april 05, 2023 you don't need to enter information from your. (only for fmv & rmd) january 31,2022 recipient copy: Paper filing may 31,2022 recipient copy: What do i do with form 5498? Web form 5498 reports various types of ira contributions you make and other account information in the reporting boxes of the form.

Form 5498QA, ABLE Account Contribution Information

Web form 5498 reports various types of ira contributions you make and other account information in the reporting boxes of the form. Solved•by turbotax•24127•updated april 05, 2023 you don't need to enter information from your. Box 1 shows the amount you. Reports total contributions received into your hsa in 2022. Web information about form 5498, ira contribution information (info copy.

2016 Form IRS 5498SA Fill Online, Printable, Fillable, Blank PDFfiller

Any state or its agency or. Box 1 shows the amount you. Web form 5498 deadline; Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. For retirement account contributions 3 min read april 20, 2021 contributing to your ira means you’re.

Fillable Form 5498SA (2022) Edit, Sign & Download in PDF PDFRun

For retirement account contributions 3 min read april 20, 2021 contributing to your ira means you’re putting savings toward your retirement. Any state or its agency or. This can include the following types of transactions: Web form 5498 reports various types of ira contributions you make and other account information in the reporting boxes of the form. Web form 5498.

IRS 5498 Form for 2022 📝 Get Tax Form 5498 IRA Contribution

Reports total contributions received into your hsa in 2022. What do i do with form 5498? This can include the following types of transactions: Web form 5498 deadline; Complete, edit or print tax forms instantly.

5498 Software to Create, Print & EFile IRS Form 5498

Solved•by turbotax•24127•updated april 05, 2023 you don't need to enter information from your. Reports total contributions received into your hsa in 2022. Web form 5498 is used to report certain changes made to your account during the tax year. This can include the following types of transactions: Web what do i do with form 5498?

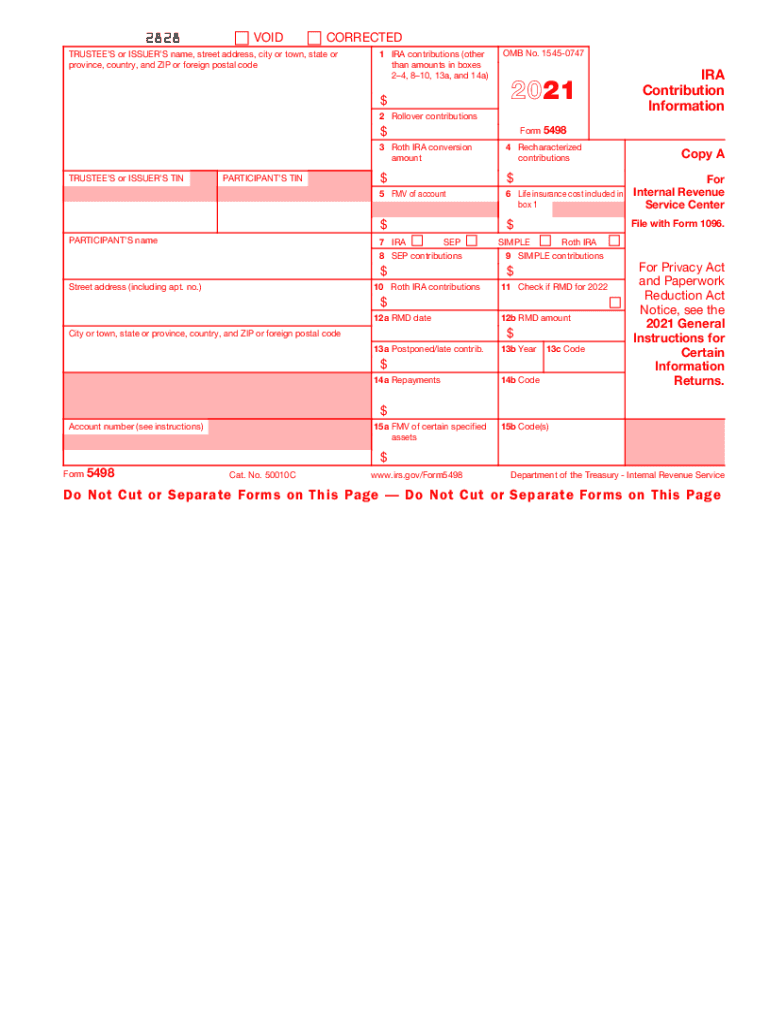

5498 Form 2021

Web form 5498 is used to report certain changes made to your account during the tax year. Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. Web form 5498 reports your total annual contributions to an ira account and identifies.

Solved•By Turbotax•24127•Updated April 05, 2023 You Don't Need To Enter Information From Your.

This can include the following types of transactions: Reports total contributions received into your hsa in 2022. Web form 5498 deadline; Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement.

File This Form For Each.

Web form 5498 is used to report certain changes made to your account during the tax year. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web form 5498 reports various types of ira contributions you make and other account information in the reporting boxes of the form.

Box 1 Shows The Amount You.

Complete, edit or print tax forms instantly. Any state or its agency or. Web what do i do with form 5498? Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including.

(Only For Fmv & Rmd) January 31,2022 Recipient Copy:

Web form 5498 reports your total annual contributions to an ira account and identifies the type of retirement account you have, such as a traditional ira, roth ira,. What do i do with form 5498? Ad download or email irs 5498 & more fillable forms, register and subscribe now! Paper filing may 31,2022 recipient copy: