2022 Form 3536

2022 Form 3536 - Web pay make payments online using web pay for businesses. 2022 form 3536 (llc extension payment); Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. Web file partnership return of income (form 565) visit 2022 partnership tax booklet for more information; Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee payment. Form 3536 only needs to be filed if your income is $250,000 or more. Get your online template and fill it in using progressive features. File and pay your state income taxes ; If the llc owes an estimated fee, complete the form below. Do not use form ftb 3536 if you are paying the 2022 $800 annual llc tax.

Form 3536 only needs to be filed if your income is $250,000 or more. You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year. Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee payment. File the statement of information with the sos; Instead use the 2022 form ftb 3522, llc tax voucher. If the llc owes an estimated fee, complete the form below. Do not use form ftb 3536 if you are paying the 2022 $800 annual llc tax. And 2023 form 3536, estimated fees for llcs. Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. Web file partnership return of income (form 565) visit 2022 partnership tax booklet for more information;

Web file partnership return of income (form 565) visit 2022 partnership tax booklet for more information; If your llc is taxed as sole proprietorship, the. Get your online template and fill it in using progressive features. 2023 form 3522, limited liability company tax voucher; File the statement of information with the sos; You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year. If the llc owes an estimated fee, complete the form below. If your llc will not earn that much in annual gross receipts (total revenue), then you don’t need to file form 3536. Mail the form along with the check or money order payable to the franchise tax board by the 15th day of the 6th month of the current taxable year (fiscal year) or june 15, 2022 (calendar year). And 2023 form 3536, estimated fees for llcs.

1099 NEC Form 2022

You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year. If your llc is taxed as sole proprietorship, the. Get your online template and fill it in using progressive features. 2022 form 3536 (llc extension payment); If the llc owes an estimated fee, complete the form below.

Form 3536 Model T Swivel Joint End For Commutator Rod, 3536

And 2023 form 3536, estimated fees for llcs. A penalty in the amount of 10% of the underpayment of the estimated fee will apply if the estimated llc fee is underpaid. Get your online template and fill it in using progressive features. Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee. If your.

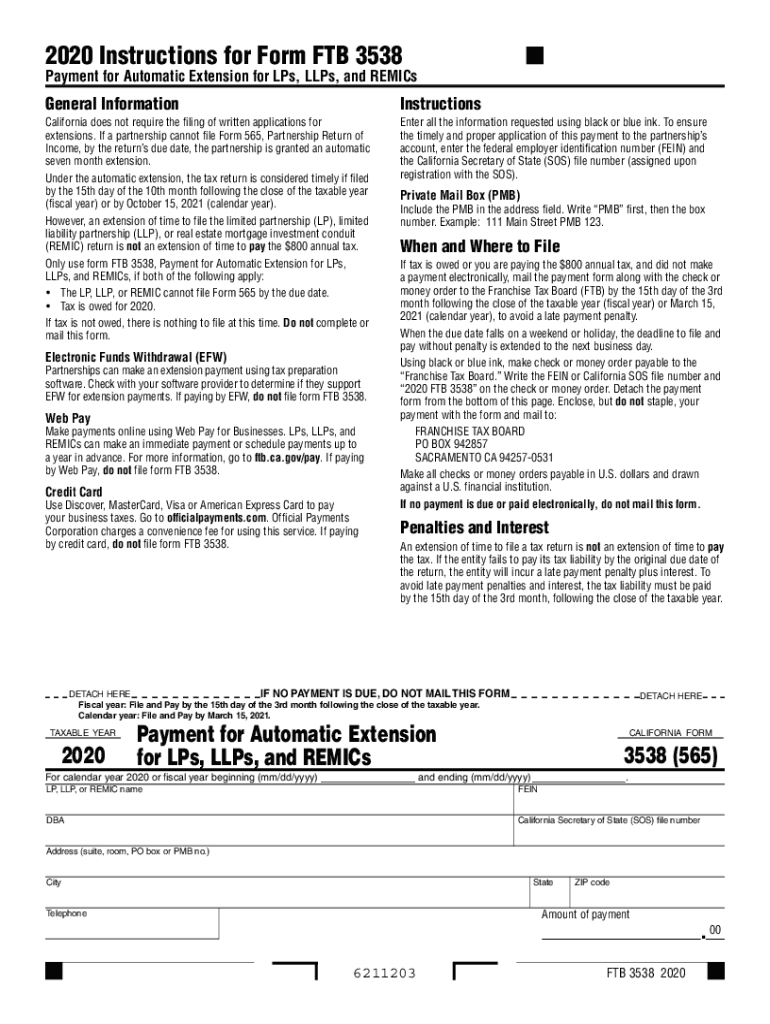

2020 Form CA FTB 3538 (565) Fill Online, Printable, Fillable, Blank

Web pay make payments online using web pay for businesses. Do not use form ftb 3536 if you are paying the 2022 $800 annual llc tax. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. File the statement of information with the sos; If your llc.

2022 Form CA FTB 3536 Fill Online, Printable, Fillable, Blank pdfFiller

2023 form 3522, limited liability company tax voucher; Web pay make payments online using web pay for businesses. If your llc is taxed as sole proprietorship, the. Reply thedjwonder12 • additional comment actions. Get form ftb 3536 for more information.

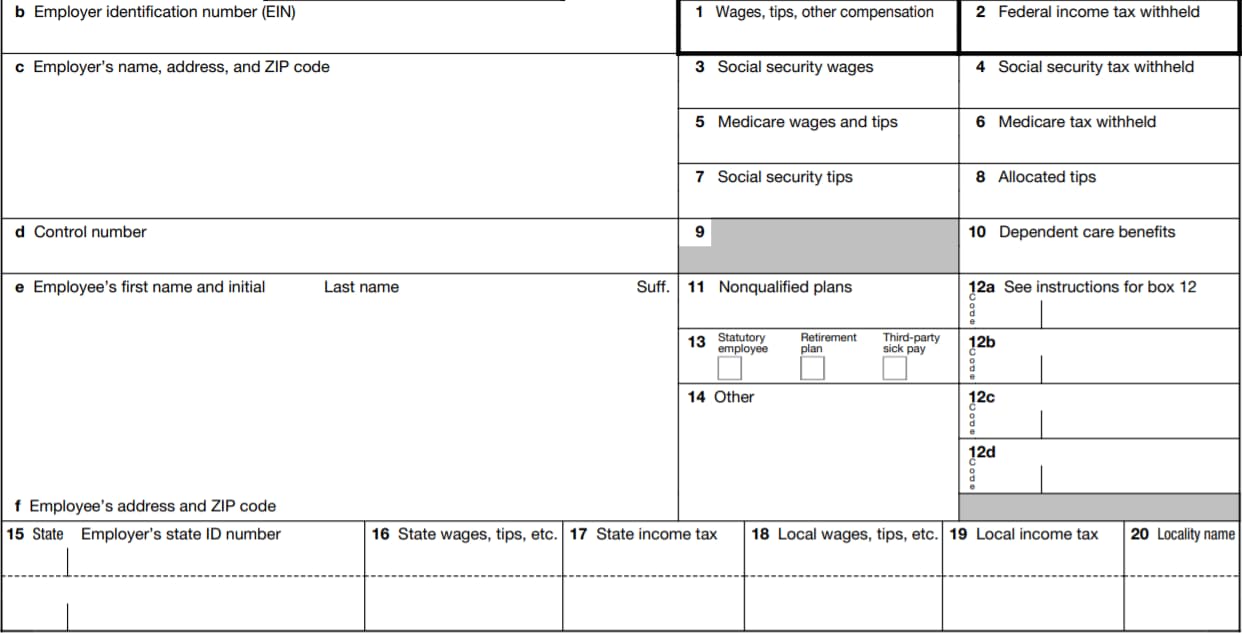

W2 Form 2022 Fillable PDF

Web use this screen to complete 2022 form 568, limited liability company return of income, side 1; Web form 3536 is used to pay an estimated fee for your california llc if it will make more than $250,000 in annual gross receipts (total revenue). Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax.

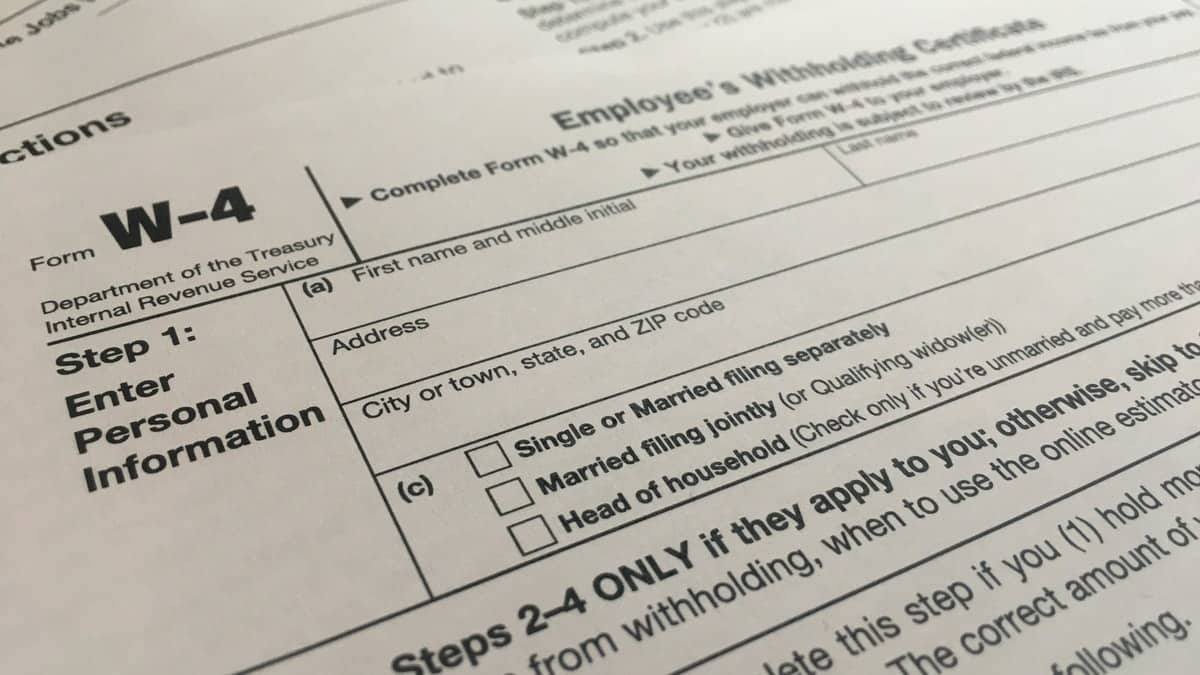

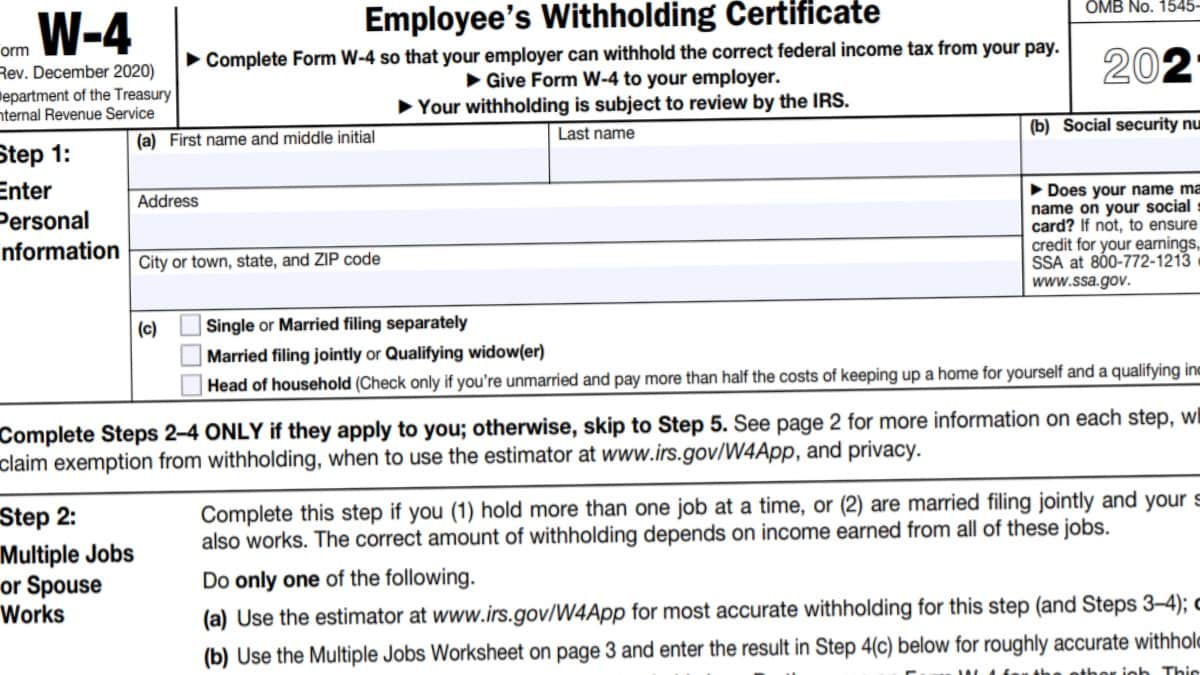

W4 Form 2023 Instructions

Instead use the 2022 form ftb 3522, llc tax voucher. Web file partnership return of income (form 565) visit 2022 partnership tax booklet for more information; To keep your llc active you must: Web complete or mail form ftb 3536. And 2023 form 3536, estimated fees for llcs.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Web file partnership return of income (form 565) visit 2022 partnership tax booklet for more information; To keep your llc active you must: Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web form 3536 is used to pay an estimated fee for your california llc.

Ca Form 3536 2022

2023 form 3522, limited liability company tax voucher; Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. We do not grant automatic extensions to file for suspended llcs. File and pay your state income taxes ; 2022 form 3536 (llc extension payment);

W4 Form 2022 Instructions W4 Forms TaxUni

Web pay make payments online using web pay for businesses. Web complete or mail form ftb 3536. To keep your llc active you must: Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. Instead use the 2022 form ftb 3522, llc tax.

W9 Form 2022

Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee. Instead use the 2022 form ftb 3522, llc tax voucher. We do not grant automatic extensions to file for suspended llcs. Get your online template and fill it in using progressive features. 2023 form 3522, limited liability company tax voucher;

Form 3536 Only Needs To Be Filed If Your Income Is $250,000 Or More.

Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee payment. File and pay your state income taxes ; File the statement of information with the sos; Web form 3536 is used to pay an estimated fee for your california llc if it will make more than $250,000 in annual gross receipts (total revenue).

We Do Not Grant Automatic Extensions To File For Suspended Llcs.

Mail the form along with the check or money order payable to the franchise tax board by the 15th day of the 6th month of the current taxable year (fiscal year) or june 15, 2022 (calendar year). Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee. Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. Instead use the 2022 form ftb 3522, llc tax voucher.

Reply Thedjwonder12 • Additional Comment Actions.

2023 form 3522, limited liability company tax voucher; You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year. Form 568 is due each year, usually by march 15th or april 15th. If your llc will not earn that much in annual gross receipts (total revenue), then you don’t need to file form 3536.

Do Not Use Form Ftb 3536 If You Are Paying The 2022 $800 Annual Llc Tax.

Get form ftb 3536 for more information. Web pay make payments online using web pay for businesses. If your llc is taxed as sole proprietorship, the. Web use this screen to complete 2022 form 568, limited liability company return of income, side 1;