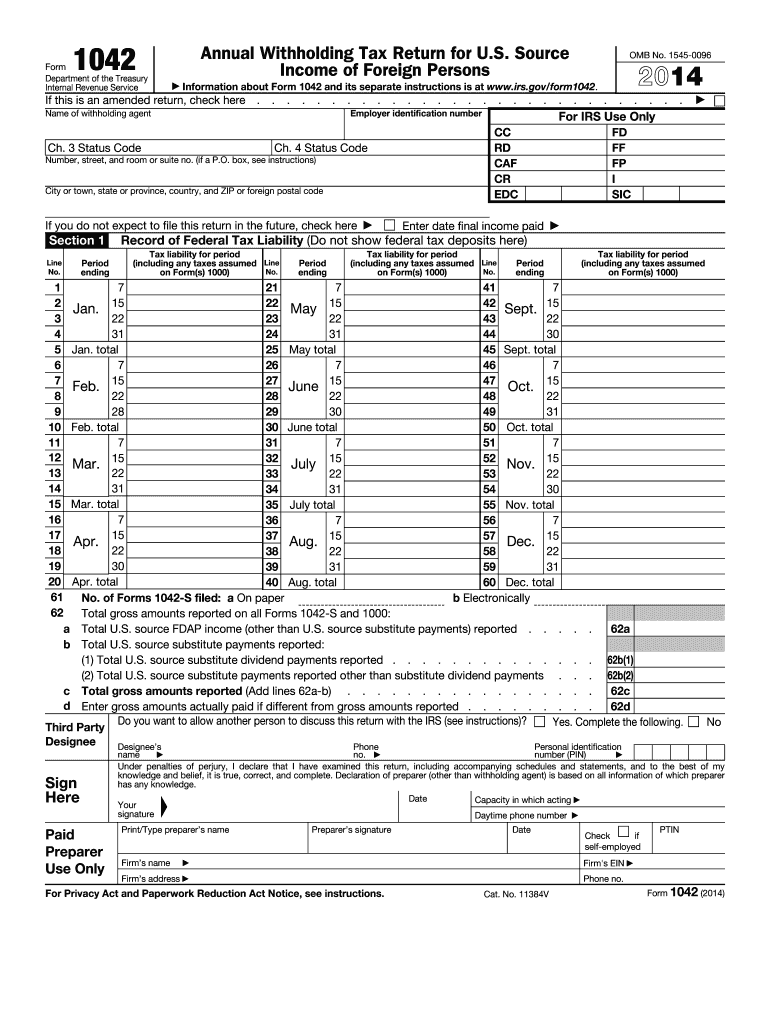

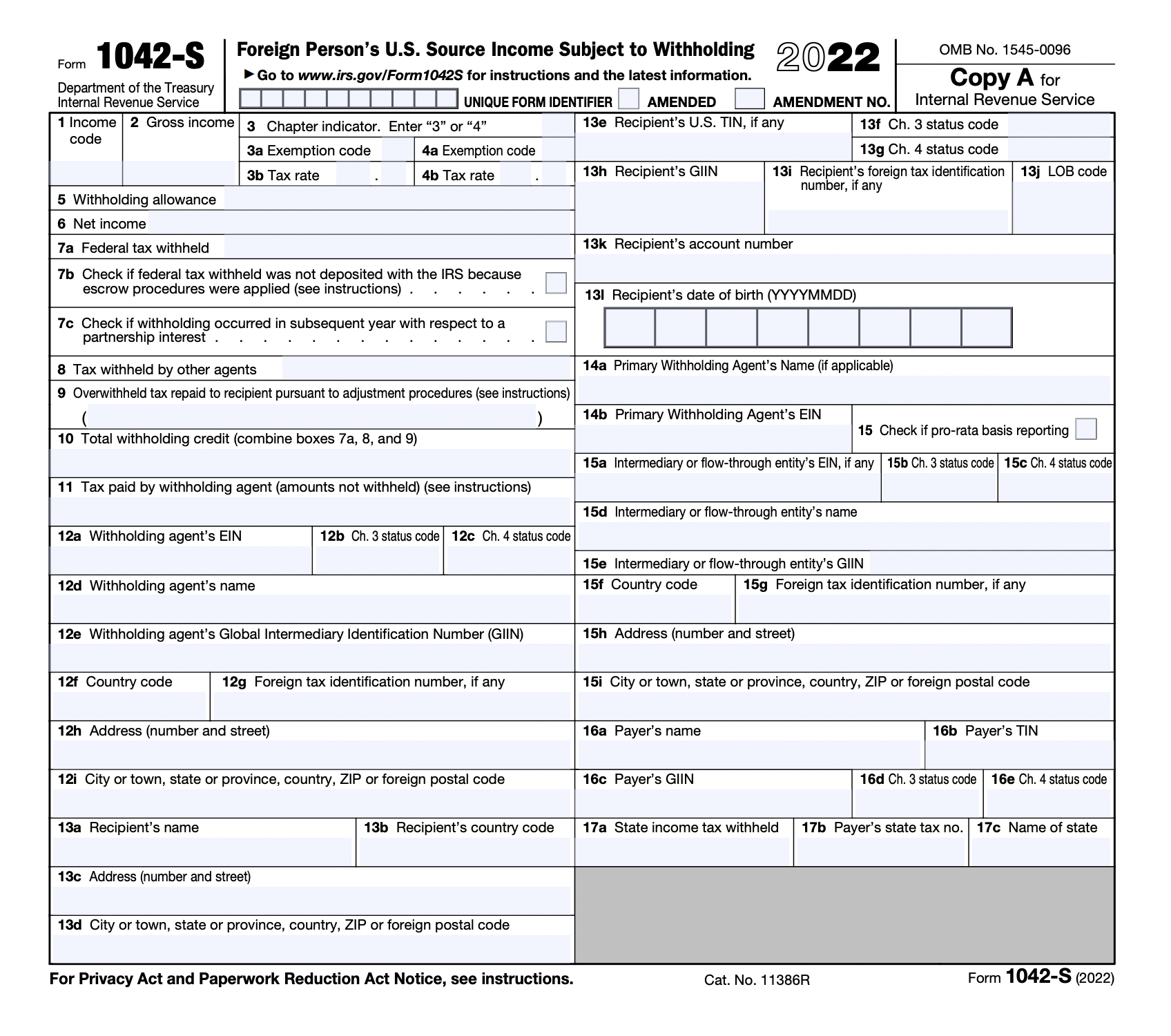

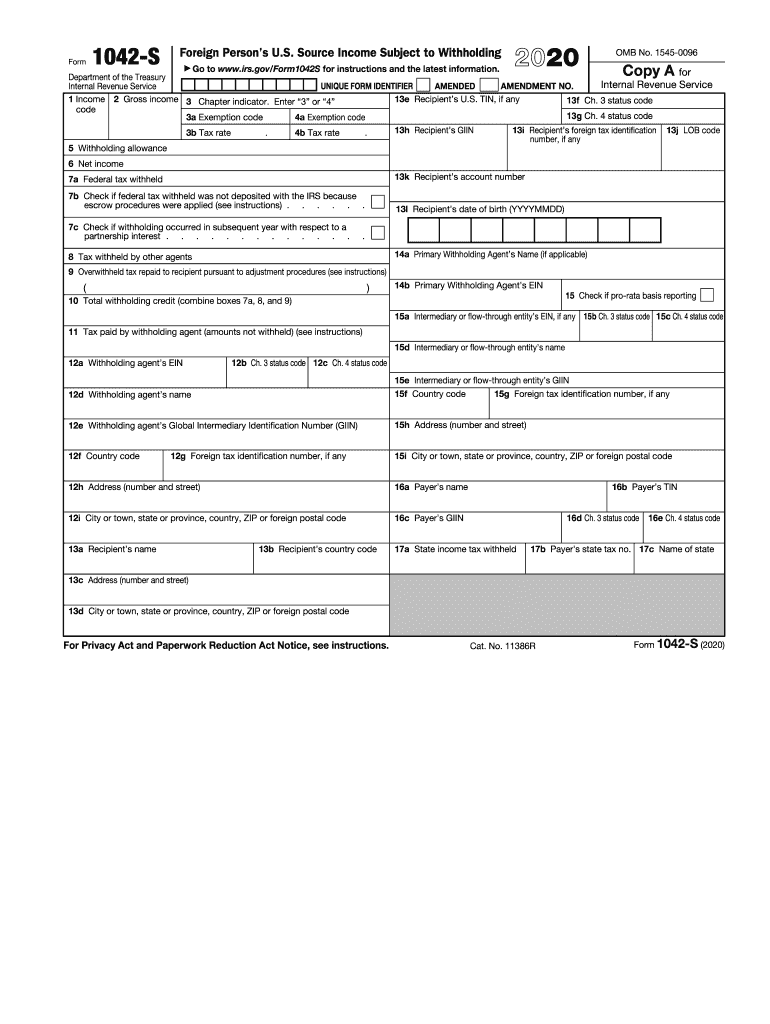

2022 Form 1042

2022 Form 1042 - Get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding) for your. The forms can be downloaded individually or you can obtain all of the forms. Web electronic filing required for 2022? While the regulations are not yet final, the irs did communicate to software filers at a recent conference that the form 1042 and. Nonresidents a draft 2022 form 1042, annual withholding. Open your return in turbotax. Complete, edit or print tax forms instantly. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Source income of foreign persons, common errors on form 1042 and.

Web the irs release a draft of the 2022 form 1042 the form reports tax withheld from payments made to u.s. On march 3, 2023, the office of the state comptroller issued. Web use form 1042 to report the following. Source income subject to withholding) for your. Ad get ready for tax season deadlines by completing any required tax forms today. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. The forms can be downloaded individually or you can obtain all of the forms. There are a number of changes to codes: Open your return in turbotax. 56 dividend equivalents under irc section 871 (m) as a result of applying the combined transaction rules added:.

Source income subject to withholding) for calendar year 2022. On march 3, 2023, the office of the state comptroller issued. Click on wages & income. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. While the regulations are not yet final, the irs did communicate to software filers at a recent conference that the form 1042 and. Web you must file form 1042 if any of the following apply. Web report error it appears you don't have a pdf plugin for this browser. Get ready for tax season deadlines by completing any required tax forms today. 56 dividend equivalents under irc section 871 (m) as a result of applying the combined transaction rules added:. Web what's new for 2022 added:

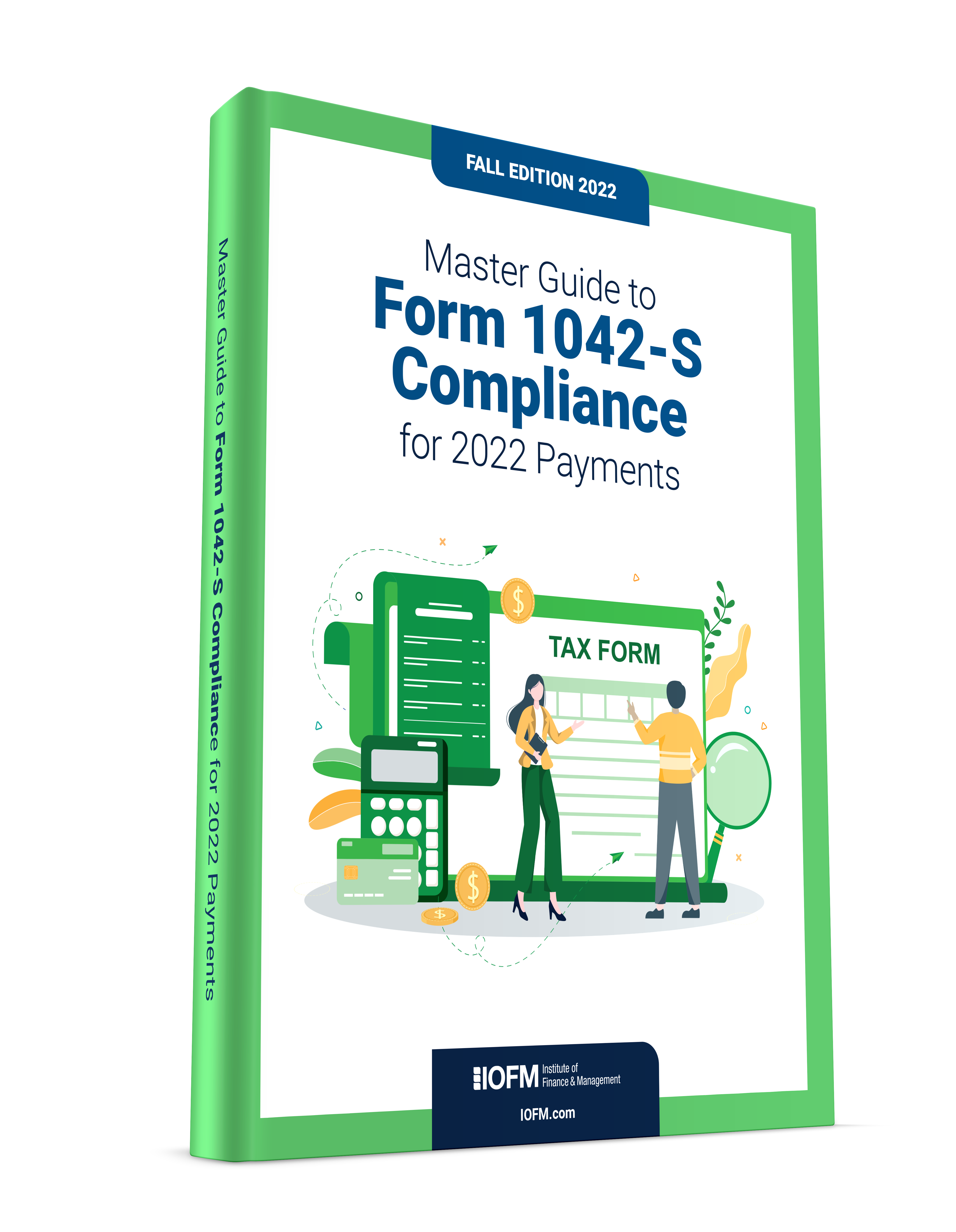

2022 Master Guide to Form 1042S Compliance Institute of Finance

Ad get ready for tax season deadlines by completing any required tax forms today. There are a number of changes to codes: Web report error it appears you don't have a pdf plugin for this browser. While the regulations are not yet final, the irs did communicate to software filers at a recent conference that the form 1042 and. Click.

Form 1042S USEReady

Web use form 1042 to report the following. Ad get ready for tax season deadlines by completing any required tax forms today. There are a number of changes to codes: Source income of foreign persons, common errors on form 1042 and. 56 dividend equivalents under irc section 871 (m) as a result of applying the combined transaction rules added:.

1042 S Form slideshare

Web electronic filing required for 2022? Web what's new for 2022 added: Use this form to transmit paper. 56 dividend equivalents under irc section 871 (m) as a result of applying the combined transaction rules added:. Get ready for tax season deadlines by completing any required tax forms today.

2022 Master Guide to Form 1042S Compliance Institute of Finance

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. There are a number of changes to codes: Scroll down to all income. Complete, edit or print tax forms instantly. Web electronic filing required for 2022?

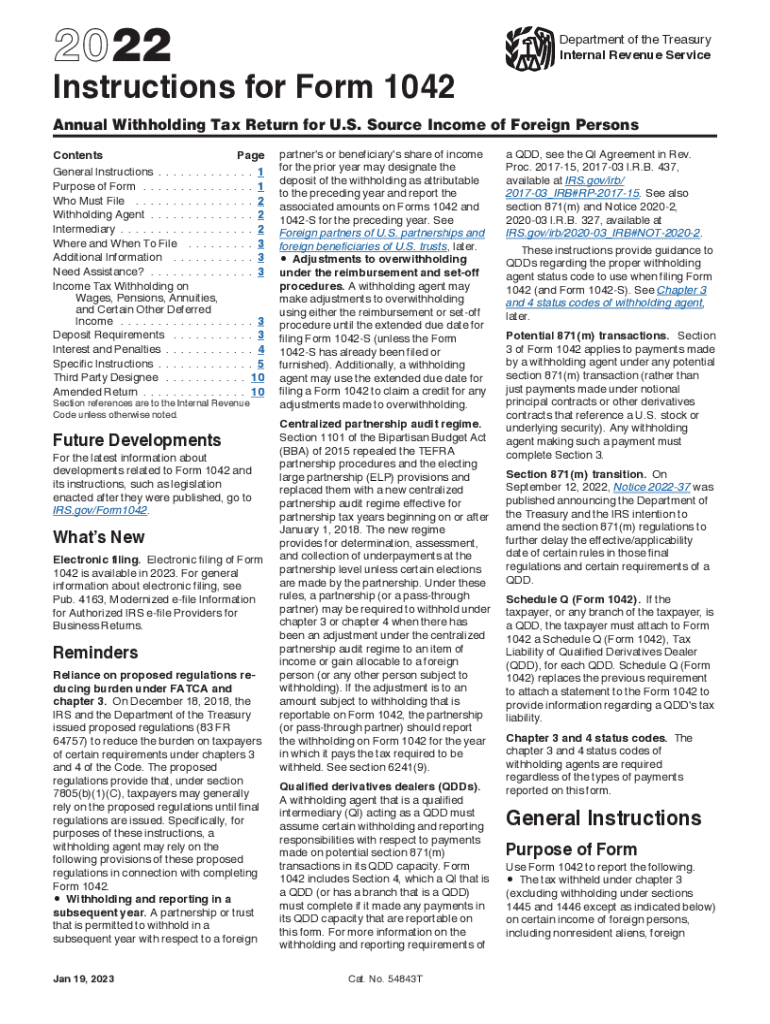

Instructions for Form 1042 Internal Revenue Service Fill Out and Sign

Get ready for tax season deadlines by completing any required tax forms today. Click on wages & income. Source income subject to withholding) for calendar year 2022. Web you must file form 1042 if any of the following apply. Use this form to transmit paper.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Click on wages & income. Source income subject to withholding. Source income of foreign persons, common errors on form 1042 and. Ad get ready for tax season deadlines by completing any required tax forms today.

Actualizar 76+ imagen can you issue a 1099 to a non us citizen Ecover.mx

Complete, edit or print tax forms instantly. Use this form to transmit paper. While the regulations are not yet final, the irs did communicate to software filers at a recent conference that the form 1042 and. Click on wages & income. Get ready for tax season deadlines by completing any required tax forms today.

1042 S Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Web november 08, 2022. Web use form 1042 to report the following: The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Ad get ready for tax season deadlines by completing any required tax forms today.

[ベスト] tr570 instructions 705117Tr 570 instructions gasaktuntasneaa

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Open your return in turbotax. Use this form to transmit paper. Source income subject to withholding. Web use form 1042 to report the following.

2014 form 1042 Fill out & sign online DocHub

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Nonresidents a draft 2022 form 1042, annual withholding. Source income subject to withholding) for your. While the regulations are not yet final, the irs did communicate to software filers at a recent conference that the form 1042 and. The forms.

Source Income Of Foreign Persons, Common Errors On Form 1042 And.

On march 3, 2023, the office of the state comptroller issued. Open your return in turbotax. There are a number of changes to codes: 56 dividend equivalents under irc section 871 (m) as a result of applying the combined transaction rules added:.

The Tax Withheld Under Chapter 3 (Excluding Withholding Under Sections 1445 And 1446 Except As Indicated Below) On Certain Income.

Web what's new for 2022 added: Web use form 1042 to report the following: Complete, edit or print tax forms instantly. Web you must file form 1042 if any of the following apply.

Source Income Subject To Withholding) For Calendar Year 2022.

Web electronic filing required for 2022? The forms can be downloaded individually or you can obtain all of the forms. Source income subject to withholding) for your. Nonresidents a draft 2022 form 1042, annual withholding.

Web The Irs Release A Draft Of The 2022 Form 1042 The Form Reports Tax Withheld From Payments Made To U.s.

The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Web report error it appears you don't have a pdf plugin for this browser. Scroll down to all income. Click on wages & income.

![[ベスト] tr570 instructions 705117Tr 570 instructions gasaktuntasneaa](https://www.irs.gov/pub/xml_bc/34025766.gif)