2021 Form 941 X

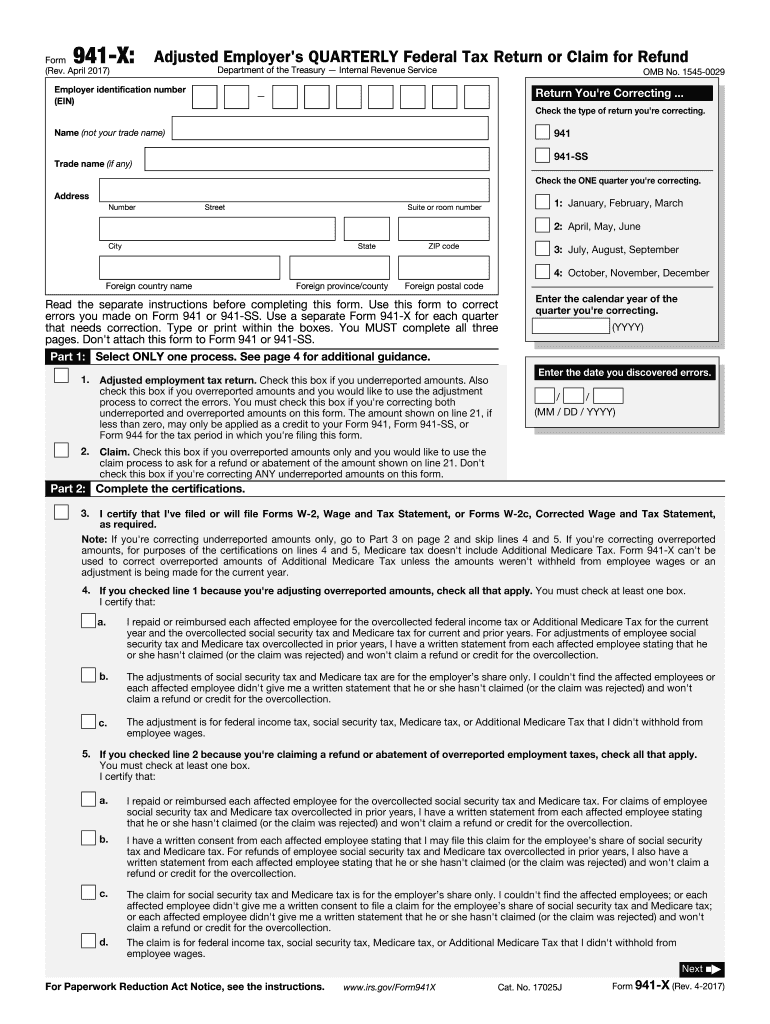

2021 Form 941 X - You must complete all five pages. If changes in law require. You should use the july 2021 revision. You must complete all three. Web the irs expects the june 2021 revision of form 941 and these instructions to be used for the second, third, and fourth quarters of 2021. Complete, edit or print tax forms instantly. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web instructions for form 941(rev. The sum of line 30 and line 31 multiplied by the credit. March 2021) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the.

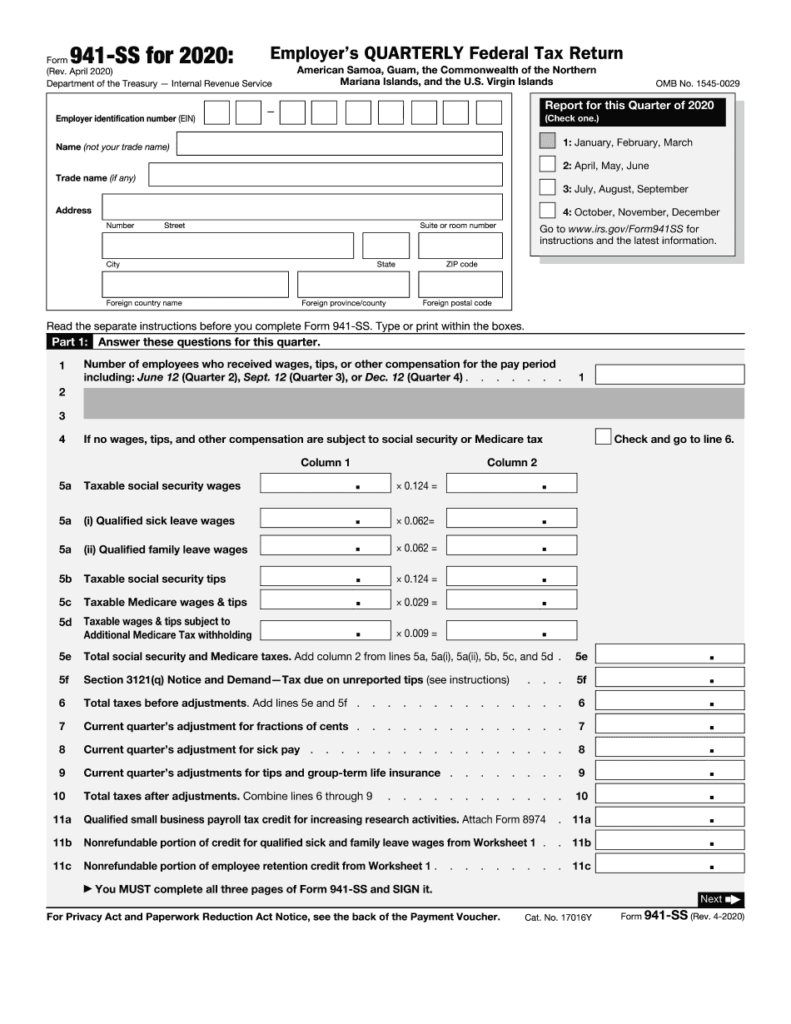

If changes in law require. Here’s everything you need to know to stay on top of your tax game. Web instructions for form 941(rev. Type or print within the boxes. March 2021) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the. Web the irs expects the june 2021 revision of form 941 and these instructions to be used for the second, third, and fourth quarters of 2021. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Complete, edit or print tax forms instantly. You should use the july 2021 revision. April, may, june read the separate instructions before completing this form.

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. April, may, june read the separate instructions before completing this form. Complete, edit or print tax forms instantly. You must complete all three. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Earlier in 2021, the irs. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. If you are located in. If changes in law require. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no.

Printable 941 Form 2021 Printable Form 2022

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Form 941 is used by employers. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Complete, edit or print tax forms instantly. Web information about form 941, employer's quarterly federal tax return, including.

The IRS Released A Draft of Form 941 for Tax Year 2021 Blog TaxBandits

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Complete, edit or print tax forms instantly. Web the irs expects the june 2021 revision of form 941 and these instructions to be used for the second, third, and fourth quarters of 2021. If changes in law require. Web city.

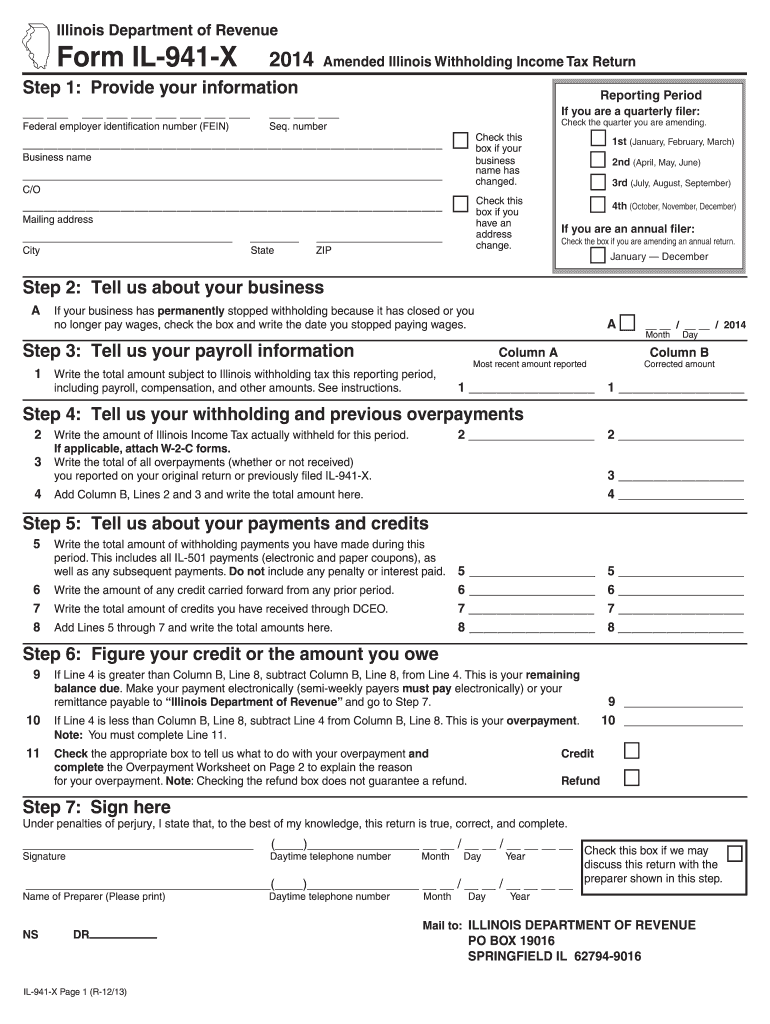

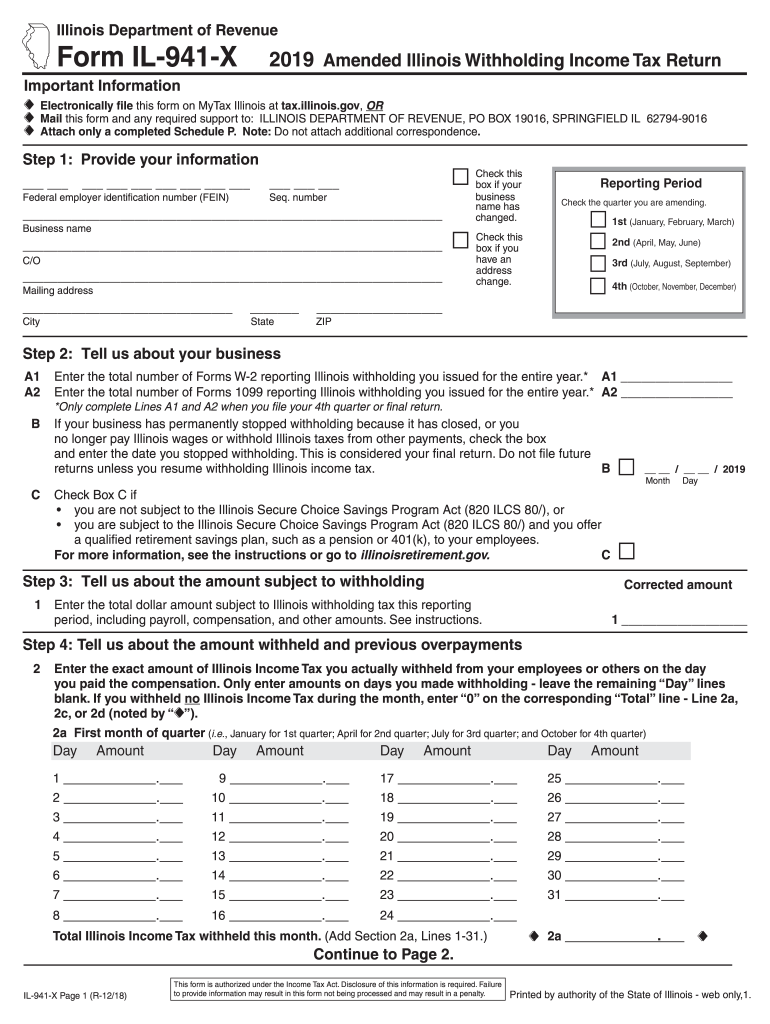

Il 941 X Form Fill Out and Sign Printable PDF Template signNow

If changes in law require. Here’s everything you need to know to stay on top of your tax game. Complete, edit or print tax forms instantly. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no.

Printable 941 Tax Form 2021 Printable Form 2022

If you are located in. If changes in law require. March 2021) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Web the irs expects the june 2021 revision of form 941 and these instructions to.

941 Form 2021

Complete, edit or print tax forms instantly. April, may, june read the separate instructions before completing this form. You must complete all five pages. If you are located in. Earlier in 2021, the irs.

941 Form Fill Out and Sign Printable PDF Template signNow

Type or print within the boxes. Here’s everything you need to know to stay on top of your tax game. If you are located in. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,.

2021 Form IL DoR IL941X Fill Online, Printable, Fillable, Blank

Type or print within the boxes. Complete, edit or print tax forms instantly. Web the irs expects the june 2021 revision of form 941 and these instructions to be used for the second, third, and fourth quarters of 2021. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file..

Form Il 941 X Fill Out and Sign Printable PDF Template signNow

If changes in law require. Complete, edit or print tax forms instantly. Form 941 is used by employers. You must complete all five pages. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,.

Form 941 Efiling Tips for the 2nd Quarter of 2021 Blog

Complete, edit or print tax forms instantly. If changes in law require. Web instructions for form 941(rev. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Earlier in 2021, the irs.

Here’s Everything You Need To Know To Stay On Top Of Your Tax Game.

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly. If changes in law require. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,.

Web City State Zip Code Foreign Country Name Foreign Province/County Foreign Postal Code 950122 Omb No.

April, may, june read the separate instructions before completing this form. You must complete all five pages. Web instructions for form 941(rev. Type or print within the boxes.

Earlier In 2021, The Irs.

The sum of line 30 and line 31 multiplied by the credit. If you are located in. You should use the july 2021 revision. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,.

Web The Irs Expects The June 2021 Revision Of Form 941 And These Instructions To Be Used For The Second, Third, And Fourth Quarters Of 2021.

March 2021) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the. Complete, edit or print tax forms instantly. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. You must complete all three.