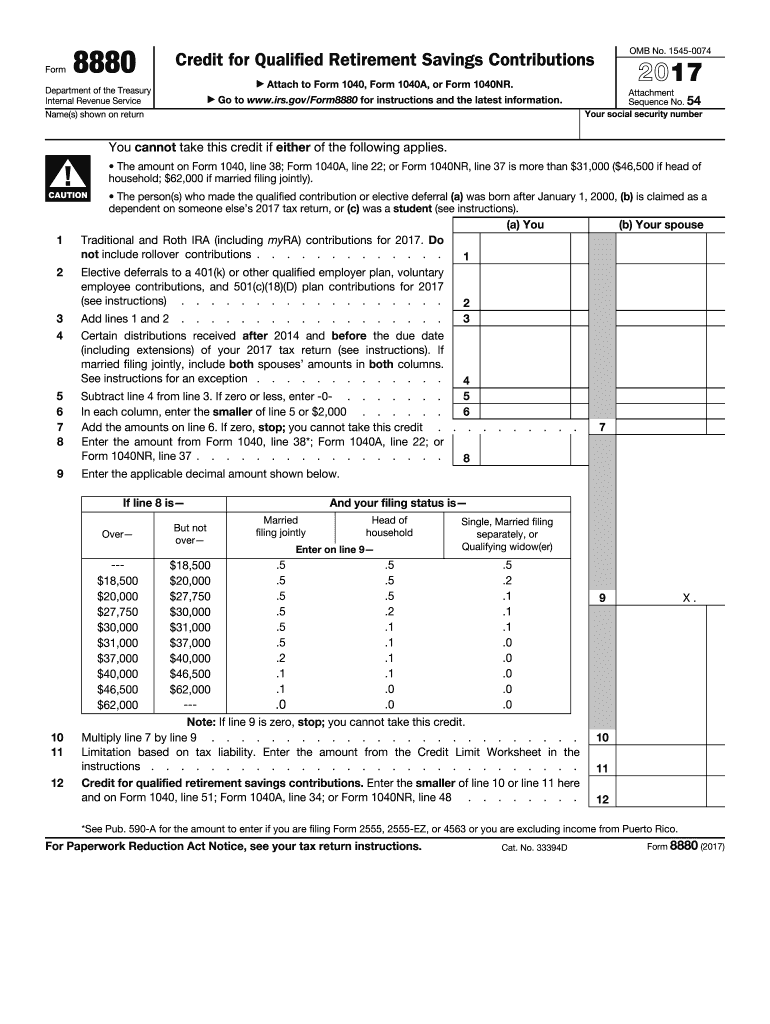

2021 Form 8880

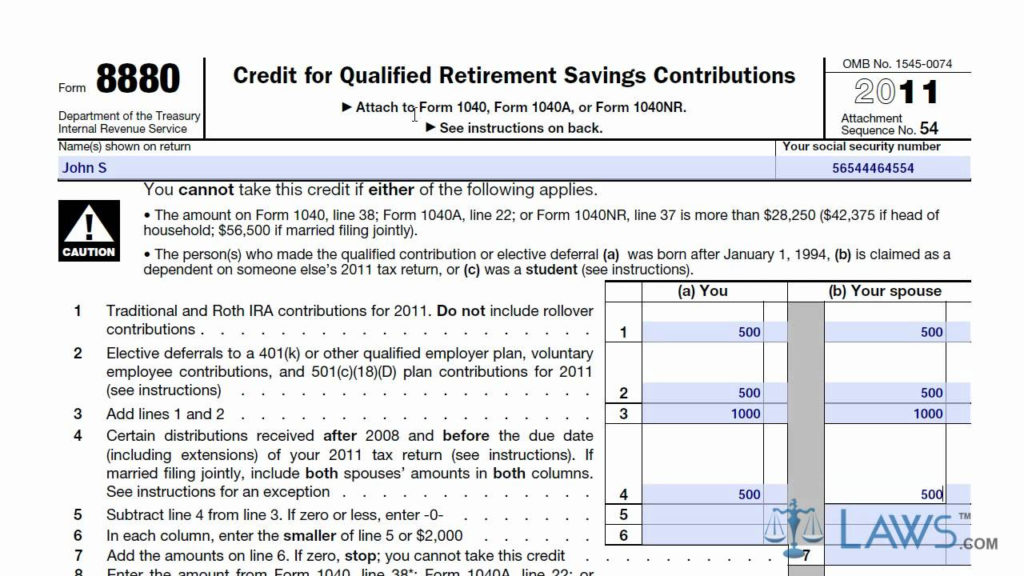

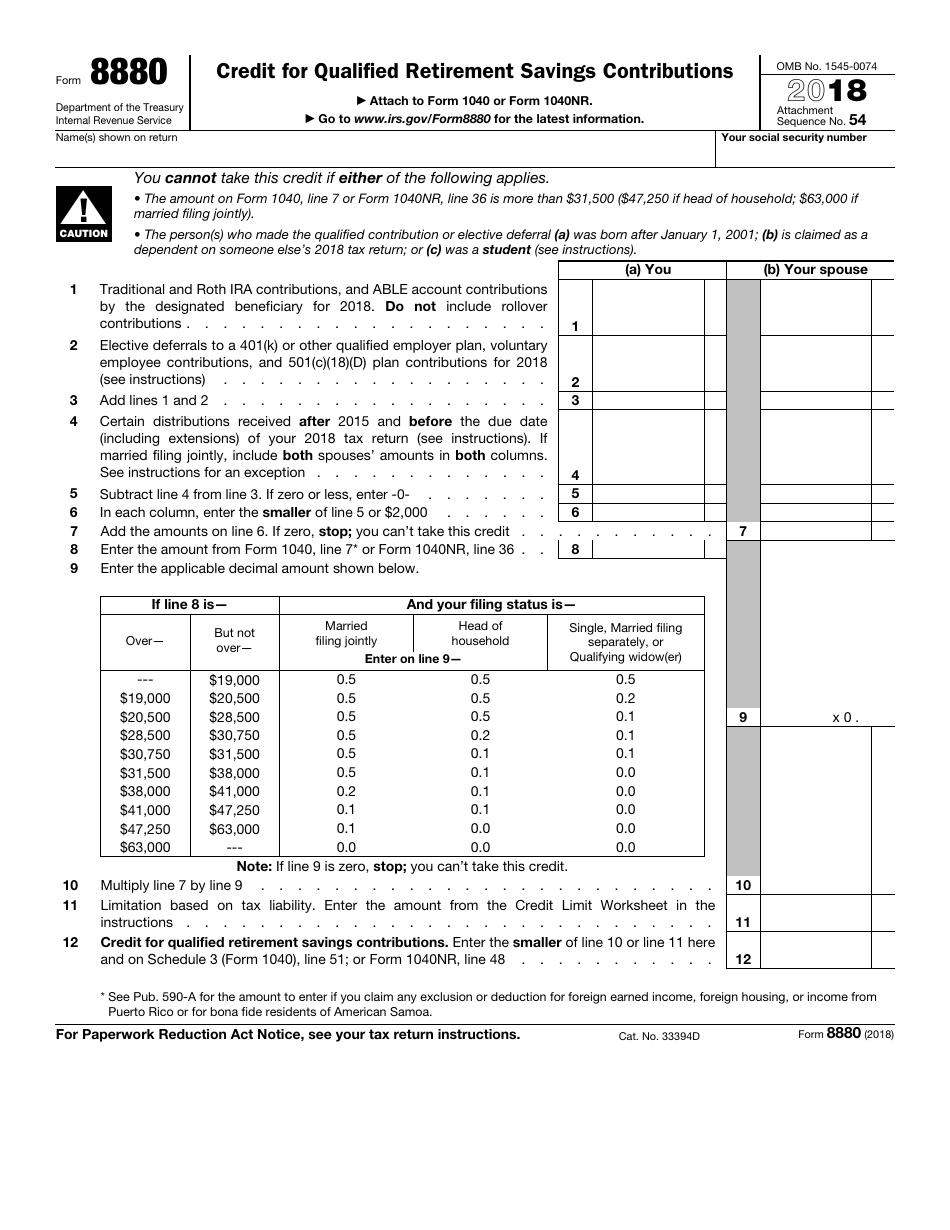

2021 Form 8880 - Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Your social security number ! Web in order to claim the retirement savings credit, you must use irs form 8880. Eligible plans to which you can make contributions and claim the. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Contributions you make to a traditional or roth ira, Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for the credit.

Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. To help determine eligibility, use the help of a tax professional at h&r block. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans. Do not include rollover contributions. Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for the credit. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Contributions you make to a traditional or roth ira,

Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Do not include rollover contributions. Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Elective deferrals to a 401(k) or other qualified employer plan, voluntary employee contributions, and 501(c)(18)(d) plan contributions for 2021 (see instructions). Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Eligible plans to which you can make contributions and claim the. Many people don’t take advantage of the credit simply because they don’t know anything about it. Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans.

8880 Form Fill Out and Sign Printable PDF Template signNow

To help determine eligibility, use the help of a tax professional at h&r block. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible.

Application Form Turbo Tax

Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Do not include rollover contributions. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web see form 8880, credit for qualified retirement savings contributions, for more.

Taxable Social Security Worksheet 2021

Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web.

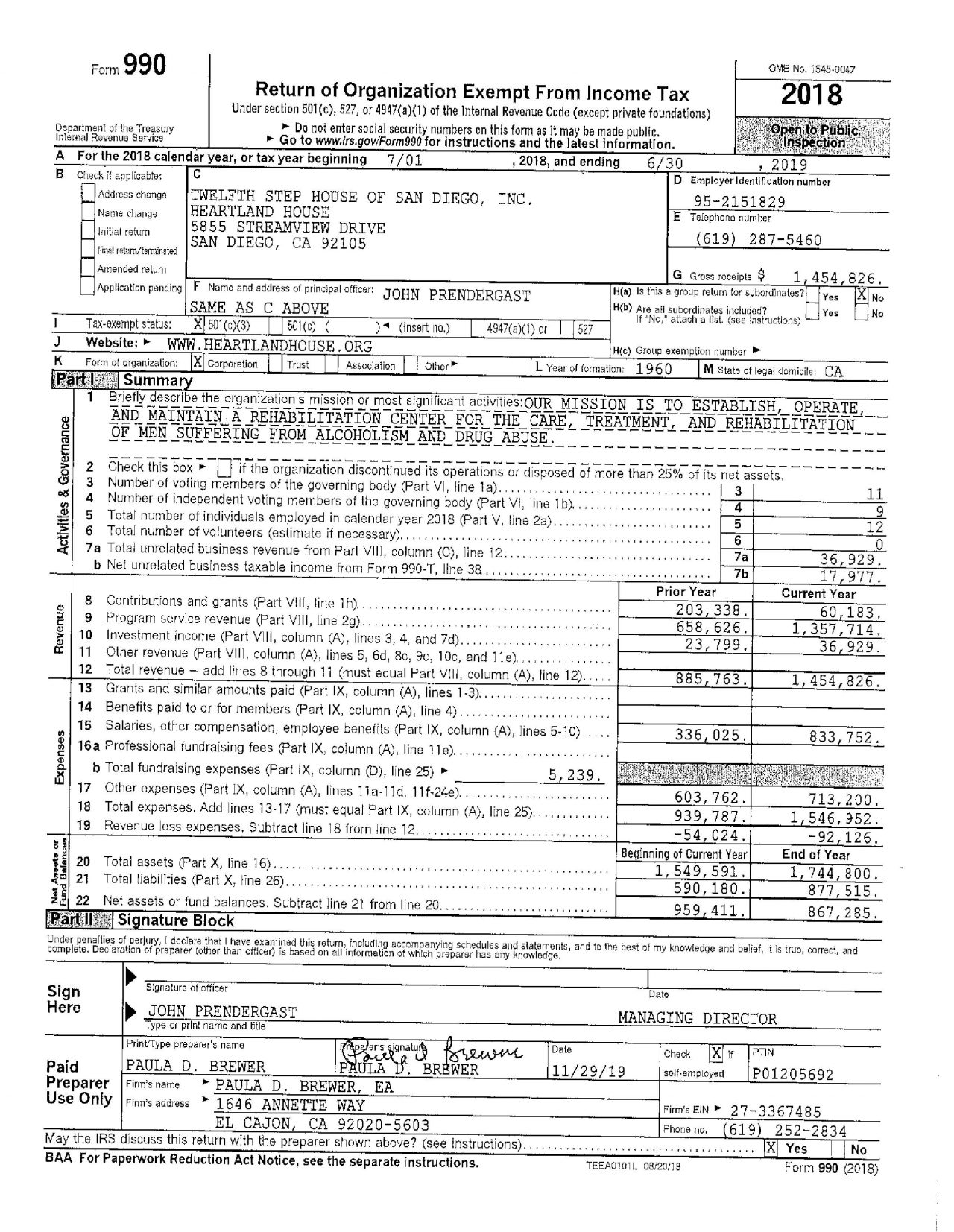

IRS Form 990 Heartland House

Web traditional and roth ira contributions, and able account contributions by the designated beneficiary for 2021. Eligible plans to which you can make contributions and claim the. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how.

Credit Limit Worksheet 8880 —

Go to www.irs.gov/form8880 for the latest information. Web traditional and roth ira contributions, and able account contributions by the designated beneficiary for 2021. Web see form 8880, credit for qualified retirement savings contributions, for more information. To help determine eligibility, use the help of a tax professional at h&r block. Web irs form 8880 calculates how much of a tax.

Das IRSFormulars 8962 richtig ausfüllen PDF Editor PDF

Web see form 8880, credit for qualified retirement savings contributions, for more information. Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Eligible plans to which you can make contributions and claim the. Web.

Form 8802 Fillable and Editable PDF Template

Web see form 8880, credit for qualified retirement savings contributions, for more information. Do not include rollover contributions. Web traditional and roth ira contributions, and able account contributions by the designated beneficiary for 2021. Eligible plans to which you can make contributions and claim the. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and.

Learn How To Fill The Form 8880 Credit For Qualified 2021 Tax Forms

Many people don’t take advantage of the credit simply because they don’t know anything about it. Web in order to claim the retirement savings credit, you must use irs form 8880. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Web see form 8880, credit for qualified.

Credit Limit Worksheet 8880 —

Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10%.

IRS Form 8880 Download Fillable PDF or Fill Online Credit for Qualified

Web traditional and roth ira contributions, and able account contributions by the designated beneficiary for 2021. Elective deferrals to a 401(k) or other qualified employer plan, voluntary employee contributions, and 501(c)(18)(d) plan contributions for 2021 (see instructions). Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for.

Web In Order To Claim The Retirement Savings Credit, You Must Use Irs Form 8880.

Contributions you make to a traditional or roth ira, Elective deferrals to a 401(k) or other qualified employer plan, voluntary employee contributions, and 501(c)(18)(d) plan contributions for 2021 (see instructions). Your social security number ! Eligible plans to which you can make contributions and claim the.

Web See Form 8880, Credit For Qualified Retirement Savings Contributions, For More Information.

Many people don’t take advantage of the credit simply because they don’t know anything about it. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit.

Depending On Your Adjusted Gross Income Reported On Your Form 1040 Series Return, The Amount Of The Credit Is 50%, 20% Or 10% Of:

To help determine eligibility, use the help of a tax professional at h&r block. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Web traditional and roth ira contributions, and able account contributions by the designated beneficiary for 2021.

Web You Can’t File Form 8880 Using A 1040Ez, So It’s Important To Consult An Expert To Make Sure You Are Eligible For The Credit.

Go to www.irs.gov/form8880 for the latest information. Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans. Do not include rollover contributions.