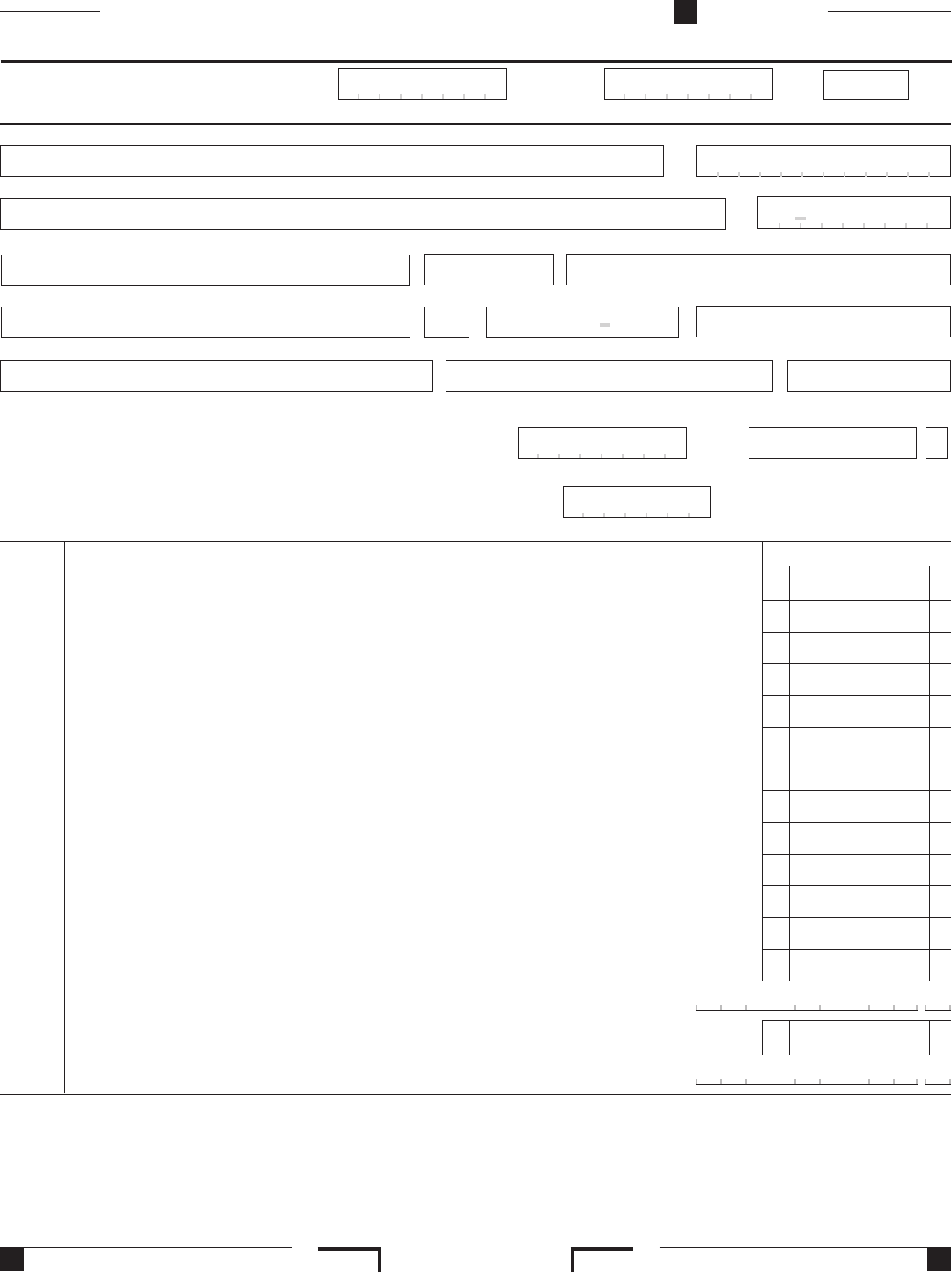

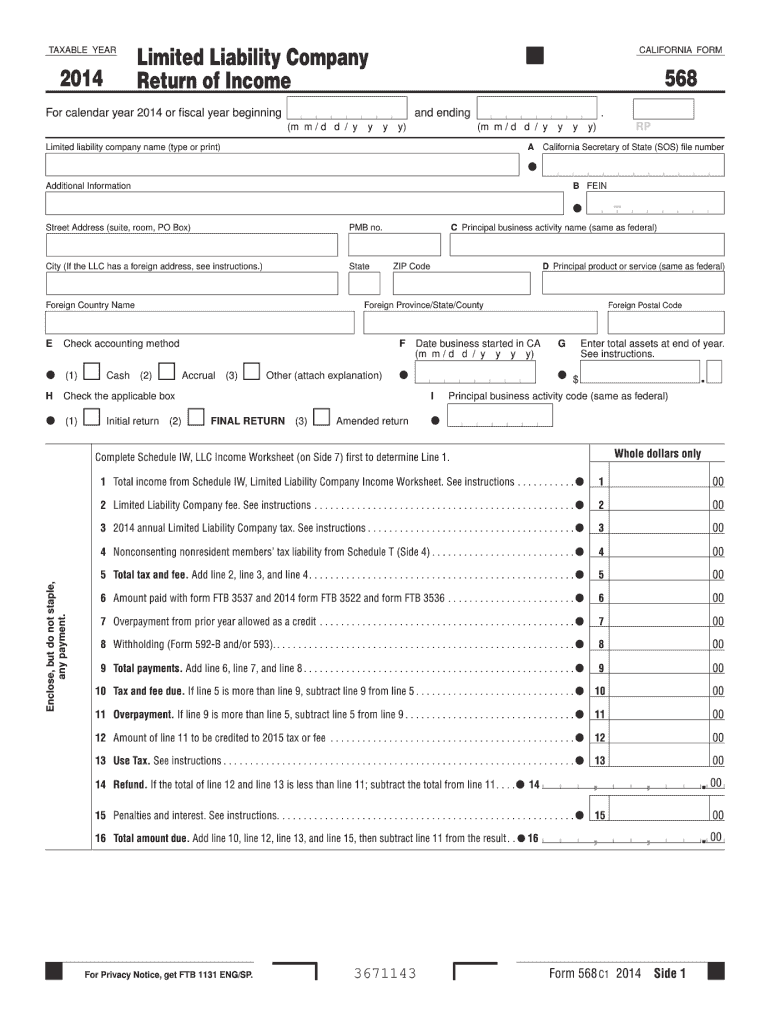

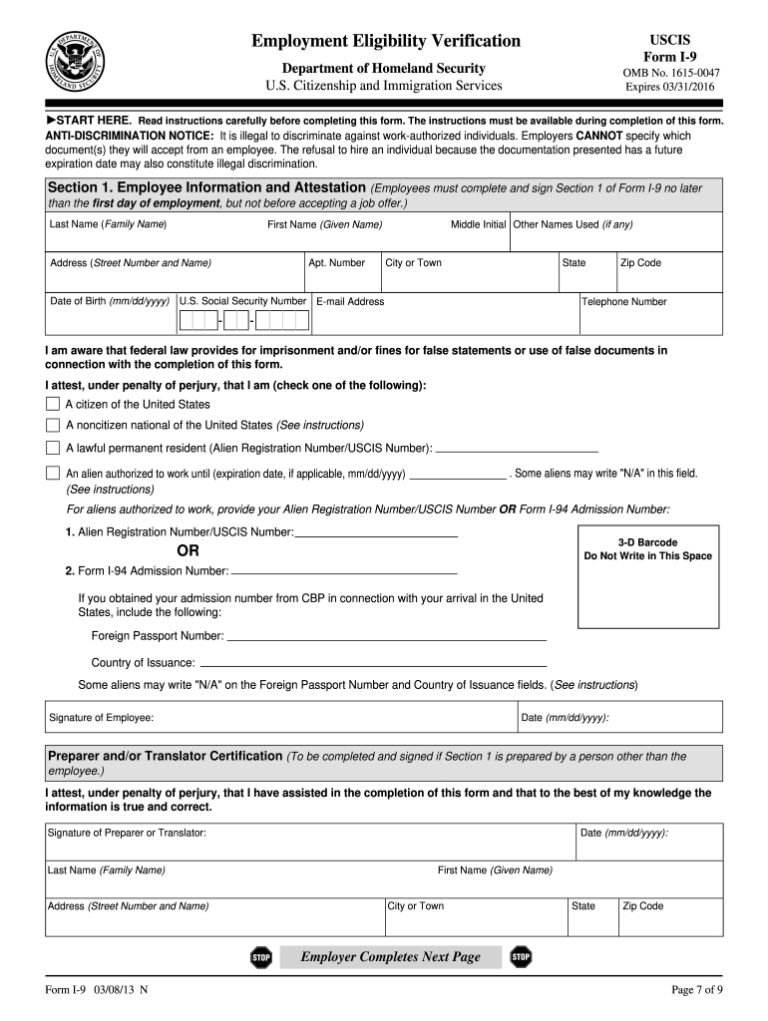

2021 Form 568 Instructions

2021 Form 568 Instructions - California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c. You can print other california tax forms here. Web 2021 instructions for form 568, limited limited company return of total. Form 568 is due on march 31st following the end of the tax year. Int general, for taxes years beginning on or after month 1, 2015, california rights conforms to the internal revenue. Web the llc’s taxable year is 15 days or less. Is the limited liability company fee deductible? And 5) a list of principal business activities and their associated code for purposes of form 568. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that are specially allocated to any members.

Web 2021 instructions for form 568, limited limited company return of total. References in these instructions are to of internal revenue code (irc) as about january 1, 2015, and till the california revenue and income code (r&tc). Registration after the year begins (foreign limited liability companies only) is the annual tax deductible? File a tax return (form 568) pay the llc annual tax. Web the booklet includes: Web with the llc be claiming deployed military exemption, enter zero on run 2 and running 3 of bilden 568. You can print other california tax forms here. The llc doesn't have a california source of income; Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. The llc isn't actively doing business in california, or;

Do not use this form to report the sale of. Web form 568 due date. References in these instructions exist to the internal revenue cipher (irc) when of january 1, 2015, and to to california revenue and taxation code (r&tc). It isn't included with the regular ca state partnership formset. Publication 541, partnerships publication 535, business expenses combine your distributive share of the llc’s business income with your own business income to determine total business income. Web this article will show you how to access california form 568 for a ca llc return in proseries professional. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that are specially allocated to any members. While you can submit your state income tax return and federal income tax return by april 15, you must prepare and file it with the franchise tax board by the deadline. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. You and your clients should be aware that a disregarded smllc is required to: Web the booklet includes: 2) schedule iw, llc income worksheet instructions; The llc did not conduct business.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Web 2021 ca form 568 company tax fee for single member llc formed in 2021 i formed a single member llc in california in 2021. 2) schedule iw, llc income worksheet instructions; 4) schedule k federal/state line references; California form 568 for limited liability company return of income is a separate state formset. 1) specific instructions for form 568;

Form 568 Instructions 2022 State And Local Taxes Zrivo

Web form 568 due date. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. 565 form (pdf) | 565 booklet 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: 2) schedule iw,.

Form 568 Fill Out and Sign Printable PDF Template signNow

Form 568 is due on march 31st following the end of the tax year. Web 2021 instructions fork form 568, limited liability company return of receipts. I believe the correct answer for first year llc's established in 2021 is $0. What is the limited liability company fee? Llcs classified as a disregarded entity or partnership are required to file form.

Form 568 Limited Liability Company Return of Fill Out and Sign

Web the booklet includes: Is the limited liability company fee deductible? References in these instructions are to of internal revenue code (irc) as about january 1, 2015, and till the california revenue and income code (r&tc). Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. References.

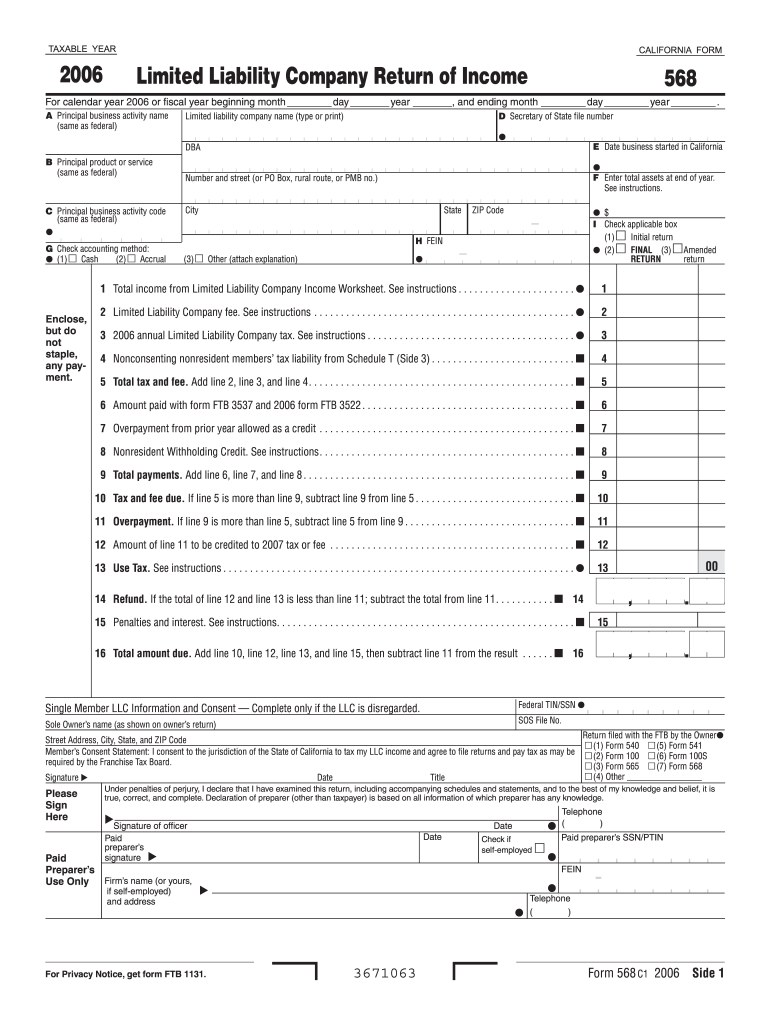

i9 form 2021 sample i9 Form 2021 Printable

Web 2021 instructions for form 568, limited limited company return of total. Int general, for taxes years beginning on or after month 1, 2015, california rights conforms to the internal revenue. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) 540nr form (pdf) | 540nr booklet (instructions included) federal: Web the.

Form 568 Instructions 2022 State And Local Taxes Zrivo

Llcs classified as a disregarded entity or partnership are required to file form 568 along with form 352 2 with the franchise tax board of california. What is the limited liability company fee? Web the booklet includes: References in these instructions are to of internal revenue code (irc) as about january 1, 2015, and till the california revenue and income.

Form Ca 568 Fill Out and Sign Printable PDF Template signNow

To complete california form 568 for a partnership, from the main menu of the california return, select: California form 568 for limited liability company return of income is a separate state formset. Pay the llc fee (if applicable) visit our due dates for businesses webpage for more information. Web form 568 due date. Web the llc’s taxable year is 15.

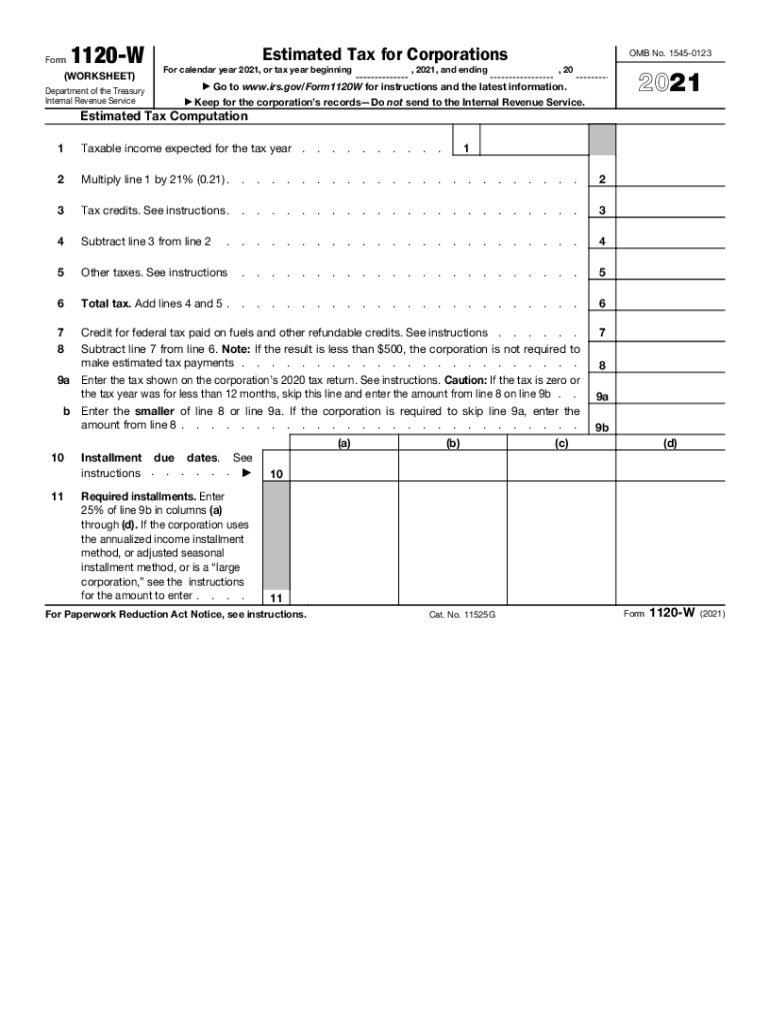

2020 1120 Form Fill Out and Sign Printable PDF Template signNow

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). References in these instructions are to of internal revenue code (irc) as about january 1, 2015, and till the california revenue and income code (r&tc). And 5) a list of principal business activities and their.

You And Your Clients Should Be Aware That A Disregarded Smllc Is Required To:

I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. The llc doesn't have a california source of income; Web the llc’s taxable year is 15 days or less. Is the limited liability company fee deductible?

Form 568 Is Due On March 31St Following The End Of The Tax Year.

It isn't included with the regular ca state partnership formset. 565 form (pdf) | 565 booklet 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) 540nr form (pdf) | 540nr booklet (instructions included) federal: The llc did not conduct business in the state during the 15 day period.

Web When Is Form 568 Due?

See the specific instructions for form 568 for more details. References in these instructions are to of internal revenue code (irc) as about january 1, 2015, and till the california revenue and income code (r&tc). Web form 568 due date. While you can submit your state income tax return and federal income tax return by april 15, you must prepare and file it with the franchise tax board by the deadline.

2) Schedule Iw, Llc Income Worksheet Instructions;

In addition to the annual tax, every llc must pay a fee if the total california annual income shall equal to or greater than $250,000. Web 2021 ca form 568 company tax fee for single member llc formed in 2021 i formed a single member llc in california in 2021. You can print other california tax forms here. When is the annual tax due?