2020 Form 944

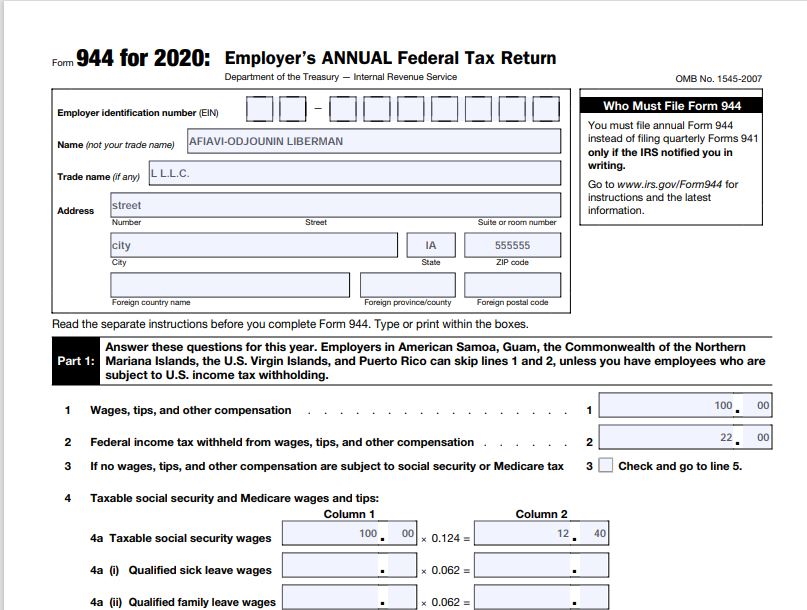

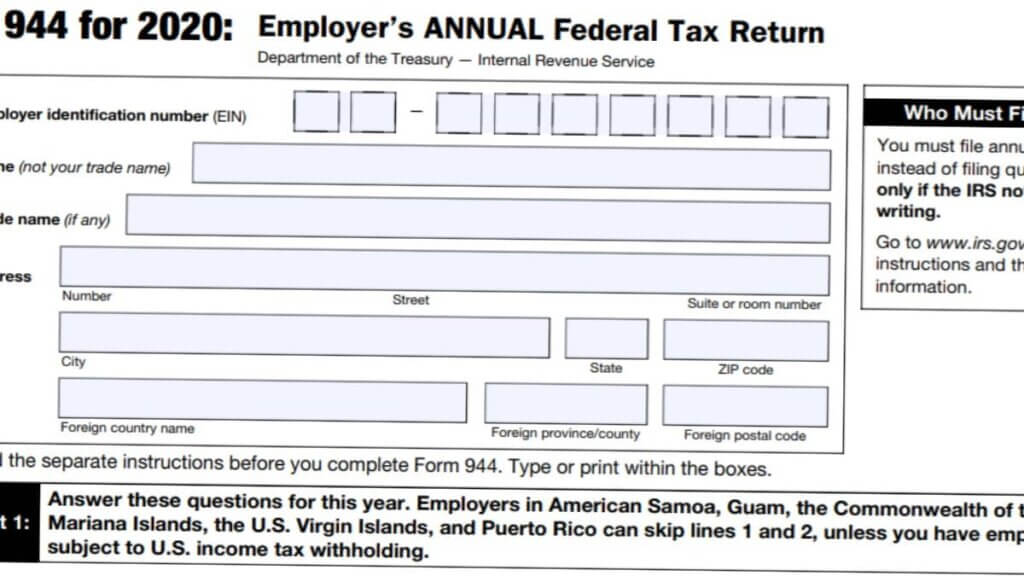

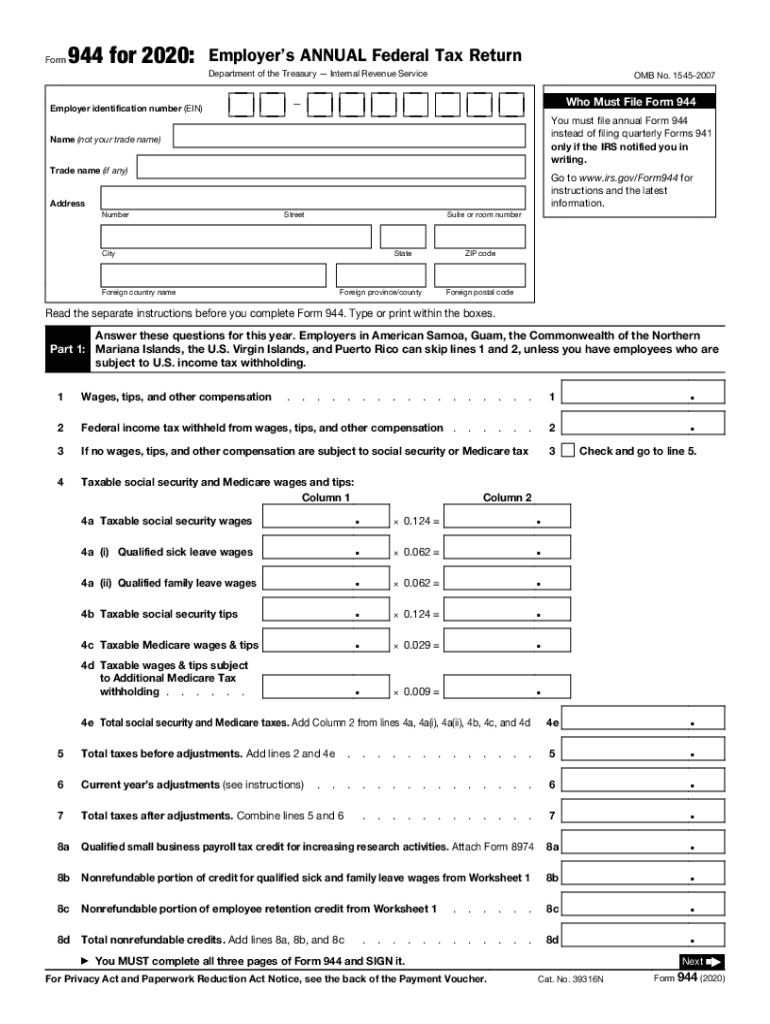

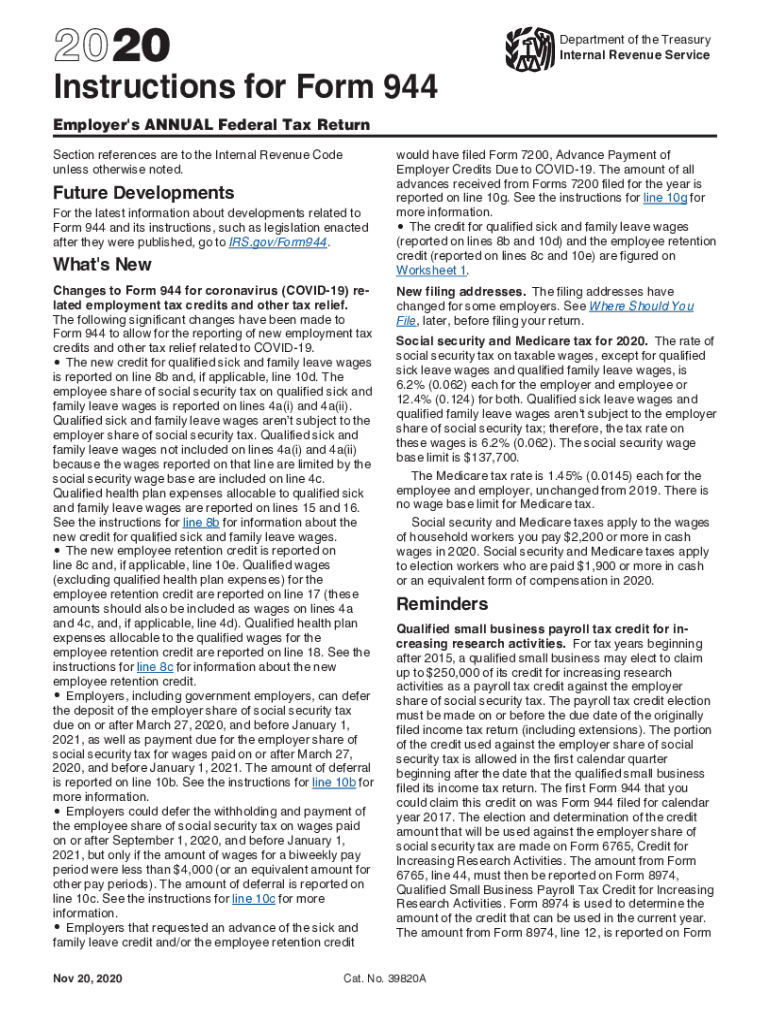

2020 Form 944 - Web form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. The payroll is completed correctly since the 941 (if i were. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Web federal employer's annual federal tax return form 944 pdf form content report error it appears you don't have a pdf plugin for this browser. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Please use the link below to. Employer’s annual federal tax return. Prepare your form and click the validate button below. Web how to fill out and sign 944 form 2020 online? Web form 944 employer’s annual federal tax return (2020) instructions:

Form 944 also asks for information regarding the additional medicare tax that is. The payroll is completed correctly since the 941 (if i were. Web • your net taxes for the year (form 944, line 9) are less than $2,500 and you’re paying in full with a timely filed return. Web how to fill out and sign 944 form 2020 online? Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Who must file form 944 you must. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Enjoy smart fillable fields and interactivity.

Web department of the treasury — internal revenue service omb no. Complete, edit or print tax forms instantly. Department of the treasury — internal revenue service. Ad access irs tax forms. Prepare your form and click the validate button below. Who must file form 944. Employer’s annual federal tax return department of the treasury — internal revenue service. Web form 944 is the reporting form for providing all this information to the irs. February 2023) adjusted employer’s annual federal tax return or claim for refund department of the treasury — internal revenue service omb no. Form 944 also asks for information regarding the additional medicare tax that is.

IRS 944 Instructions 2020 Fill out Tax Template Online US Legal Forms

Prepare your form and click the validate button below. Ad access irs tax forms. Who must file form 944 you must. Web form 944 is the reporting form for providing all this information to the irs. Web form 944 for 2020:

Want To File Form 941 Instead of 944? This Is How Blog TaxBandits

Who must file form 944. Who must file form 944 you must. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Web form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. • your.

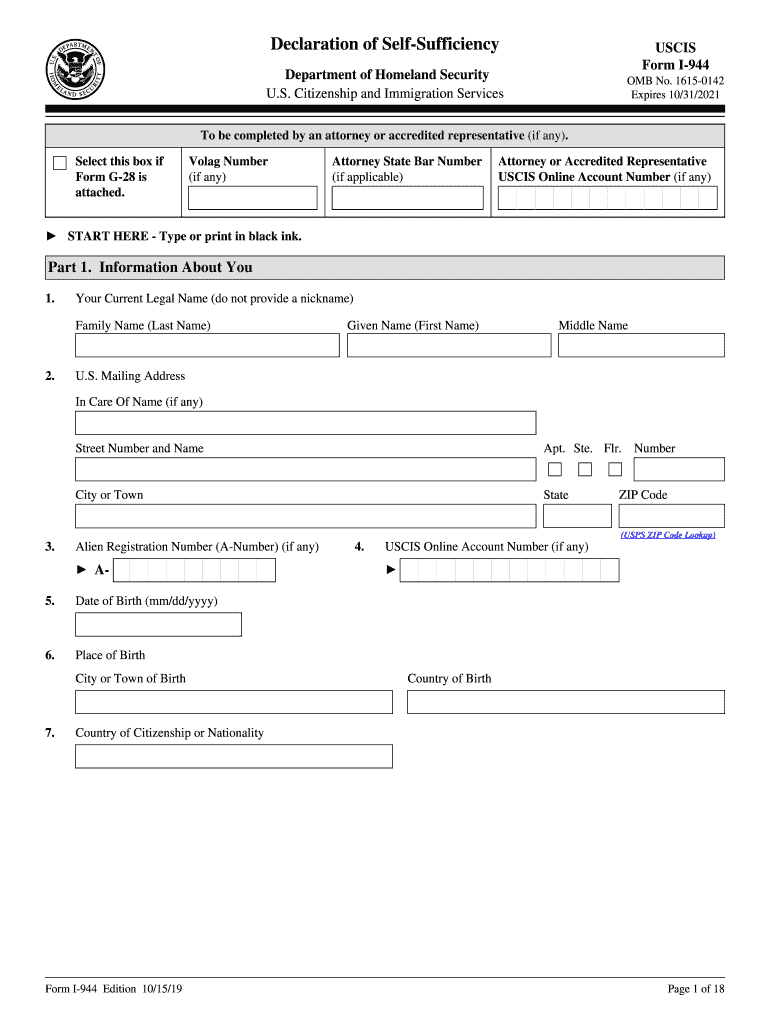

Is Form I 944 Mandatory [September 2020] YouTube

Complete, edit or print tax forms instantly. Prepare your form and click the validate button below. Web • your net taxes for the year (form 944, line 9) are less than $2,500 and you’re paying in full with a timely filed return. Please use the link below to. Web form 944 for 2021:

I 944 Pdf 20202021 Fill and Sign Printable Template Online US

Have it in on your computer and start to fill it out. Please use the link below to. Enjoy smart fillable fields and interactivity. Web department of the treasury — internal revenue service omb no. Employer’s annual federal tax return.

How To Fill Out Form I944 StepByStep Instructions [2021]

Web federal employer's annual federal tax return form 944 pdf form content report error it appears you don't have a pdf plugin for this browser. Web form 944 employer’s annual federal tax return (2020) instructions: Prepare your form and click the validate button below. Who must file form 944 you must. Get your online template and fill it in using.

Form i944 Tax & Finances During US Immigration VisaJourney

Complete, edit or print tax forms instantly. Web form 944 employer’s annual federal tax return (2020) instructions: The payroll is completed correctly since the 941 (if i were. Web form 944 for 2021: Ad access irs tax forms.

How to Complete Form 944 for 2020 Employer’s Annual Federal Tax

Who must file form 944 you must. No usernames or passwords required. Form 944 also asks for information regarding the additional medicare tax that is. • your net taxes for the year (form 944, line 9) are $2,500 or. February 2023) adjusted employer’s annual federal tax return or claim for refund department of the treasury — internal revenue service omb.

944 Form 2021 2022 IRS Forms Zrivo

Web how to fill out and sign 944 form 2020 online? Get your online template and fill it in using progressive features. Web • your net taxes for the year (form 944, line 9) are less than $2,500 and you’re paying in full with a timely filed return. Prepare your form and click the validate button below. Employer’s annual federal.

2020 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

Employer’s annual federal tax return. Web • your net taxes for the year (form 944, line 9) are less than $2,500 and you’re paying in full with a timely filed return. Form 944 also asks for information regarding the additional medicare tax that is. Web federal employer's annual federal tax return form 944 pdf form content report error it appears.

11 Part 3 How to Fill out Form 944 for 2020 YouTube

Get ready for tax season deadlines by completing any required tax forms today. The payroll is completed correctly since the 941 (if i were. Employer’s annual federal tax return department of the treasury — internal revenue service. February 2023) adjusted employer’s annual federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web.

Form 944 Also Asks For Information Regarding The Additional Medicare Tax That Is.

Web form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. Web how to fill out and sign 944 form 2020 online? Employer’s annual federal tax return. Prepare your form and click the validate button below.

Please Use The Link Below To.

Ad access irs tax forms. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Ad access irs tax forms.

Web Form 944 Is An Irs Tax Form That Reports The Taxes — Including Federal Income Tax, Social Security Tax And Medicare Tax — That You’ve Withheld From Your.

Get your online template and fill it in using progressive features. Who must file form 944. Web form 944 is the reporting form for providing all this information to the irs. Employer’s annual federal tax return department of the treasury — internal revenue service.

Web 2020 Form 944 The 2020 Form 944 Isn't Populating The Employee Retention Fields (Quickbooks Desktop).

Web form 944 for 2020: No usernames or passwords required. • your net taxes for the year (form 944, line 9) are $2,500 or. Web form 944 for 2021:

![Is Form I 944 Mandatory [September 2020] YouTube](https://i.ytimg.com/vi/md4SJcBR8-8/maxresdefault.jpg)

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)