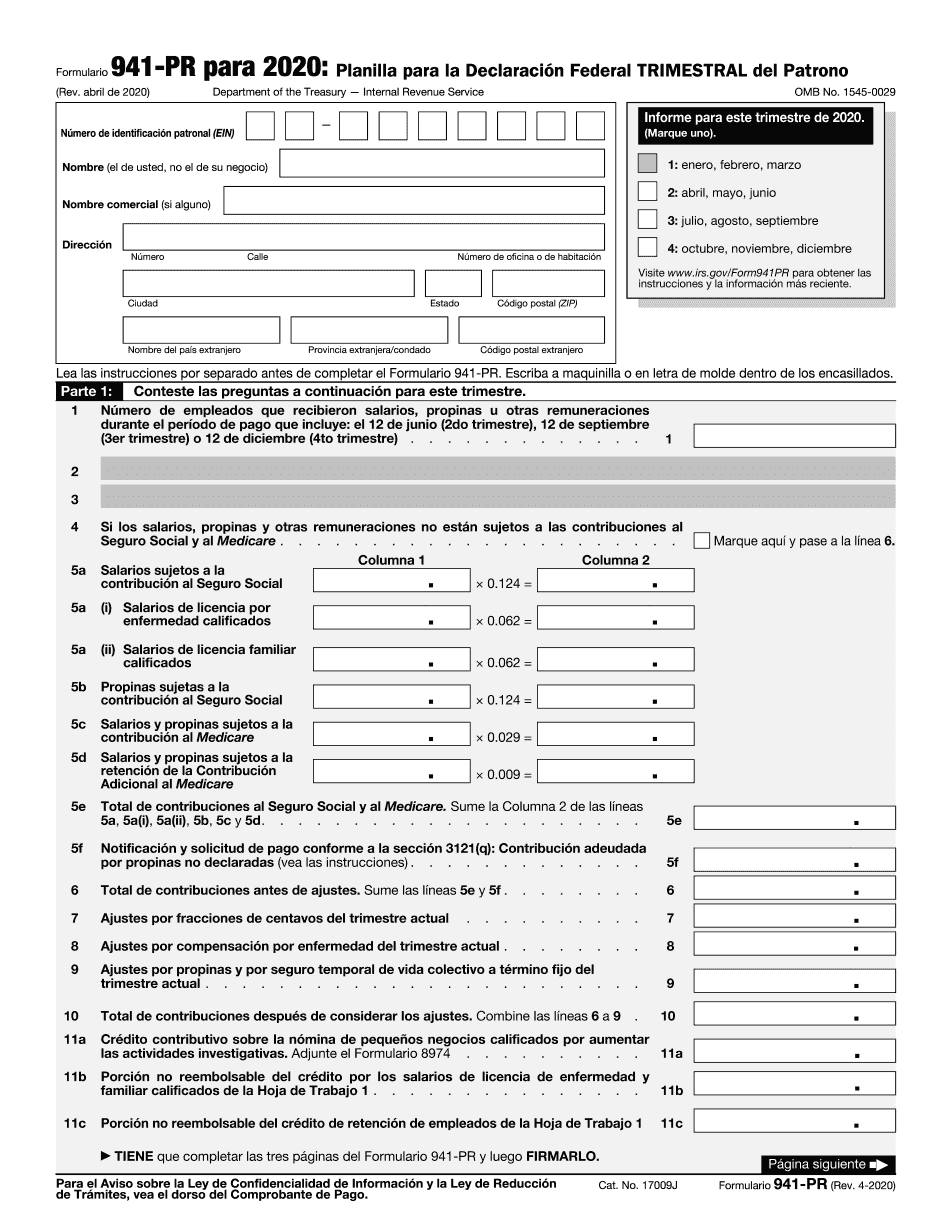

2020 Form 941 Pdf

2020 Form 941 Pdf - Instructions for form 941, employer's quarterly federal tax return created date: January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. The use of a counterfeit “is obviously intended to confuse consumers,” and we have described a counterfeiting claim as “merely the hard core or first degree of trademark infringement.” Web f.3d 1074, 1079 (9th cir. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Instructions for form 941 (2021) pdf. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Employer s quarterly federal tax return keywords: Employer identification number (ein) — name (not your trade name) trade name (if.

Instructions for form 941 (2021) pdf. Web f.3d 1074, 1079 (9th cir. Web employer's quarterly federal tax return for 2021. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. For more information, see the instructions for form January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Employer s quarterly federal tax return keywords: Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. The use of a counterfeit “is obviously intended to confuse consumers,” and we have described a counterfeiting claim as “merely the hard core or first degree of trademark infringement.” Employer identification number (ein) — name (not your trade name) trade name (if.

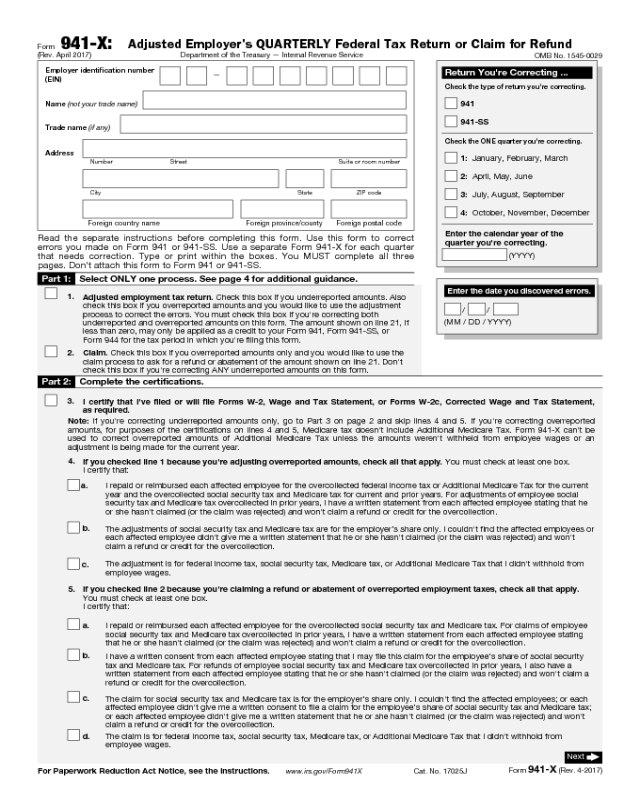

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. The use of a counterfeit “is obviously intended to confuse consumers,” and we have described a counterfeiting claim as “merely the hard core or first degree of trademark infringement.” The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Instructions for form 941 (2021) pdf. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). For more information, see the instructions for form Web employer's quarterly federal tax return for 2021. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. Instructions for form 941 (rev.

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web employer's quarterly federal tax return for 2021. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Employer s quarterly federal tax.

941 Worksheet 1 2020 Fillable Pdf

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web f.3d 1074, 1079 (9th cir. The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Instructions for form 941 (2021) pdf. Instructions for form 941.

Printable 941 Form 2021 Printable Form 2022

Instructions for form 941 (rev. The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Instructions for form 941 (2021) pdf. For more information, see the instructions for form January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no.

Printable 941 For 2020 Printable World Holiday

For more information, see the instructions for form Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. The use of a counterfeit “is obviously intended to confuse consumers,” and we.

2022 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Instructions for form 941 (rev. Employer identification number (ein) — name (not your trade name) trade name (if. For more information, see the instructions for form For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web f.3d 1074, 1079 (9th cir.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Instructions for form 941, employer's quarterly federal tax return created date: Employer identification number (ein) — name (not your trade name) trade name (if. Correcting a previously filed form 941. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Instructions for form 941 (2021) pdf.

How to Complete 2020 Form 941 Employer’s Quarterly Federal Tax Return

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. The use of a counterfeit “is obviously intended to confuse consumers,” and we have described a counterfeiting claim as “merely the.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Instructions for form 941, employer's quarterly federal tax return created date: Employer s quarterly federal tax return keywords:.

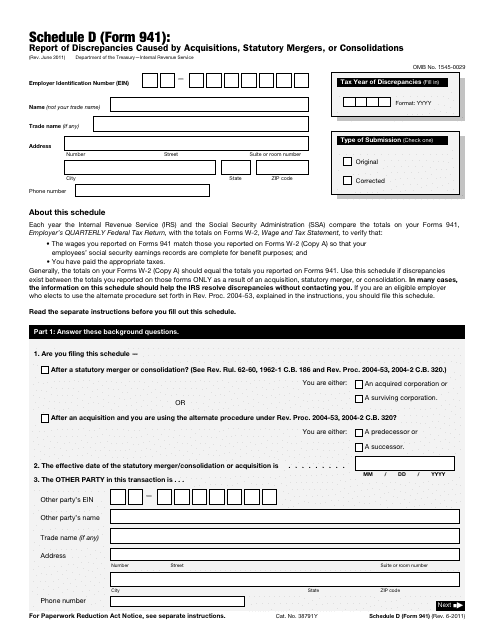

IRS Form 941 Schedule D Download Fillable PDF or Fill Online Report of

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Employer identification number (ein) — name (not your trade name) trade name (if. The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. For more information, see the instructions.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Employer identification number (ein) — name (not your trade name) trade name (if. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Instructions for form 941 (2021).

January 2020) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service 950117 Omb No.

Instructions for form 941 (rev. Web f.3d 1074, 1079 (9th cir. Employer identification number (ein) — name (not your trade name) trade name (if. Instructions for form 941, employer's quarterly federal tax return created date:

Web For The Best Experience, Open This Pdf Portfolio In Acrobat X Or Adobe Reader X, Or Later.

Web employer's quarterly federal tax return for 2021. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Correcting a previously filed form 941.

Employer S Quarterly Federal Tax Return Keywords:

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). For more information, see the instructions for form The use of a counterfeit “is obviously intended to confuse consumers,” and we have described a counterfeiting claim as “merely the hard core or first degree of trademark infringement.”

Instructions For Form 941 (2021) Pdf.

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.