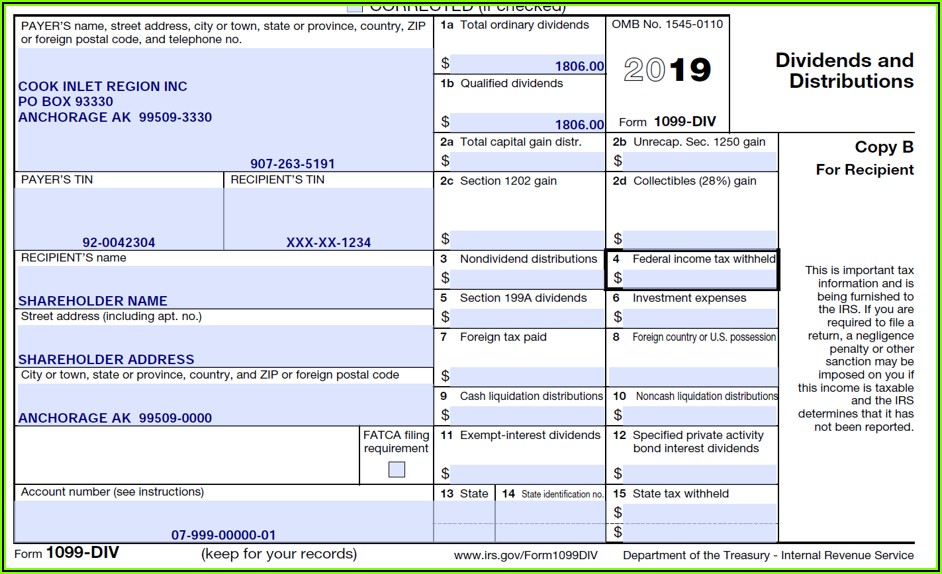

2019 Form 1099

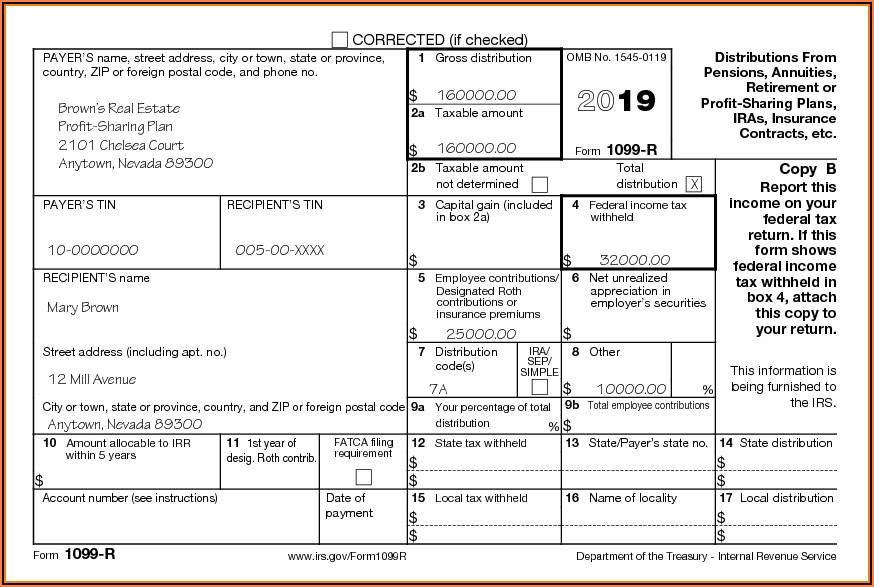

2019 Form 1099 - Web 2019 certain government payments 2nd tin not. Get everything done in minutes. Transferor’s taxpayer identification number (tin). Web printable 1099 form 2019 are widely available. All 1099 forms are available on the irs website, and they can be printed out from home. For privacy act and paperwork reduction act notice, see the 2019 general instructions for certain information returns. This is true for both 2019 and 2018 1099s, even years later. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. No.) employee contributions/ city or town, state or province, country, and zip or foreign postal code 9a $ your percentage of total distribution % for privacy act and paperwork reduction act notice, see the

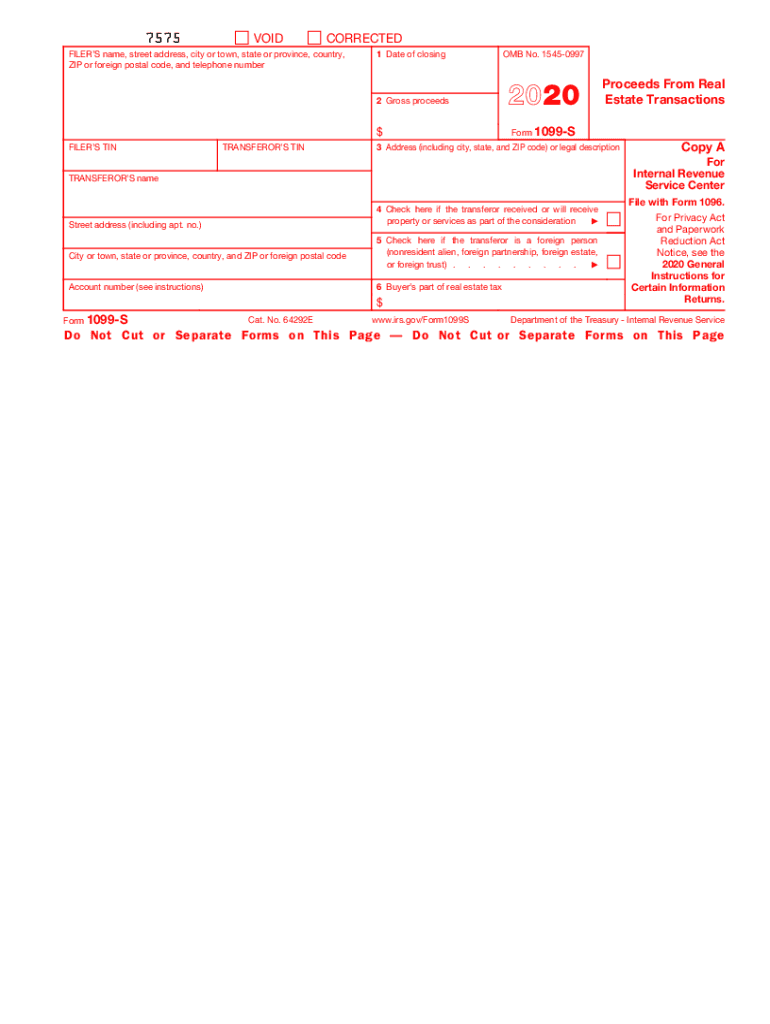

Your income for the year you sold or disposed of your home was over a specified amount. See the instructions for form 8938. Get everything done in minutes. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web instructions for recipient recipient's taxpayer identification number (tin). Web printable 1099 form 2019 are widely available. This will increase your tax. Transferor’s taxpayer identification number (tin).

For privacy act and paperwork reduction act notice, see the 2019 general instructions for certain information returns. Transferor’s taxpayer identification number (tin). You may also have a filing requirement. However, it is important to remember that each 1099 filing needs several copies of the form, and not all of them can be printed from home on regular. This is true for both 2019 and 2018 1099s, even years later. When and where to file. Your income for the year you sold or disposed of your home was over a specified amount. Web printable 1099 form 2019 are widely available. See your tax return instructions for where to report. This will increase your tax.

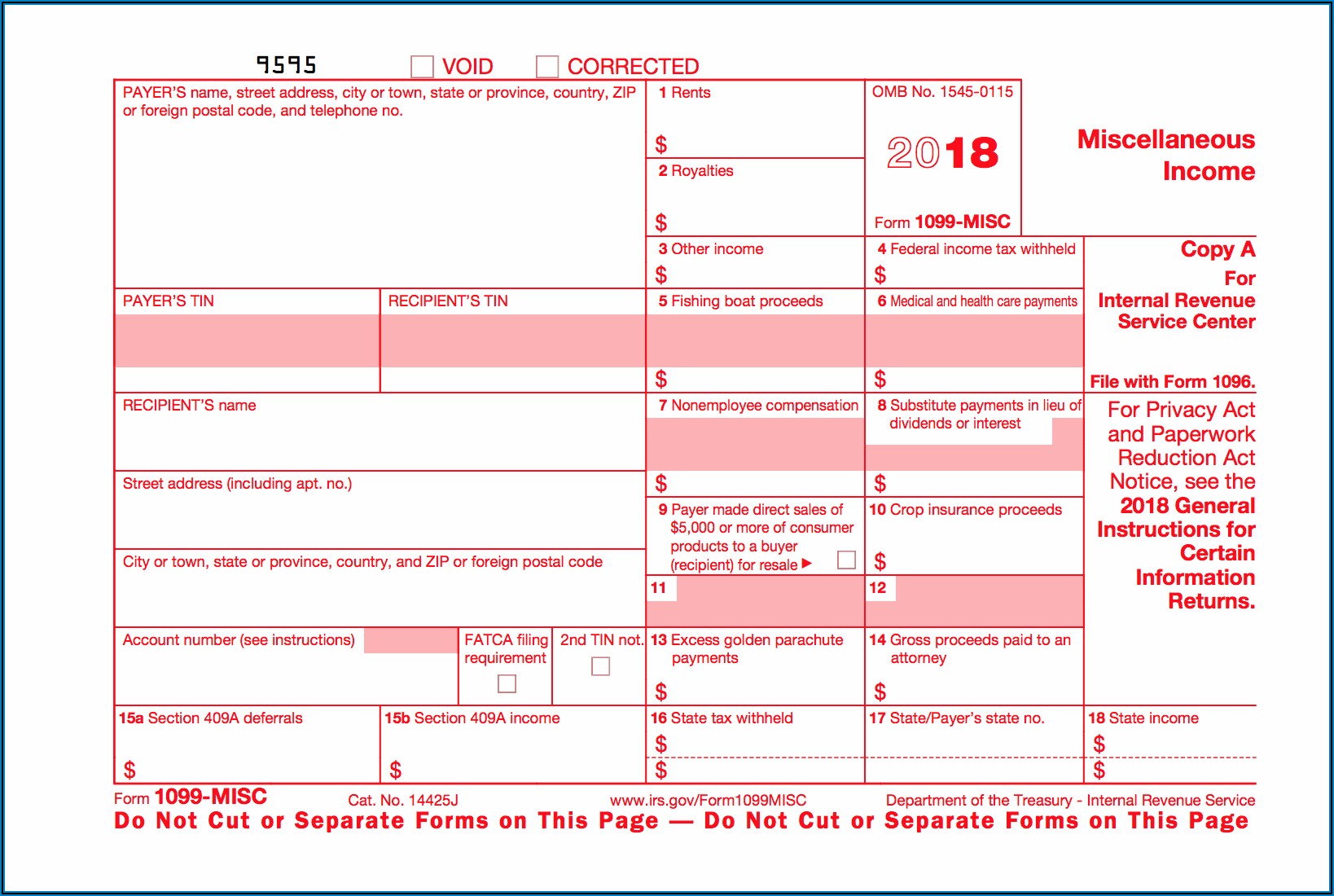

1099MISC or 1099NEC? What You Need to Know about the New IRS

However, it is important to remember that each 1099 filing needs several copies of the form, and not all of them can be printed from home on regular. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number.

Fillable Form 1099 For 2019 Form Resume Examples QJ9eqwP9my

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). See the instructions for form 8938. See your tax return instructions for where to report. Shows your total compensation of excess golden parachute payments subject to a.

9 Form Irs 9 9 Small But Important Things To Observe In 9 Form Irs 9

When and where to file. Web you have received this form because you have either (a) accepted payment cards for payments, or (b) received payments through a third party network that exceeded $20,000 in gross total reportable transactions and the aggregate number of those transactions exceeded 200 for the calendar year. You can instantly download a printable copy of the.

1099 Free Form 2019 Form Resume Examples wRYPp87Y4a

You may also have a filing requirement. All 1099 forms are available on the irs website, and they can be printed out from home. Web printable 1099 form 2019 are widely available. In addition to these specific instructions, you also should use the 2019 general instructions for certain information returns. Web on this form 1099 to satisfy its account reporting.

Irs.gov 1099 Form 2019 Form Resume Examples n49mAOe9Zz

Web you sold or disposed of your home at a gain during the first 9 years after you received the federal mortgage subsidy. This is true for both 2019 and 2018 1099s, even years later. Web instructions for recipient recipient's taxpayer identification number (tin). Web 2019 certain government payments 2nd tin not. Web you have received this form because you.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. Web instructions for recipient recipient's taxpayer identification number (tin). Web you sold or disposed of your home at a gain during the first 9 years after you received the federal mortgage subsidy. You may also have a.

1099 Form 2019 Fill and Sign Printable Template Online US Legal Forms

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). This is true for both 2019 and 2018 1099s, even years later. All 1099 forms are available on the irs website, and they can be printed out.

NJ Tax Preparer Admits Conspiring To Commit Tax Fraud Thru False Filing

However, it is important to remember that each 1099 filing needs several copies of the form, and not all of them can be printed from home on regular. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. Web on this form 1099 to satisfy its account.

Irs.gov 1099 Form 2019 Form Resume Examples n49mAOe9Zz

Web 2019 certain government payments 2nd tin not. This will increase your tax. See your tax return instructions for where to report. Your income for the year you sold or disposed of your home was over a specified amount. Web you sold or disposed of your home at a gain during the first 9 years after you received the federal.

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

See the instructions for form 8938. Web instructions for recipient recipient's taxpayer identification number (tin). Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. You may also have a filing requirement. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax.

Transferor’s Taxpayer Identification Number (Tin).

Copy a for internal revenue service center 11 state income tax withheld $ $ file with form 1096. Web instructions for recipient recipient's taxpayer identification number (tin). Web you sold or disposed of your home at a gain during the first 9 years after you received the federal mortgage subsidy. Those general instructions include information about the following topics.

See Your Tax Return Instructions For Where To Report.

Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. For privacy act and paperwork reduction act notice, see the 2019 general instructions for certain information returns. No.) employee contributions/ city or town, state or province, country, and zip or foreign postal code 9a $ your percentage of total distribution % for privacy act and paperwork reduction act notice, see the However, it is important to remember that each 1099 filing needs several copies of the form, and not all of them can be printed from home on regular.

You Can Instantly Download A Printable Copy Of The Tax Form By Logging In To Or Creating A Free My Social Security Account.

When and where to file. Web 2019 certain government payments 2nd tin not. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). This is true for both 2019 and 2018 1099s, even years later.

This Will Increase Your Tax.

Web you have received this form because you have either (a) accepted payment cards for payments, or (b) received payments through a third party network that exceeded $20,000 in gross total reportable transactions and the aggregate number of those transactions exceeded 200 for the calendar year. In addition to these specific instructions, you also should use the 2019 general instructions for certain information returns. All 1099 forms are available on the irs website, and they can be printed out from home. See form 8828 and pub.