2018 Form 1099

2018 Form 1099 - File this form for each person to whom you made certain types of payment during the tax year. Web you'll receive a form 1099 if you earned money from a nonemployer source. Web how to report the sale of your main home. At least $600 in services, rents, prizes or. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. If you cannot get this form corrected, attach an explanation to your tax return and. Payment card and third party network transactions. The time to receive social security 1099 for 2018 has come and gone. If you have to report the sale or exchange, report it on form 8949. Web how to access your social security 1099 for 2018.

Web you'll receive a form 1099 if you earned money from a nonemployer source. The time to receive social security 1099 for 2018 has come and gone. File this form for each person to whom you made certain types of payment during the tax year. Web get federal tax return forms and file by mail. Irs i1099msc & more fillable forms, register and subscribe now! If you have to report the sale or exchange, report it on form 8949. Mistakes happen, especially at small businesses. At least $600 in services, rents, prizes or. If you cannot get this form corrected, attach an explanation to your tax return and. Web 22 rows the form is used to report income, proceeds, etc., only on a calendar year (january 1 through december 31) basis, regardless of the fiscal year used by the payer.

All taxable distributions from your fund (including any capital gains) and. Web 22 rows the form is used to report income, proceeds, etc., only on a calendar year (january 1 through december 31) basis, regardless of the fiscal year used by the payer. Web how to access your social security 1099 for 2018. Web you'll receive a form 1099 if you earned money from a nonemployer source. If this form is incorrect or has been issued in error, contact the payer. The time to receive social security 1099 for 2018 has come and gone. Web how to report the sale of your main home. Payment card and third party network transactions. File this form for each person to whom you made certain types of payment during the tax year. Web www.irs.gov/form1099a instructions for borrower certain lenders who acquire an interest in property that was security for a loan or who have reason to know.

Eagle Life Tax Form 1099R for Annuity Distribution

Web there are two filing thresholds to consider for the 2018 form 1099. For internal revenue service center. Mistakes happen, especially at small businesses. Web how to report the sale of your main home. If you have to report the sale or exchange, report it on form 8949.

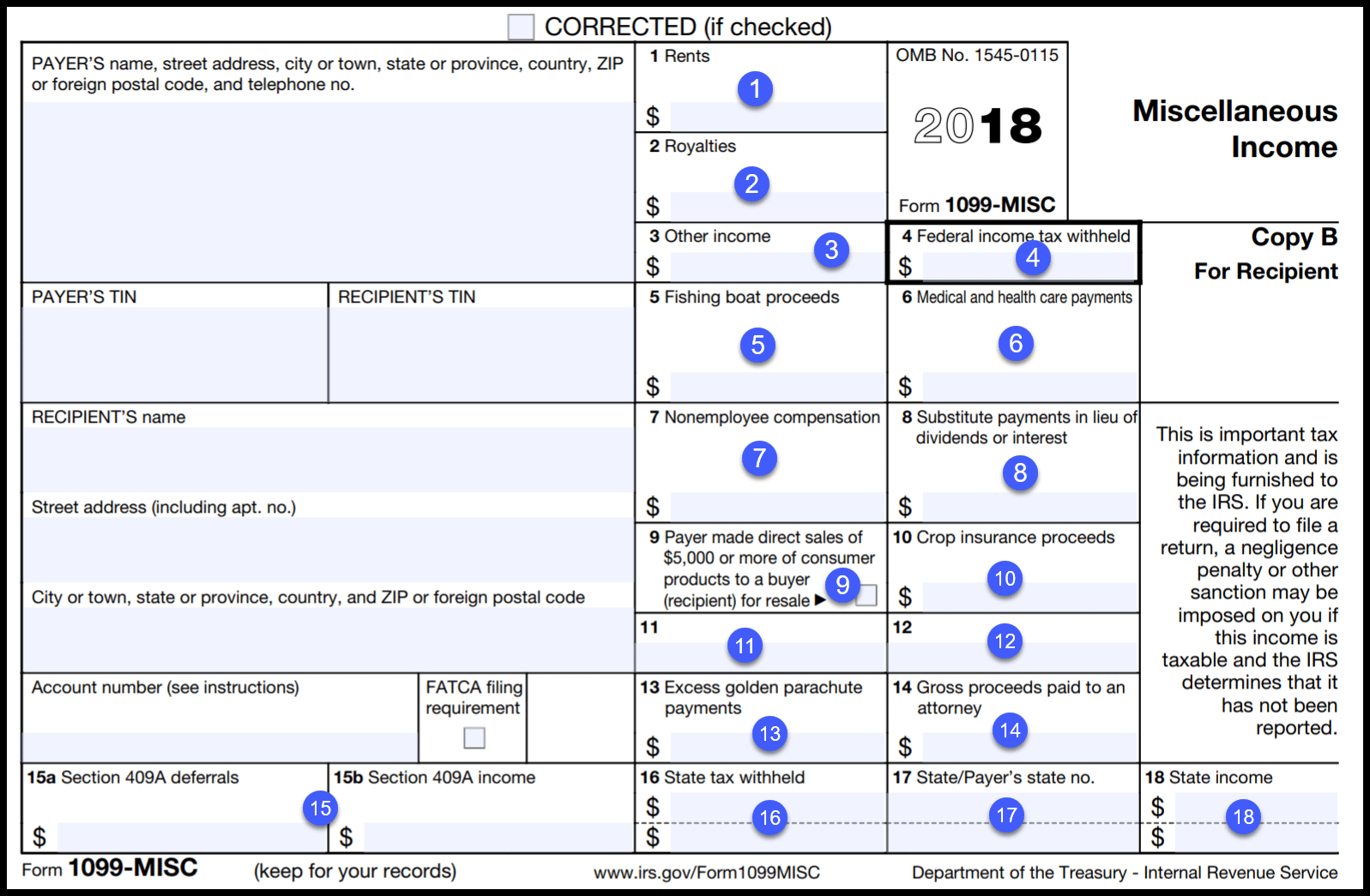

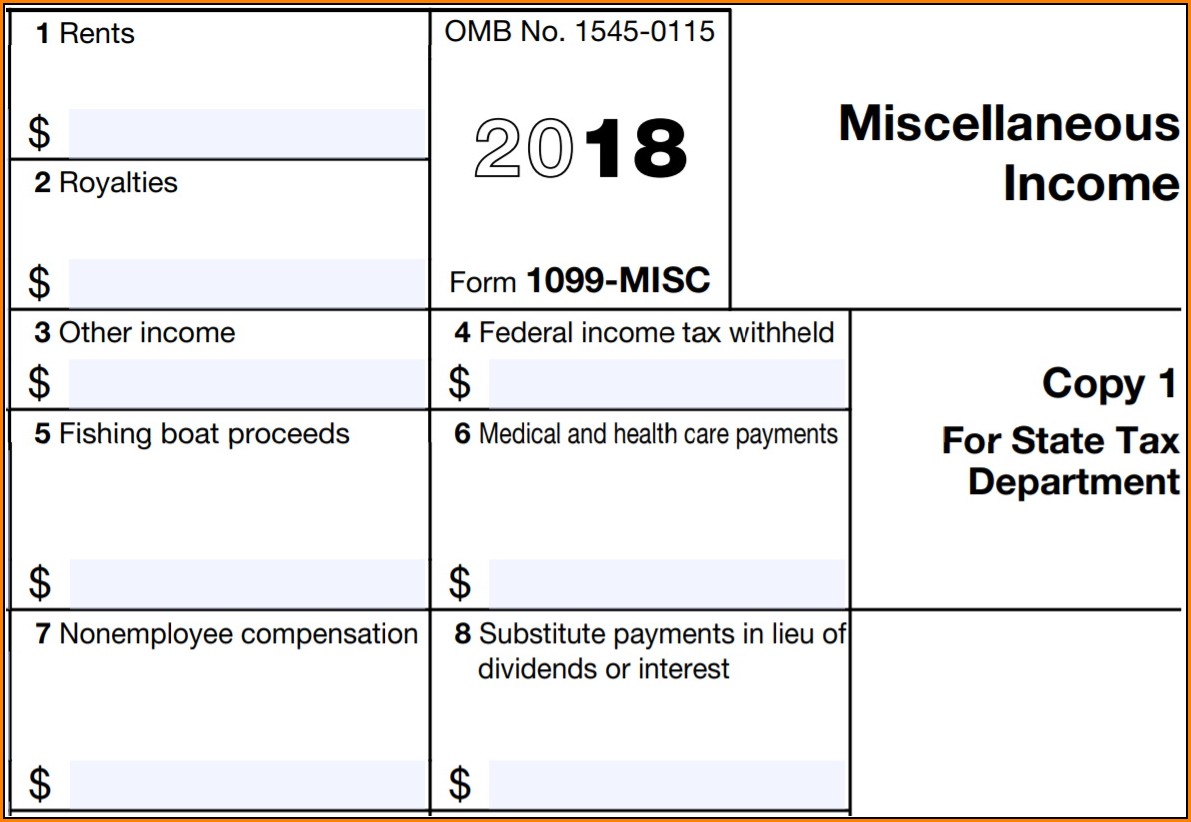

1099MISC Tax Basics

Payment card and third party network transactions. All taxable distributions from your fund (including any capital gains) and. Ad get ready for tax season deadlines by completing any required tax forms today. Web how to access your social security 1099 for 2018. Web you'll receive a form 1099 if you earned money from a nonemployer source.

What is a 1099 & 5498? uDirect IRA Services, LLC

File this form for each person to whom you made certain types of payment during the tax year. The time to receive social security 1099 for 2018 has come and gone. Irs i1099msc & more fillable forms, register and subscribe now! Web 22 rows the form is used to report income, proceeds, etc., only on a calendar year (january 1.

2018 Form 1099 Filing Deadline Form Resume Template Collections

Web there are two filing thresholds to consider for the 2018 form 1099. At least $600 in services, rents, prizes or. If this form is incorrect or has been issued in error, contact the payer. That said, there are a few reasons why an individual may. Payment card and third party network transactions.

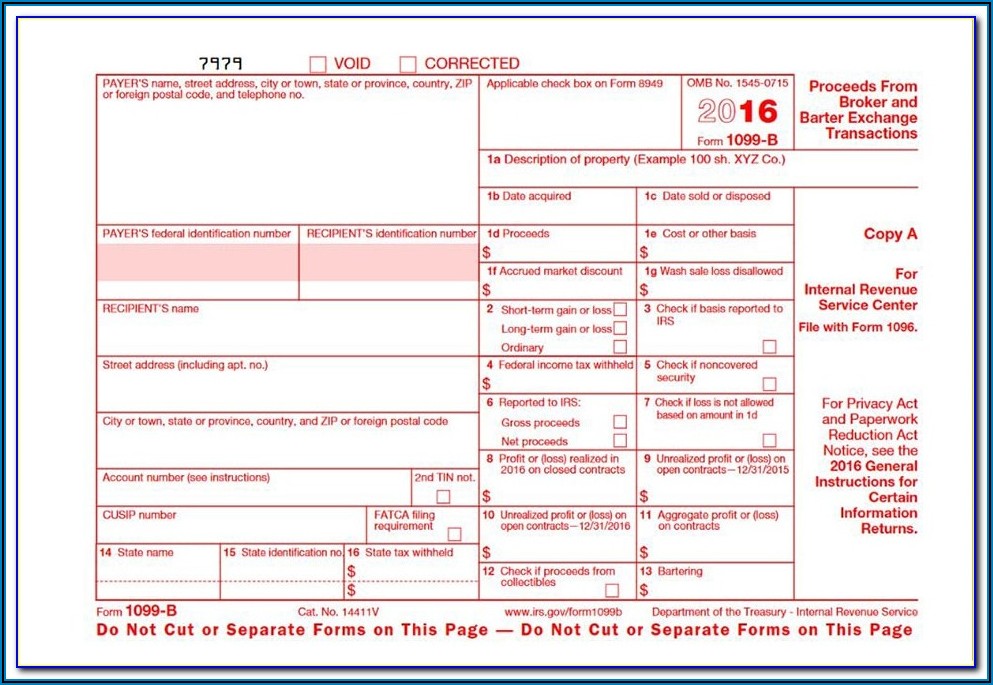

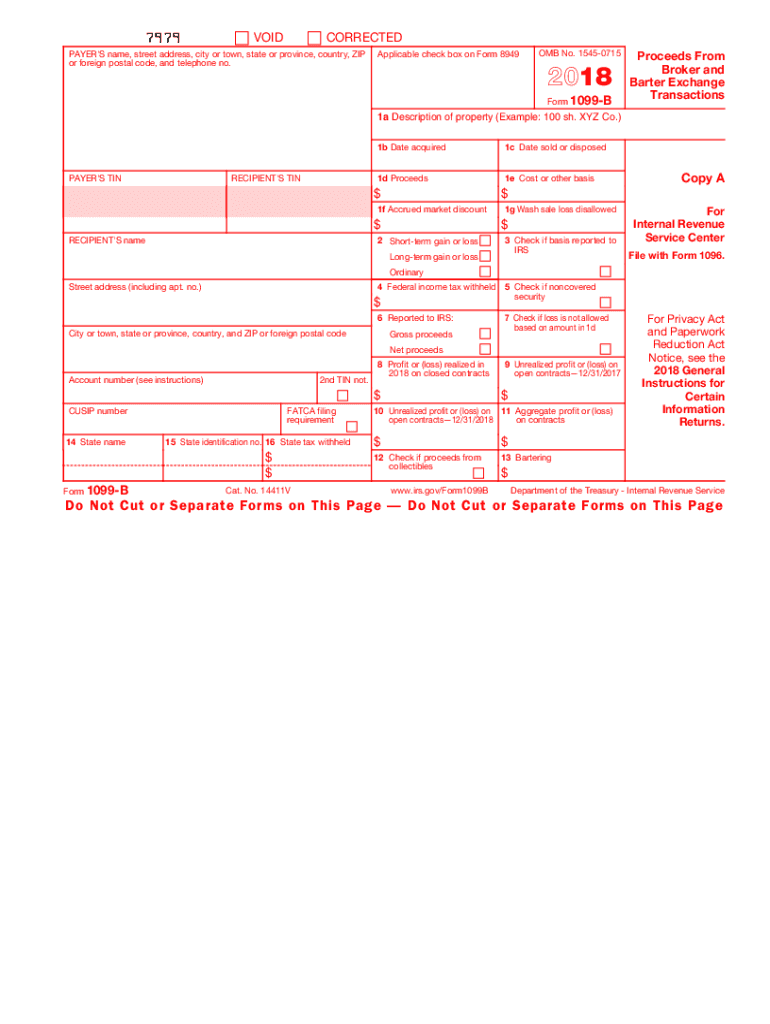

2018 Form IRS 1099B Fill Online, Printable, Fillable, Blank pdfFiller

Ad get ready for tax season deadlines by completing any required tax forms today. Web 22 rows the form is used to report income, proceeds, etc., only on a calendar year (january 1 through december 31) basis, regardless of the fiscal year used by the payer. All taxable distributions from your fund (including any capital gains) and. Web how to.

1099 MISC Laser Federal Copy A

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. For internal revenue service center. Web get federal tax return forms and file by mail. If this form is incorrect or has been issued in error, contact the payer. Web you'll receive a form 1099 if you earned money from a nonemployer source.

Free Printable 1099 Form 2018 Free Printable

Web www.irs.gov/form1099a instructions for borrower certain lenders who acquire an interest in property that was security for a loan or who have reason to know. That said, there are a few reasons why an individual may. Ad get ready for tax season deadlines by completing any required tax forms today. The time to receive social security 1099 for 2018 has.

W2 Form Irs 2018 Form Resume Examples MoYoopNYZB

Ad get ready for tax season deadlines by completing any required tax forms today. Web you'll receive a form 1099 if you earned money from a nonemployer source. Web get federal tax return forms and file by mail. The time to receive social security 1099 for 2018 has come and gone. That said, there are a few reasons why an.

Irs.gov 1099 Form 2018 Form Resume Examples EY39Ayd32V

The time to receive social security 1099 for 2018 has come and gone. All taxable distributions from your fund (including any capital gains) and. Web how to report the sale of your main home. Irs i1099msc & more fillable forms, register and subscribe now! Web get federal tax return forms and file by mail.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

Mistakes happen, especially at small businesses. Web 22 rows the form is used to report income, proceeds, etc., only on a calendar year (january 1 through december 31) basis, regardless of the fiscal year used by the payer. The time to receive social security 1099 for 2018 has come and gone. Web get federal tax return forms and file by.

Web How To Access Your Social Security 1099 For 2018.

Mistakes happen, especially at small businesses. If you have to report the sale or exchange, report it on form 8949. If you cannot get this form corrected, attach an explanation to your tax return and. If this form is incorrect or has been issued in error, contact the payer.

For Internal Revenue Service Center.

The time to receive social security 1099 for 2018 has come and gone. Ad get ready for tax season deadlines by completing any required tax forms today. Yes, you can still file a 1099 correction form 2018. Web 22 rows the form is used to report income, proceeds, etc., only on a calendar year (january 1 through december 31) basis, regardless of the fiscal year used by the payer.

That Said, There Are A Few Reasons Why An Individual May.

Web you'll receive a form 1099 if you earned money from a nonemployer source. At least $600 in services, rents, prizes or. All taxable distributions from your fund (including any capital gains) and. Web get federal tax return forms and file by mail.

Web How To Report The Sale Of Your Main Home.

Payment card and third party network transactions. Here are some common types of 1099 forms: Web www.irs.gov/form1099a instructions for borrower certain lenders who acquire an interest in property that was security for a loan or who have reason to know. File this form for each person to whom you made certain types of payment during the tax year.