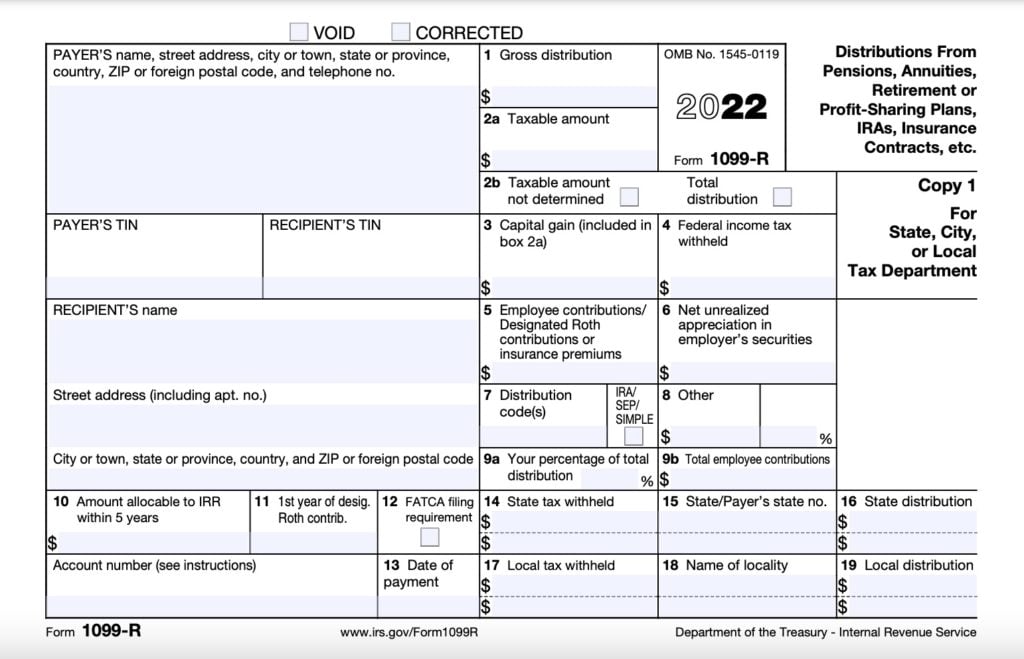

1099 R Form Rollover

1099 R Form Rollover - Web to enter a rollover distribution into the individual tax return in taxslayer pro, from the main menu of the return (form 1040) select: Income ira, pension distributions (1099r, rrb. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Ad download or email irs 1099r & more fillable forms, register and subscribe now! You will need to report the distribution even though it was rolled over. Rollover with the same trustee if you are rolling over an ira to a different account with the same trustee,. Pick a needed year and fill out your template instantly online. If the taxpayer has rolled over all or a portion of a distribution from a retirement account to another retirement account, the word rollover will print on. Complete, edit or print tax forms instantly.

Pick a needed year and fill out your template instantly online. Ad download or email irs 1099r & more fillable forms, register and subscribe now! Rollover with the same trustee if you are rolling over an ira to a different account with the same trustee,. If the taxpayer has rolled over all or a portion of a distribution from a retirement account to another retirement account, the word rollover will print on. Complete, edit or print tax forms instantly. According to the irs, an entity that manages any of the accounts. You have 60 days from the time you receive the funds from one company to. Web retirement account rollovers. Get ready for tax season deadlines by completing any required tax forms today. Web to enter a rollover distribution into the individual tax return in taxslayer pro, from the main menu of the return (form 1040) select:

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Pick a needed year and fill out your template instantly online. You will need to report the distribution even though it was rolled over. Web to enter a rollover distribution into the individual tax return in taxslayer pro, from the main menu of the return (form 1040) select: Ad download or email irs 1099r & more fillable forms, register and subscribe now! Web retirement account rollovers. You have 60 days from the time you receive the funds from one company to. If the taxpayer has rolled over all or a portion of a distribution from a retirement account to another retirement account, the word rollover will print on. If you roll over an ira, you are moving it from one company to another.

IRS Form 1099R Box 7 Distribution Codes — Ascensus

According to the irs, an entity that manages any of the accounts. Complete, edit or print tax forms instantly. Web to enter a rollover distribution into the individual tax return in taxslayer pro, from the main menu of the return (form 1040) select: Ad download or email irs 1099r & more fillable forms, register and subscribe now! Pick a needed.

Form 1099R Distribution Codes for Defined Contribution Plans DWC

Web to enter a rollover distribution into the individual tax return in taxslayer pro, from the main menu of the return (form 1040) select: Web retirement account rollovers. Complete, edit or print tax forms instantly. If you roll over an ira, you are moving it from one company to another. Pick a needed year and fill out your template instantly.

Formulario 1099R Instrucciones e información sobre el Formulario de

Ad download or email irs 1099r & more fillable forms, register and subscribe now! You have 60 days from the time you receive the funds from one company to. Complete, edit or print tax forms instantly. Pick a needed year and fill out your template instantly online. Income ira, pension distributions (1099r, rrb.

1099R Software EFile TIN Matching Print and Mail 1099R Forms

If the taxpayer has rolled over all or a portion of a distribution from a retirement account to another retirement account, the word rollover will print on. If you roll over an ira, you are moving it from one company to another. Pick a needed year and fill out your template instantly online. Income ira, pension distributions (1099r, rrb. Rollover.

What Is a 1099R? Tax Forms for Annuities & Pensions

Pick a needed year and fill out your template instantly online. According to the irs, an entity that manages any of the accounts. You will need to report the distribution even though it was rolled over. Ad download or email irs 1099r & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly.

1099 R Simplified Method Worksheet

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. If the taxpayer has rolled over all or a portion of a distribution from a retirement account to another retirement account, the word rollover will print on. If you roll over an ira, you are moving it from one company to another. You will need to.

How to report a 1099 R rollover to your self directed 401k YouTube

Complete, edit or print tax forms instantly. If you roll over an ira, you are moving it from one company to another. Get ready for tax season deadlines by completing any required tax forms today. Rollover with the same trustee if you are rolling over an ira to a different account with the same trustee,. Income ira, pension distributions (1099r,.

Roth Ira Withdrawal Form Universal Network

Ad download or email irs 1099r & more fillable forms, register and subscribe now! Web retirement account rollovers. If you roll over an ira, you are moving it from one company to another. You have 60 days from the time you receive the funds from one company to. Income ira, pension distributions (1099r, rrb.

Ira Rollover Form Fidelity Universal Network

If the taxpayer has rolled over all or a portion of a distribution from a retirement account to another retirement account, the word rollover will print on. Income ira, pension distributions (1099r, rrb. You have 60 days from the time you receive the funds from one company to. Rollover with the same trustee if you are rolling over an ira.

Mega Backdoor Roth IRA » Emparion

Pick a needed year and fill out your template instantly online. Complete, edit or print tax forms instantly. Rollover with the same trustee if you are rolling over an ira to a different account with the same trustee,. Web to enter a rollover distribution into the individual tax return in taxslayer pro, from the main menu of the return (form.

Web To Enter A Rollover Distribution Into The Individual Tax Return In Taxslayer Pro, From The Main Menu Of The Return (Form 1040) Select:

If you roll over an ira, you are moving it from one company to another. You have 60 days from the time you receive the funds from one company to. According to the irs, an entity that manages any of the accounts. Rollover with the same trustee if you are rolling over an ira to a different account with the same trustee,.

Income Ira, Pension Distributions (1099R, Rrb.

You will need to report the distribution even though it was rolled over. Complete, edit or print tax forms instantly. Ad download or email irs 1099r & more fillable forms, register and subscribe now! If the taxpayer has rolled over all or a portion of a distribution from a retirement account to another retirement account, the word rollover will print on.

Complete, Edit Or Print Tax Forms Instantly.

Web retirement account rollovers. Get ready for tax season deadlines by completing any required tax forms today. Pick a needed year and fill out your template instantly online.