1099 Q Form Instructions

1099 Q Form Instructions - Submit copy a to the irs with form 1096,. It's reported on the tax return. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. From within your taxact return ( online or desktop), click federal (on. Please report any errors immediately to. Web 3131 void $ check if the recipient is not the designated beneficiary copy a for internal revenue service center file with form 1096. Ad get ready for tax season deadlines by completing any required tax forms today. Is used to report the gross distribution paid over the past year from a qtp or. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. What should i do with it?

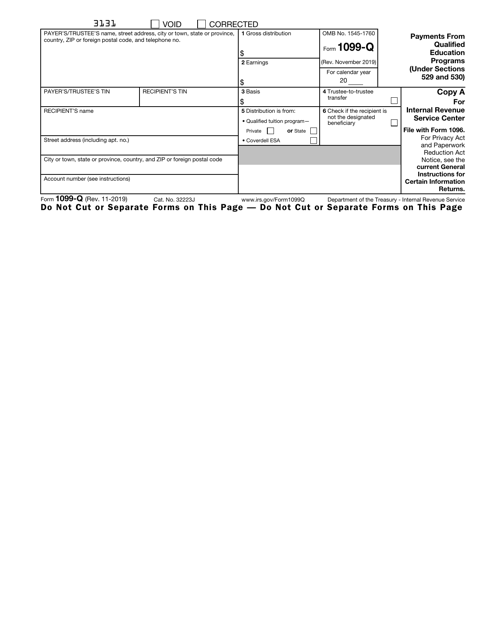

Web for the latest information about developments related to the general instructions for certain information returns after they were published, go to general instructions for. Please report any errors immediately to. For privacy act and paperwork reduction. Web 3131 void $ check if the recipient is not the designated beneficiary copy a for internal revenue service center file with form 1096. Complete, edit or print tax forms instantly. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Submit copy a to the irs with form 1096,. Is used to report the gross distribution paid over the past year from a qtp or. What should i do with it? It's reported on the tax return.

Furnish a copy of form 5498. What should i do with it? Is used to report the gross distribution paid over the past year from a qtp or. Web for the latest information about developments related to the general instructions for certain information returns after they were published, go to general instructions for. Please report any errors immediately to. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Submit copy a to the irs with form 1096,.

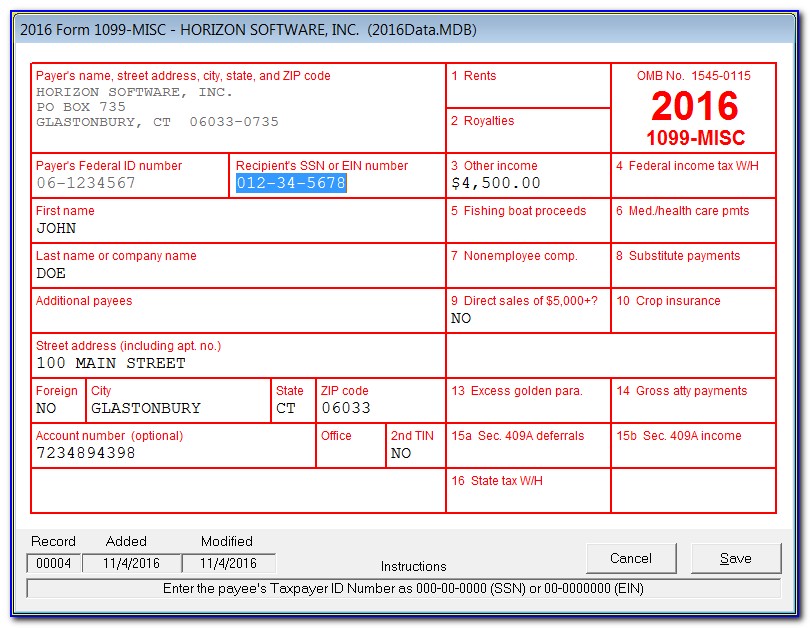

What is a 1099Misc Form? Financial Strategy Center

What should i do with it? Submit copy a to the irs with form 1096,. Ad get ready for tax season deadlines by completing any required tax forms today. Is used to report the gross distribution paid over the past year from a qtp or. For privacy act and paperwork reduction.

IRS Approved 1099Q Tax Forms File Form 1099Q, Payments From Qualified

Furnish a copy of form 5498. Please report any errors immediately to. For privacy act and paperwork reduction. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Is used to report the gross distribution paid over the past year from a qtp or.

Florida 1099 Form Online Universal Network

For privacy act and paperwork reduction. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Submit copy a to the irs with form 1096,. Is used to report the gross distribution paid over the past year from a qtp or. Complete, edit or print tax forms instantly.

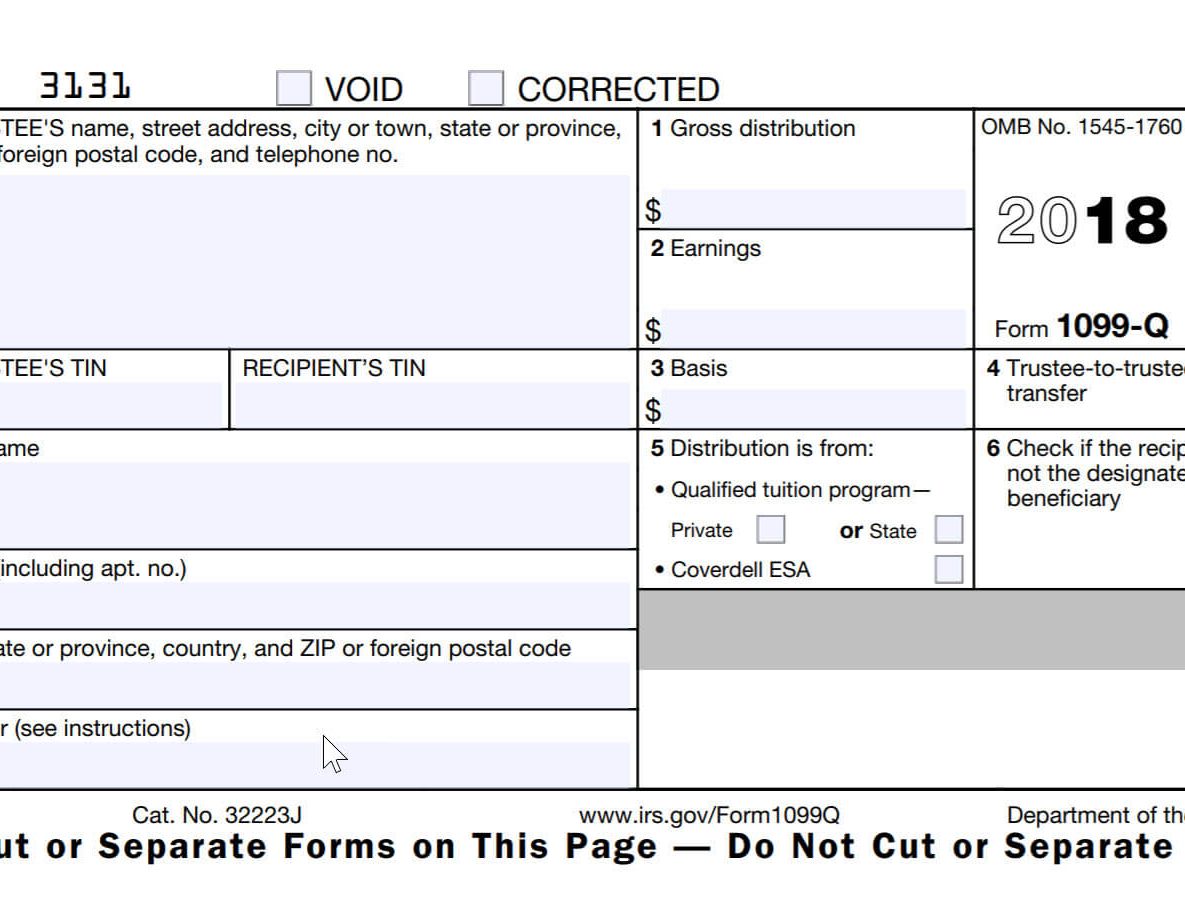

form1099Q_ Kelly CPA

For privacy act and paperwork reduction. Complete, edit or print tax forms instantly. Web 3131 void $ check if the recipient is not the designated beneficiary copy a for internal revenue service center file with form 1096. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. What should i do with it?

Irs Printable 1099 Form Printable Form 2022

Complete, edit or print tax forms instantly. Please report any errors immediately to. Web 3131 void $ check if the recipient is not the designated beneficiary copy a for internal revenue service center file with form 1096. Ad get ready for tax season deadlines by completing any required tax forms today. Is used to report the gross distribution paid over.

25 ++ sample completed 1099 misc form 2020 325140How to fill in 1099

It's reported on the tax return. What should i do with it? Please report any errors immediately to. Submit copy a to the irs with form 1096,. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

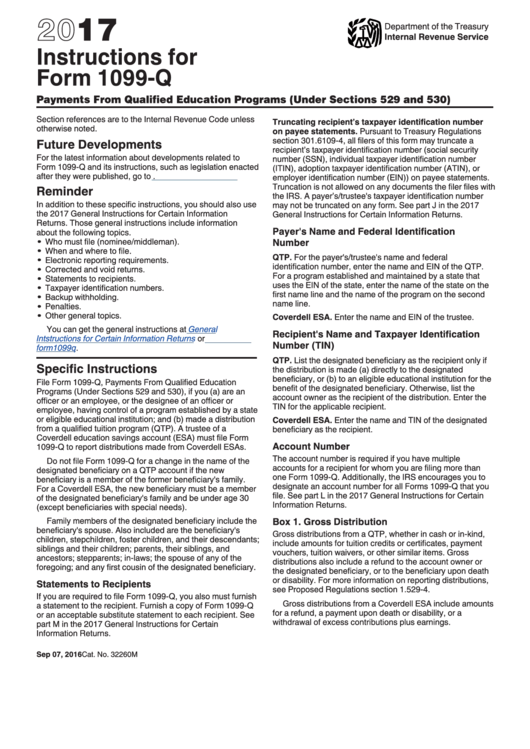

Instructions For Form 1099Q 2017 printable pdf download

What should i do with it? Complete, edit or print tax forms instantly. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web 3131 void $ check if the recipient is not the designated beneficiary copy a for internal revenue service center file with form 1096. It's reported on the tax return.

IRS Form 1099Q Download Fillable PDF or Fill Online Payments From

Submit copy a to the irs with form 1096,. What should i do with it? Is used to report the gross distribution paid over the past year from a qtp or. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web for the latest information about developments related to the general instructions for.

Irs 1099 Template 2016 Beautiful Form 1099 R Instructions Awesome Form

Complete, edit or print tax forms instantly. Is used to report the gross distribution paid over the past year from a qtp or. It's reported on the tax return. What should i do with it? For privacy act and paperwork reduction.

1099 Form Irs Instructions Universal Network

What should i do with it? Please report any errors immediately to. Web for the latest information about developments related to the general instructions for certain information returns after they were published, go to general instructions for. Submit copy a to the irs with form 1096,. It's reported on the tax return.

What Should I Do With It?

Please report any errors immediately to. Ad get ready for tax season deadlines by completing any required tax forms today. For privacy act and paperwork reduction. Submit copy a to the irs with form 1096,.

From Within Your Taxact Return ( Online Or Desktop), Click Federal (On.

It's reported on the tax return. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web 3131 void $ check if the recipient is not the designated beneficiary copy a for internal revenue service center file with form 1096.

Is Used To Report The Gross Distribution Paid Over The Past Year From A Qtp Or.

Web for the latest information about developments related to the general instructions for certain information returns after they were published, go to general instructions for. Furnish a copy of form 5498. Complete, edit or print tax forms instantly.