1099 Nec Red Form

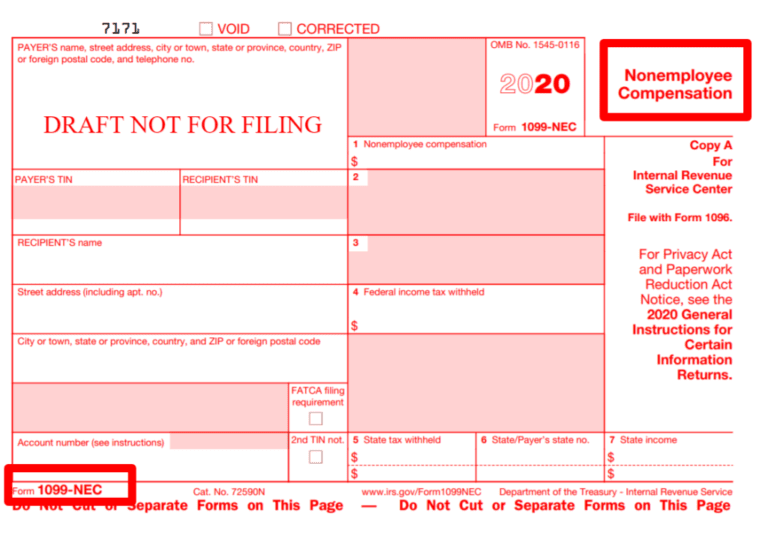

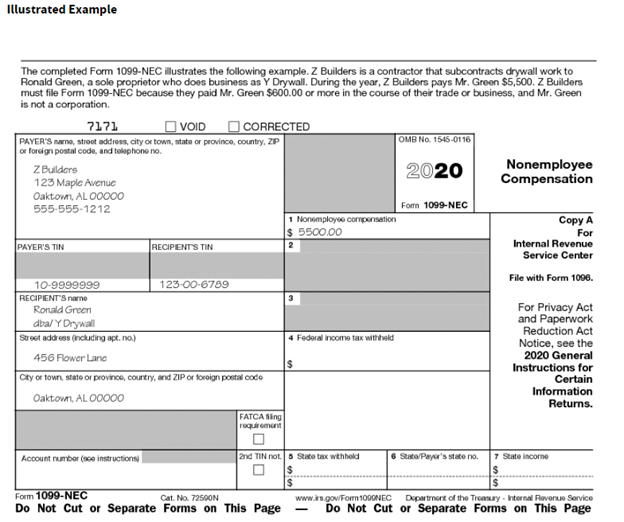

1099 Nec Red Form - Get ready for tax season deadlines by completing any required tax forms today. Nov 21, 2022,09:23am est listen to article. Web the irs specifically states that you must use the red forms so that they can be scanned or be subject to penalty. Deliver recipient copies by mail or online. Go to www.irs.gov/freefile to see. You can order them through the irs. This is one of the more important copies of the 1099 because it. Wood senior contributor i focus on taxes and litigation. Do not miss the deadline. Copy a is printed in red because it prevents duplication.

Deliver form copies by mail or online. Copy a is printed in red because it prevents duplication. Ad file form 1099 nec for 2022 with irs & state. Do not miss the deadline. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Get ready for tax season deadlines by completing any required tax forms today. It's a relatively new addition to the. Web all income must be reported to the irs and taxes must be paid on all income. Deliver recipient copies by mail or online. It certainly appears that there are no options to print.

Go to www.irs.gov/freefile to see. This is one of the more important copies of the 1099 because it. Web all income must be reported to the irs and taxes must be paid on all income. Copy a is printed in red because it prevents duplication. Do not miss the deadline. Deliver form copies by mail or online. Wood senior contributor i focus on taxes and litigation. Web yes, the red form is required for copy a of the 1099. Nov 21, 2022,09:23am est listen to article. It's a relatively new addition to the.

Form 1099MISC vs Form 1099NEC How are they Different?

You can order them through the irs. Web yes, the red form is required for copy a of the 1099. Web the irs specifically states that you must use the red forms so that they can be scanned or be subject to penalty. Get ready for tax season deadlines by completing any required tax forms today. Wood senior contributor i.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Copy a is printed in red because it prevents duplication. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web the irs specifically states that you must use the red forms so that they can be scanned or be subject to penalty. It certainly appears that there are no options to print. Nov 21,.

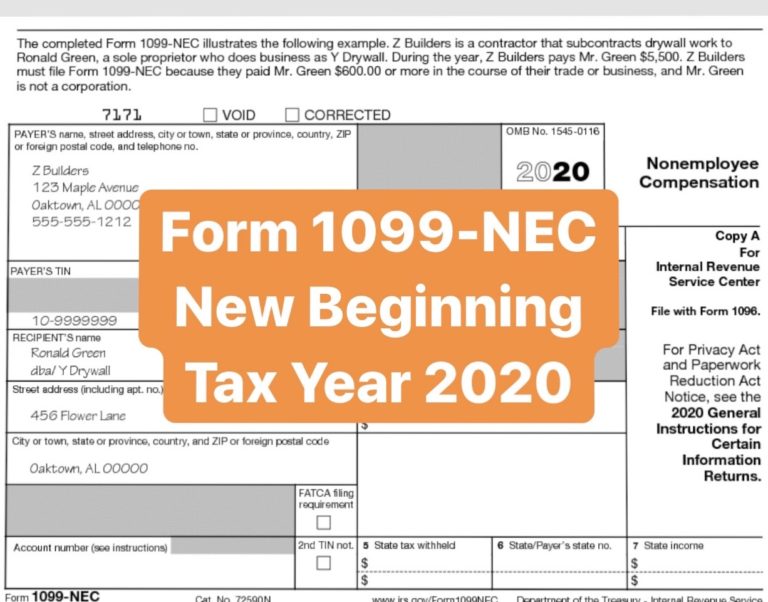

What is Form 1099NEC for Nonemployee Compensation

It certainly appears that there are no options to print. Web yes, the red form is required for copy a of the 1099. It's a relatively new addition to the. Do not miss the deadline. Get ready for tax season deadlines by completing any required tax forms today.

How To File Form 1099NEC For Contractors You Employ VacationLord

Deliver recipient copies by mail or online. This is one of the more important copies of the 1099 because it. Copy a is printed in red because it prevents duplication. It certainly appears that there are no options to print. Go to www.irs.gov/freefile to see.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

This is one of the more important copies of the 1099 because it. Do not miss the deadline. Web all income must be reported to the irs and taxes must be paid on all income. Deliver form copies by mail or online. Wood senior contributor i focus on taxes and litigation.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Wood senior contributor i focus on taxes and litigation. It certainly appears that there are no options to print. Deliver recipient copies by mail or online. It's a relatively new addition to the.

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

Go to www.irs.gov/freefile to see. Web yes, the red form is required for copy a of the 1099. You can order them through the irs. It certainly appears that there are no options to print. Deliver form copies by mail or online.

How to File Your Taxes if You Received a Form 1099NEC

This is one of the more important copies of the 1099 because it. Wood senior contributor i focus on taxes and litigation. Do not miss the deadline. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web the irs specifically states that you must use the red forms so that they can be scanned.

1099 Nec Form 2021 Fill and Sign Printable Template Online US Legal

Wood senior contributor i focus on taxes and litigation. You can order them through the irs. Deliver form copies by mail or online. Web the irs specifically states that you must use the red forms so that they can be scanned or be subject to penalty. Go to www.irs.gov/freefile to see.

How do I Access 1099NEC form Files for Use with Sage Checks & Forms?

Ad file form 1099 nec for 2022 with irs & state. You can order them through the irs. This is one of the more important copies of the 1099 because it. Deliver form copies by mail or online. Web yes, the red form is required for copy a of the 1099.

Ad File Form 1099 Nec For 2022 With Irs & State.

Web yes, the red form is required for copy a of the 1099. Web all income must be reported to the irs and taxes must be paid on all income. This is one of the more important copies of the 1099 because it. Deliver recipient copies by mail or online.

It Certainly Appears That There Are No Options To Print.

Nov 21, 2022,09:23am est listen to article. Web the social security administration shares the information with the internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. You can order them through the irs.

Web The Irs Specifically States That You Must Use The Red Forms So That They Can Be Scanned Or Be Subject To Penalty.

It's a relatively new addition to the. Go to www.irs.gov/freefile to see. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Do not miss the deadline.

Deliver Form Copies By Mail Or Online.

Copy a is printed in red because it prevents duplication. Wood senior contributor i focus on taxes and litigation.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://static.wixstatic.com/media/9fe6e6_c02527d741474d7e88dbd9fa3595b59f~mv2.png/v1/fit/w_1000%2Ch_853%2Cal_c%2Cq_80/file.jpg)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)