1099 Form Oregon

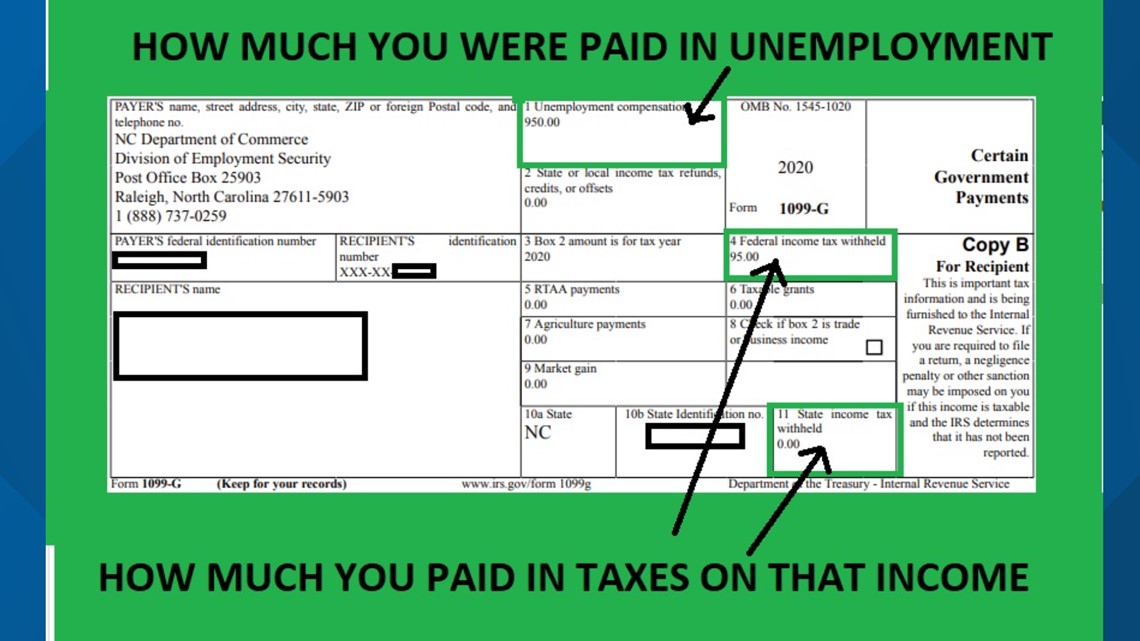

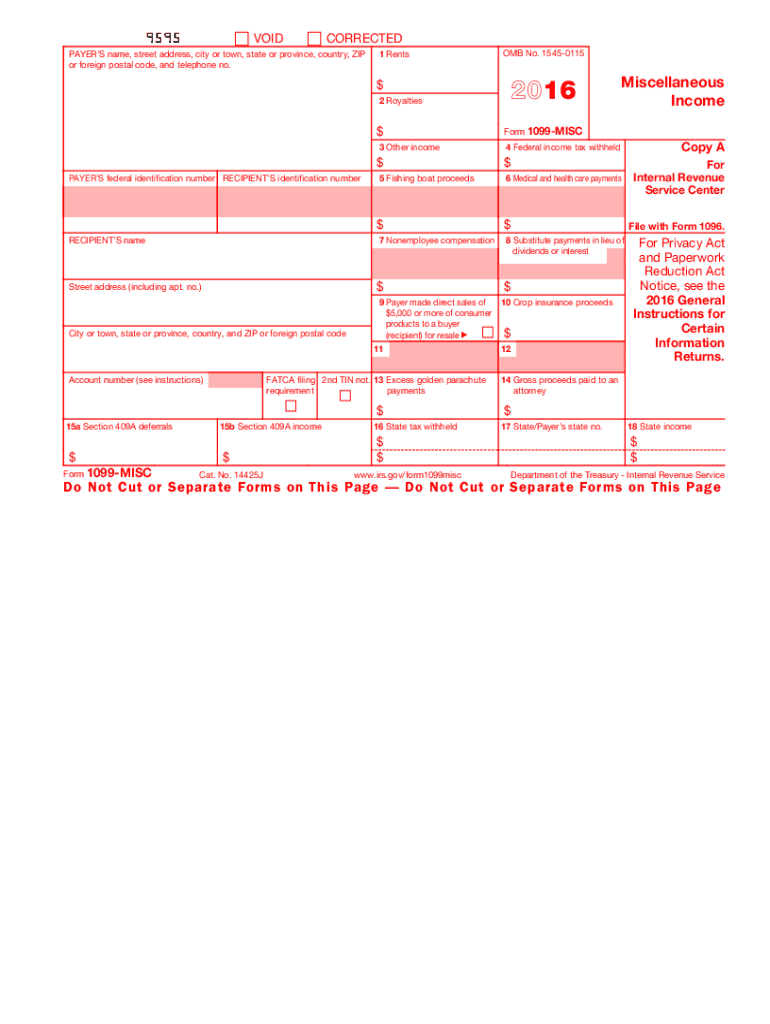

1099 Form Oregon - Business sba.gov's business licenses and permits search tool allows you to get a. Web the oregon small business development center network online services: Web the 1099g form is used for filing both federal income taxes to the internal revenue service (irs) and state income taxes to the oregon department of revenue. Ad get ready for tax season deadlines by completing any required tax forms today. 1099g is a tax form sent to people who have received unemployment insurance benefits. We use this form to report interest that we paid you if the amount was $10 or more. Web 2022 forms and publications. Web current forms and publications. Web independent contractors receive a form 1099 at the end of the year and are solely responsible for reporting and paying taxes, including state and federal income taxes, self. Yes, oregon requires all 1099 forms to be filed with the oregon department of revenue.

Web current forms and publications. Web 2022 forms and publications. This interest is taxable and must be included on both your federal and oregon. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Web fill out the form and mail it to the address listed on the form. View all of the current year's forms and publications by popularity or program area. The state of oregon also mandates the filing of. Once you subtract the federal and state income. Business sba.gov's business licenses and permits search tool allows you to get a. Web does oregon require state 1099 tax filing?

Ad get ready for tax season deadlines by completing any required tax forms today. The irs compares reported income. We don't recommend using your. Web fill out the form and mail it to the address listed on the form. You use it when you are filing federal and state. This interest is taxable and must be included on both your federal and oregon. Web the 1099g form is used for filing both federal income taxes to the internal revenue service (irs) and state income taxes to the oregon department of revenue. Business sba.gov's business licenses and permits search tool allows you to get a. Web 2022 forms and publications. Ad discover a wide selection of 1099 tax forms at staples®.

1099 Form Utah 2019 Form Resume Examples AjYdEAZVl0

Web does oregon require state 1099 tax filing? Web the 1099g form is used for filing both federal income taxes to the internal revenue service (irs) and state income taxes to the oregon department of revenue. Once you subtract the federal and state income. Download and save the form to your computer, then open it in adobe reader to complete.

How To Get 1099 G Form Online Iowa Nicolette Mill's Template

Select a heading to view its forms, then u se the search. You use it when you are filing federal and state. We use this form to report interest that we paid you if the amount was $10 or more. Web independent contractors receive a form 1099 at the end of the year and are solely responsible for reporting and.

Sample of completed 1099int 205361How to calculate 1099int

Web fill out the form and mail it to the address listed on the form. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. The irs compares reported income. You use it when you are filing.

How To File Form 1099NEC For Contractors You Employ VacationLord

Web the 1099g form is used for filing both federal income taxes to the internal revenue service (irs) and state income taxes to the oregon department of revenue. Web current forms and publications. Business sba.gov's business licenses and permits search tool allows you to get a. This interest is taxable and must be included on both your federal and oregon..

What is a 1099 & 5498? uDirect IRA Services, LLC

Complete, edit or print tax forms instantly. Web the oregon small business development center network online services: Web the 1099g form is used for filing both federal income taxes to the internal revenue service (irs) and state income taxes to the oregon department of revenue. They are produced every january for the prior tax year. We don't recommend using your.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

View all of the current year's forms and publications by popularity or program area. Web independent contractors receive a form 1099 at the end of the year and are solely responsible for reporting and paying taxes, including state and federal income taxes, self. Ad electronically file 1099 forms. Once you subtract the federal and state income. Download and save the.

Oregon Iwire Fill Out and Sign Printable PDF Template signNow

Business sba.gov's business licenses and permits search tool allows you to get a. They are produced every january for the prior tax year. Web the 1099g form is used for filing both federal income taxes to the internal revenue service (irs) and state income taxes to the oregon department of revenue. The filing threshold will be “if required to file.

Free Printable 1099 Misc Forms Free Printable

Web current forms and publications. We use this form to report interest that we paid you if the amount was $10 or more. Ad discover a wide selection of 1099 tax forms at staples®. Yes, oregon requires all 1099 forms to be filed with the oregon department of revenue. View all of the current year's forms and publications by popularity.

Fast Answers About 1099 Forms for Independent Workers

They are produced every january for the prior tax year. Download and save the form to your computer, then open it in adobe reader to complete and print. Web fill out the form and mail it to the address listed on the form. Web 2022 forms and publications. You use it when you are filing federal and state.

Blank 1099 Form Fill Out and Sign Printable PDF Template signNow

Select a heading to view its forms, then u se the search. You use it when you are filing federal and state. Web fill out the form and mail it to the address listed on the form. Yes, oregon requires all 1099 forms to be filed with the oregon department of revenue. Web 1099 statements are reports of taxable income.

Web 1099 Statements Are Reports Of Taxable Income Paid To Individuals And Companies By Oregon State University.

This interest is taxable and must be included on both your federal and oregon. The irs compares reported income. Ad get ready for tax season deadlines by completing any required tax forms today. Web the oregon small business development center network online services:

Web 2022 Forms And Publications.

The filing threshold will be “if required to file federally and file over 10. We don't recommend using your. Web current forms and publications. They are produced every january for the prior tax year.

Web Fill Out The Form And Mail It To The Address Listed On The Form.

Business sba.gov's business licenses and permits search tool allows you to get a. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. You use it when you are filing federal and state. Ad discover a wide selection of 1099 tax forms at staples®.

1099G Is A Tax Form Sent To People Who Have Received Unemployment Insurance Benefits.

Ad electronically file 1099 forms. • use the online claim system and select “electronic deposit,” from the main menu select enter your information, or • print the authorization for electronic deposit. Select a heading to view its forms, then u se the search. Download and save the form to your computer, then open it in adobe reader to complete and print.