1099 Form For Real Estate Sale

1099 Form For Real Estate Sale - Web said note, in the event of the sale, transfer or other conveyance of the properly described herein,. Main home, timeshare/vacation home, investment property, business, or rental. Edit, sign and save real estate proceeds form. Jackson county may file a lawsuit seeking a judgment of foreclosure for unpaid delinquent taxes. Where you report information on the form depends on how you use the property: Main home, timeshare/vacation home, investment property, business, or rental. If you must report it, complete form 8949 before schedule d. Web who is in the tax sale? Sale of your home you may not need to report the sale or exchange of your main home. Title insurance and other loan costs:

Ad ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. You will report the information on a specific part of the form, depending on how you use the property: Edit, sign and save real estate proceeds form. Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Main home, timeshare/vacation home, investment property, business, or rental. Web 3.earnest monies and additional deposits: Buyer and seller acknowledge and. Sale of your home you may not need to report the sale or exchange of your main home. Jackson county may file a lawsuit seeking a judgment of foreclosure for unpaid delinquent taxes. Nonresident alien with income from missouri

Where you report information on the form depends on how you use the property: Ad ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Main home, timeshare/vacation home, investment property, business, or rental. Title insurance and other loan costs: Provide the note holder with copy of paid receipts for real estate taxes on an annual basis. Why do i have to report capital gains from my mutual funds if i never sold any shares of that mutual fund? Buyer shall pay for mortgagee’s title. How do i report this? Sale of business property is reported on form 4797, otherwise the transaction is reported on form 8949. Jackson county may file a lawsuit seeking a judgment of foreclosure for unpaid delinquent taxes.

EFile 1099S 2021 Form 1099S Online How to File 1099S

Sale of business property is reported on form 4797, otherwise the transaction is reported on form 8949. Sale of your main home Web said note, in the event of the sale, transfer or other conveyance of the properly described herein,. Buyer shall pay for mortgagee’s title. Ap leaders rely on iofm’s expertise to keep them up to date on irs.

Form 1099S Proceeds from Real Estate Transactions (2014) Free Download

Buyer shall pay for mortgagee’s title. If a real estate parcel has a delinquent tax that is 3 years old, that property faces a foreclosure sale to recover back taxes. Web 3.earnest monies and additional deposits: Ad ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. You will report the information on a.

IRS Form 1099 Reporting for Small Business Owners

Nonresident alien with income from missouri Web how do i report my loss? You will report the information on a specific part of the form, depending on how you use the property: Sale of business property is reported on form 4797, otherwise the transaction is reported on form 8949. Buyer shall pay for mortgagee’s title.

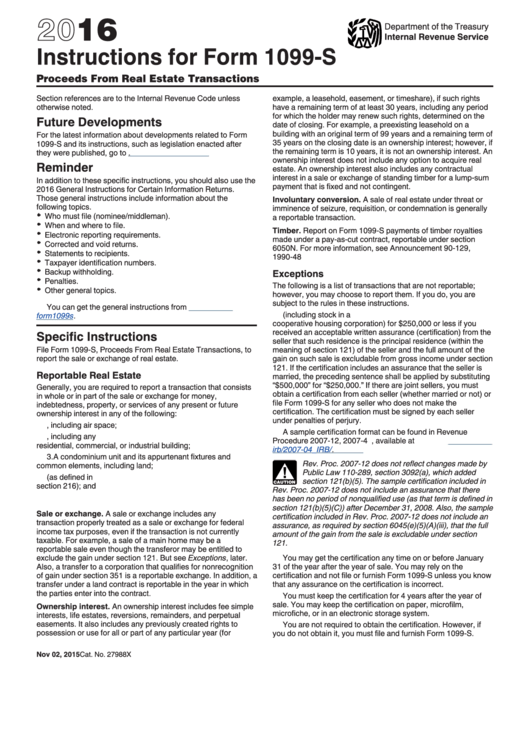

Instructions For Form 1099S Proceeds From Real Estate Transactions

Nonresident alien with income from missouri Why do i have to report capital gains from my mutual funds if i never sold any shares of that mutual fund? You will report the information on a specific part of the form, depending on how you use the property: To determine if you have to report the sale or exchange of your.

What is a 1099 & 5498? uDirect IRA Services, LLC

Where you report information on the form depends on how you use the property: Main home, timeshare/vacation home, investment property, business, or rental. Provide the note holder with copy of paid receipts for real estate taxes on an annual basis. Uslegalforms allows users to edit, sign, fill & share all type of documents online. If you must report it, complete.

Everything You Need To Know About Form 1099S Blog TaxBandits

How do i report this? Where you report information on the form depends on how you use the property: If a real estate parcel has a delinquent tax that is 3 years old, that property faces a foreclosure sale to recover back taxes. Sale of your main home Uslegalforms allows users to edit, sign, fill & share all type of.

Product Reviews

Why do i have to report capital gains from my mutual funds if i never sold any shares of that mutual fund? Edit, sign and save real estate proceeds form. Web said note, in the event of the sale, transfer or other conveyance of the properly described herein,. If a real estate parcel has a delinquent tax that is 3.

1099 Contract Template HQ Printable Documents

Web said note, in the event of the sale, transfer or other conveyance of the properly described herein,. If you must report it, complete form 8949 before schedule d. Edit, sign and save real estate proceeds form. Web how do i report my loss? Main home, timeshare/vacation home, investment property, business, or rental.

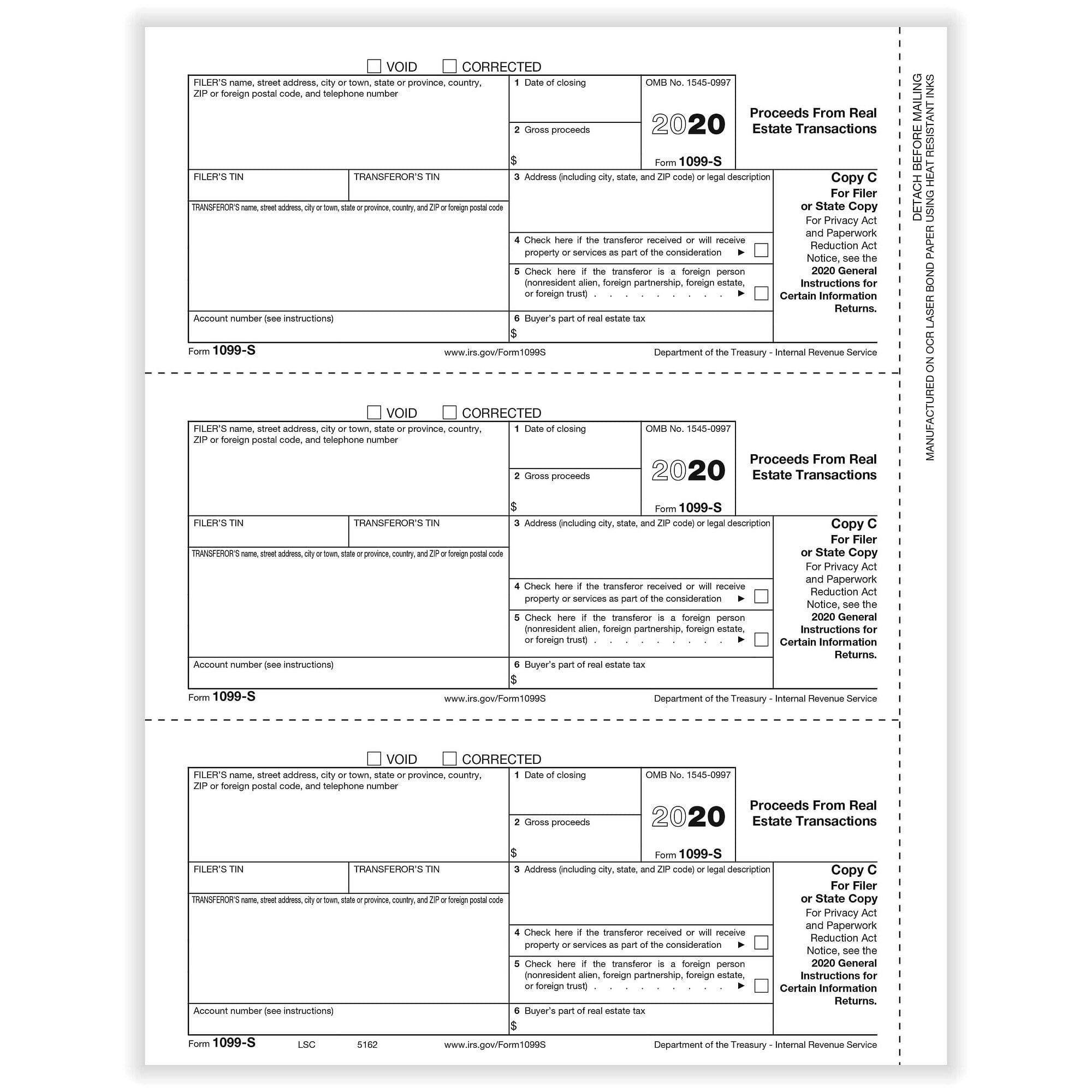

1099S IRS Real Estate Proceeds Form The Supplies Shops

Web said note, in the event of the sale, transfer or other conveyance of the properly described herein,. Upon acceptance of this contract, unless agreed, any earnest money referenced in paragraph 2 (a) shall be deposited within 5 business days of the effective date, in an Edit, sign and save real estate proceeds form. Web 3.earnest monies and additional deposits:.

Form 1099S Proceeds from Real Estate Transactions (2014) Free Download

Web said note, in the event of the sale, transfer or other conveyance of the properly described herein,. Jackson county may file a lawsuit seeking a judgment of foreclosure for unpaid delinquent taxes. Web how do i report my loss? Upon acceptance of this contract, unless agreed, any earnest money referenced in paragraph 2 (a) shall be deposited within 5.

Jackson County May File A Lawsuit Seeking A Judgment Of Foreclosure For Unpaid Delinquent Taxes.

Upon acceptance of this contract, unless agreed, any earnest money referenced in paragraph 2 (a) shall be deposited within 5 business days of the effective date, in an Buyer shall pay for mortgagee’s title. Nonresident alien with income from missouri Main home, timeshare/vacation home, investment property, business, or rental.

Ap Leaders Rely On Iofm’s Expertise To Keep Them Up To Date On Irs Regulations.

Web for sales or exchanges of certain real estate, the person responsible for closing a real estate transaction must report the real estate proceeds to the irs and must furnish this statement to you. Web who is in the tax sale? Main home, timeshare/vacation home, investment property, business, or rental. Web 3.earnest monies and additional deposits:

Uslegalforms Allows Users To Edit, Sign, Fill & Share All Type Of Documents Online.

Sale of your main home How do i report this? If you must report it, complete form 8949 before schedule d. To determine if you have to report the sale or exchange of your main home on your tax return, see the instructions for schedule d (form 1040).

You Will Report The Information On A Specific Part Of The Form, Depending On How You Use The Property:

Web how do i report my loss? Why do i have to report capital gains from my mutual funds if i never sold any shares of that mutual fund? Ad ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Sale of business property is reported on form 4797, otherwise the transaction is reported on form 8949.