1042-S Form 2022

1042-S Form 2022 - Get ready for tax season deadlines by completing any required tax forms today. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web recipient fields common to all form types. Source income subject to withholding. Source income of foreign persons go to www.irs.gov/form1042 for. Irs use only—do not write or staple in this. By march 15, the company. Source income subject to withholding, to report amounts paid to. Web futureplan erisa team december 14 2021. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.

Web futureplan erisa team december 14 2021. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. This webinar is scheduled for approximately 120 minutes. Complete, edit or print tax forms instantly. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web go to sign in or create an account. Get ready for tax season deadlines by completing any required tax forms today. Ad get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding, to report amounts paid to. Tax return for seniors 2022 department of the treasury—internal revenue service.

Web futureplan erisa team december 14 2021. Web recipient fields common to all form types. Irs use only—do not write or staple in this. Web go to sign in or create an account. Ad get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding, to report amounts paid to. By march 15, the company. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Complete, edit or print tax forms instantly. Tax return for seniors 2022 department of the treasury—internal revenue service.

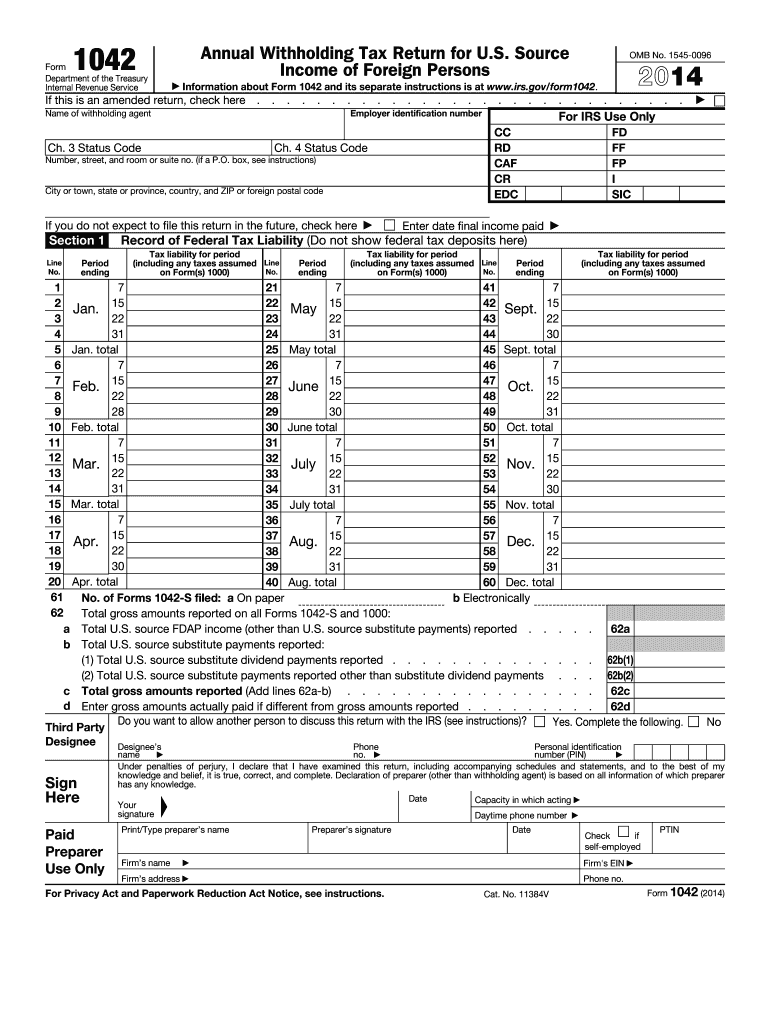

2014 form 1042 Fill out & sign online DocHub

Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Source income of foreign persons go to www.irs.gov/form1042 for. This webinar is scheduled for approximately 120 minutes.

Form 1042S USEReady

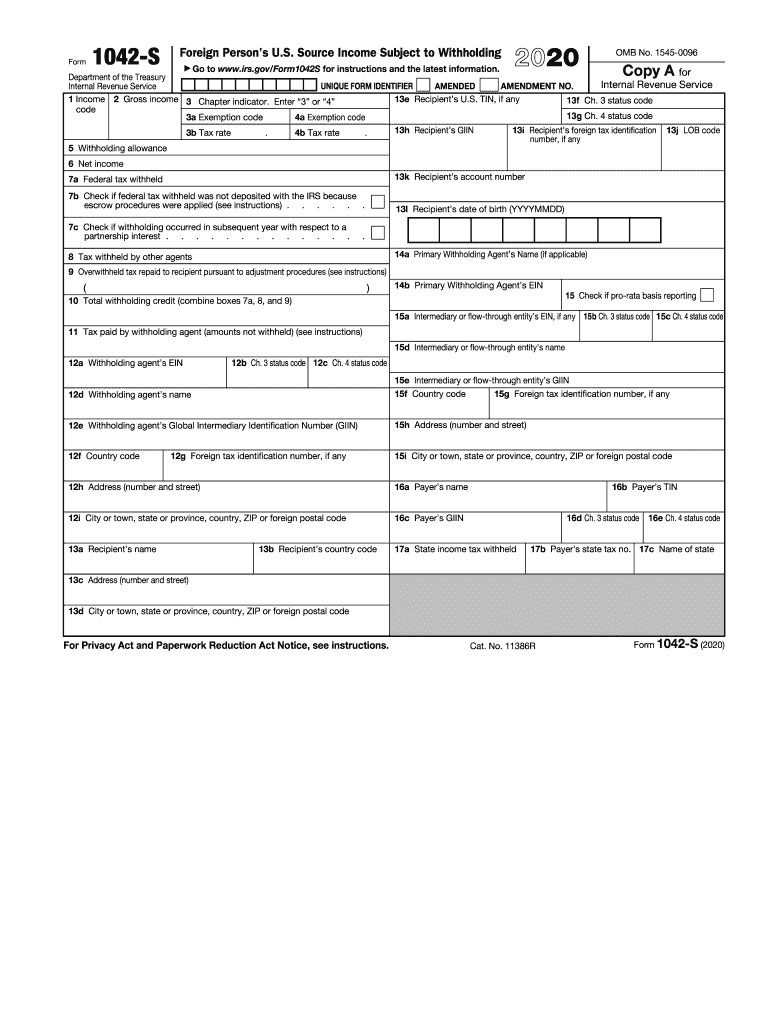

Web recipient fields common to all form types. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. A withholding agent must provide a unique form identifier number. Irs use only—do not write or staple in this. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s.

Form 1042S It's Your Yale

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income subject to withholding, to report amounts paid to. By march 15, the company. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s.

IRS Form 1042s What It is & 1042s Instructions Tipalti

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income subject to withholding. Ad get ready for tax season deadlines by completing any required tax forms today. Source income of foreign persons go to www.irs.gov/form1042 for. A withholding agent must provide a unique form identifier number.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

Source income subject to withholding. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Web go to sign in or create an account. Get ready for tax season deadlines by completing any required tax forms today. This webinar is scheduled for approximately 120 minutes.

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. By march 15, the company. This webinar is scheduled for approximately 120 minutes. A withholding agent must provide a unique form identifier number. Source income subject to withholding, to report amounts paid to.

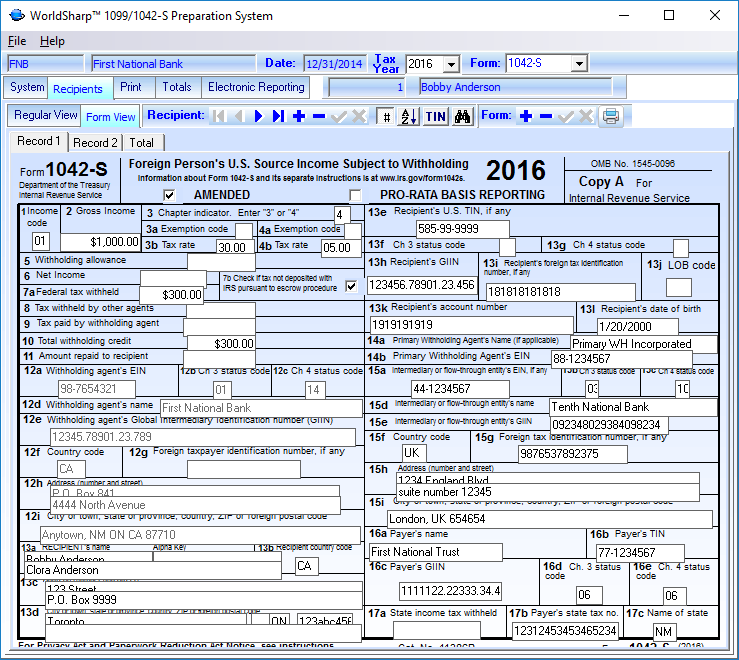

1042S Software WorldSharp 1099/1042S Software features

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income of foreign persons go to www.irs.gov/form1042 for. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Tax return for seniors 2022 department of the treasury—internal revenue service.

1042 Fill out & sign online DocHub

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Complete, edit or print tax forms instantly. Source income subject to withholding, to report amounts paid to. Web futureplan erisa team december 14 2021. Irs use only—do not write or staple in this.

2022 Master Guide to Form 1042S Compliance Institute of Finance

Ad get ready for tax season deadlines by completing any required tax forms today. This webinar is scheduled for approximately 120 minutes. Source income subject to withholding, to report amounts paid to. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Web.

1042 S Form slideshare

Source income subject to withholding. Get ready for tax season deadlines by completing any required tax forms today. A withholding agent must provide a unique form identifier number. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Source income subject to withholding, including recent updates, related forms,.

Web Go To Sign In Or Create An Account.

Web recipient fields common to all form types. This webinar is scheduled for approximately 120 minutes. Web futureplan erisa team december 14 2021. Source income subject to withholding, to report amounts paid to.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Tax return for seniors 2022 department of the treasury—internal revenue service. Source income of foreign persons go to www.irs.gov/form1042 for. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income subject to withholding.

Irs Use Only—Do Not Write Or Staple In This.

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

By march 15, the company. A withholding agent must provide a unique form identifier number. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.