1031 Form 8824

1031 Form 8824 - Part iii computes the amount of gain required to be reported on the tax return in the current year. When to file this form must be included with your tax return for the tax year in which a. Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Increase cash flow potential and lower your closing risk. • part i of form 8824 is where you provide details about the. You can find instructions to the form 8824 worksheets in the paragraphs following. For details on the exclusion of gain (including how to figure the amount of the exclusion), see pub. Ad own real estate without dealing with the tenants, toilets and trash. Web exchanges limited to real property. Use parts i, ii, and iii of form.

Part iii computes the amount of gain required to be reported on the tax return in the current year. Web if the exchanger has recognized gain, in addition to irs form 8824, the exchanger may need to report the gain on irs form 4797, sales of business property, schedule d (irs. Web you only need one form 8824 to report a 1031 exchange (even if one property for two properties). Also file form 8824 for the 2 years following the year of a related party exchange. Web irs form 8824 is used to report a 1031 exchange for the tax year in which you complete it. Web form 8824 worksheetworksheet 2 tax deferred exchanges under irc § 1031 analysis of cash boot received or paid sale of exchange property sale. Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Web form 8824 click below to download the form 8824 worksheets. You can find instructions to the form 8824 worksheets in the paragraphs following. Section iii of the form determines the net results of the transaction (gain or.

Web form 8824 worksheetworksheet 2 tax deferred exchanges under irc § 1031 analysis of cash boot received or paid sale of exchange property sale. Increase cash flow potential and lower your closing risk. Web you only need one form 8824 to report a 1031 exchange (even if one property for two properties). Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Web irs form 8824 is used to report a 1031 exchange for the tax year in which you complete it. Steel mill) and indicate that the property is located in the. Also file form 8824 for the 2 years following the year of a related party exchange. Web form 8824 click below to download the form 8824 worksheets. Ad own real estate without dealing with the tenants, toilets and trash. Execution of the form calculates the amount of gain deferred due to a.

Reporting 1031 Exchanges to the IRS via Form 8824

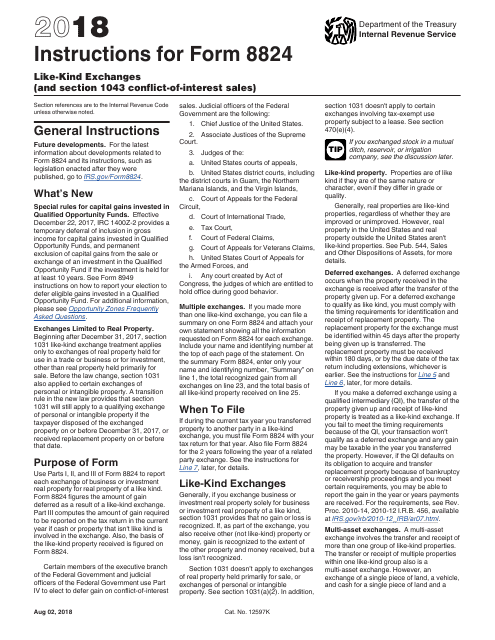

When to file this form must be included with your tax return for the tax year in which a. Also file form 8824 for the 2 years following the year of a related party exchange. Steel mill) and indicate that the property is located in the. Web exchanges limited to real property. Web form 8824 click below to download the.

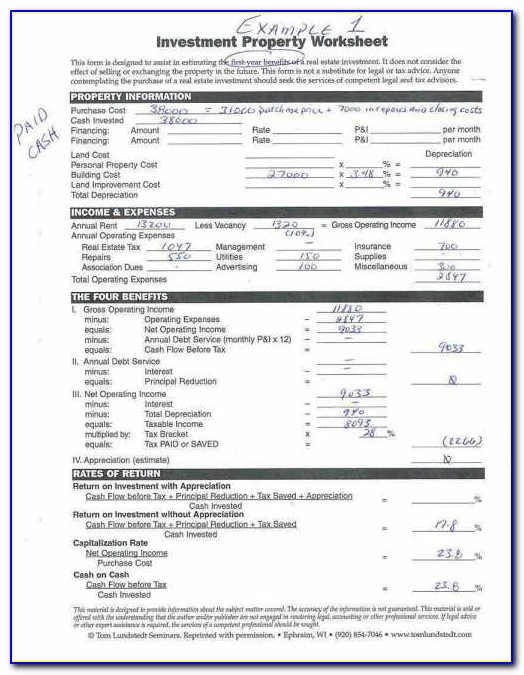

1031 Exchange Worksheet Excel Master of Documents

Use parts i, ii, and iii of form. Web you only need one form 8824 to report a 1031 exchange (even if one property for two properties). Section iii of the form determines the net results of the transaction (gain or. You can find instructions to the form 8824 worksheets in the paragraphs following. • part i of form 8824.

Download Instructions for IRS Form 8824 LikeKind Exchanges PDF, 2018

Increase cash flow potential and lower your closing risk. Web gain figured on form 8824. Part iii computes the amount of gain required to be reported on the tax return in the current year. Execution of the form calculates the amount of gain deferred due to a. Web form 8824 click below to download the form 8824 worksheets.

How can/should I fill out Form 8824 with the following information

You can find instructions to the form 8824 worksheets in the paragraphs following. Ad own real estate without dealing with the tenants, toilets and trash. For details on the exclusion of gain (including how to figure the amount of the exclusion), see pub. Execution of the form calculates the amount of gain deferred due to a. Web gain figured on.

1031 Exchange Form 1099 S Forms NzA1Nw Resume Examples

Execution of the form calculates the amount of gain deferred due to a. Web gain figured on form 8824. When to file this form must be included with your tax return for the tax year in which a. Web if the exchanger has recognized gain, in addition to irs form 8824, the exchanger may need to report the gain on.

1031 Exchange All You Need to Know About Completing IRS Form 8824

Web gain figured on form 8824. • part i of form 8824 is where you provide details about the. Web if the exchanger has recognized gain, in addition to irs form 8824, the exchanger may need to report the gain on irs form 4797, sales of business property, schedule d (irs. Use parts i, ii, and iii of form. Steel.

1031 Exchange Form 8824 Universal Network

• part i of form 8824 is where you provide details about the. Steel mill) and indicate that the property is located in the. Web you only need one form 8824 to report a 1031 exchange (even if one property for two properties). Web form 8824 click below to download the form 8824 worksheets. Web irs form 8824 is used.

Form 8824 Do it correctly Michael Lantrip Wrote The Book

Web irs form 8824 is used to report a 1031 exchange for the tax year in which you complete it. Also file form 8824 for the 2 years following the year of a related party exchange. Ad own real estate without dealing with the tenants, toilets and trash. Use parts i, ii, and iii of form. Web if the exchanger.

1031 Exchange Form 1099 S Forms NzA1Nw Resume Examples

Use parts i, ii, and iii of form. Web gain figured on form 8824. Ad own real estate without dealing with the tenants, toilets and trash. Web exchanges limited to real property. Web you only need one form 8824 to report a 1031 exchange (even if one property for two properties).

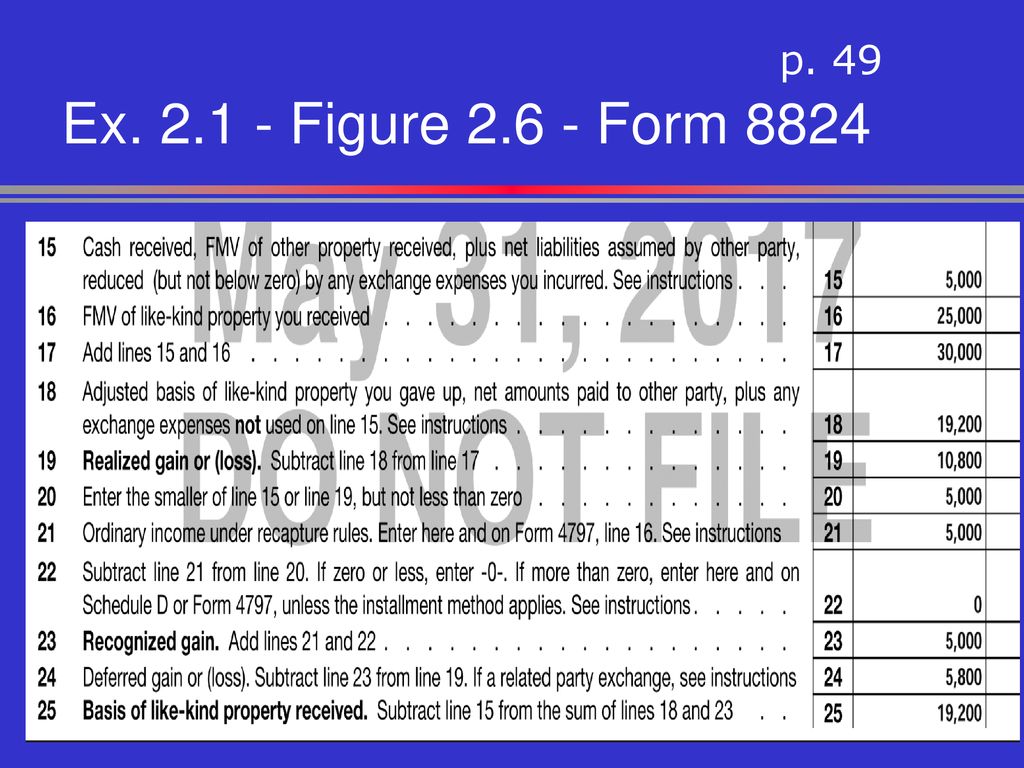

Ex Figure Form 8824 P. 49 Universal Network

Web you only need one form 8824 to report a 1031 exchange (even if one property for two properties). Web form 8824 click below to download the form 8824 worksheets. Web gain figured on form 8824. Web irs form 8824 is used to report a 1031 exchange for the tax year in which you complete it. Section iii of the.

Web Form 8824 Click Below To Download The Form 8824 Worksheets.

Web gain figured on form 8824. Part iii computes the amount of gain required to be reported on the tax return in the current year. Section iii of the form determines the net results of the transaction (gain or. Increase cash flow potential and lower your closing risk.

Also File Form 8824 For The 2 Years Following The Year Of A Related Party Exchange.

Web form 8824 worksheetworksheet 2 tax deferred exchanges under irc § 1031 analysis of cash boot received or paid sale of exchange property sale. Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Web exchanges limited to real property. When to file this form must be included with your tax return for the tax year in which a.

Web You Only Need One Form 8824 To Report A 1031 Exchange (Even If One Property For Two Properties).

Steel mill) and indicate that the property is located in the. For details on the exclusion of gain (including how to figure the amount of the exclusion), see pub. Web irs form 8824 is used to report a 1031 exchange for the tax year in which you complete it. Use parts i, ii, and iii of form.

Ad Own Real Estate Without Dealing With The Tenants, Toilets And Trash.

Web the information provided in irs form 8824 makes it easy for the irs to review a taxpayer's prior 8824 forms to verify that the appropriate amount of taxable gain is calculated and. Web if the exchanger has recognized gain, in addition to irs form 8824, the exchanger may need to report the gain on irs form 4797, sales of business property, schedule d (irs. Execution of the form calculates the amount of gain deferred due to a. • part i of form 8824 is where you provide details about the.