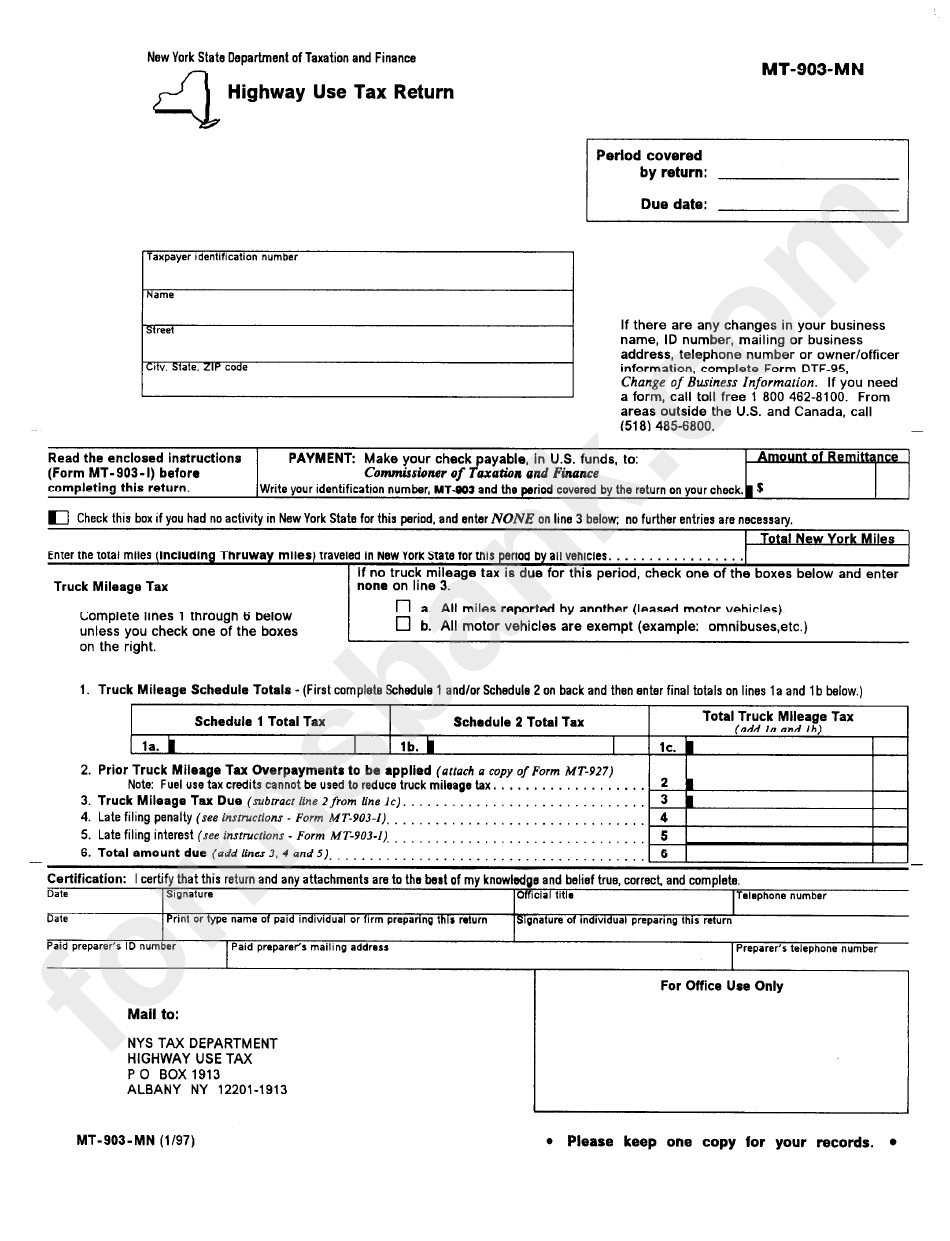

Highway Use Tax Return Form Mt - 903

Highway Use Tax Return Form Mt - 903 - Web for tax periods beginning on and after january 1, 2022, the thresholds for monthly, quarterly, and annual filing requirements increased, allowing many filers to report less. Web you must file form mt‐903, highway use tax return, if you have been issued a certificate of registration (certificate) or if you operate a motor vehicle (as defined in tax. File heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. You may web file your highway use tax return. Web there are two ways to file: Be sure to use the proper. Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Figure and pay the tax due on highway motor vehicles used during the period with a.

Be sure to use the proper. Web for tax periods beginning on and after january 1, 2022, the thresholds for monthly, quarterly, and annual filing requirements increased, allowing many filers to report less. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web about form 2290, heavy highway vehicle use tax return. Jul 14, 2022 — for more information, see when to file and pay. Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. You may web file your highway use tax return. Figure and pay the tax due on highway motor vehicles used during the period with a. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web there are two ways to file:

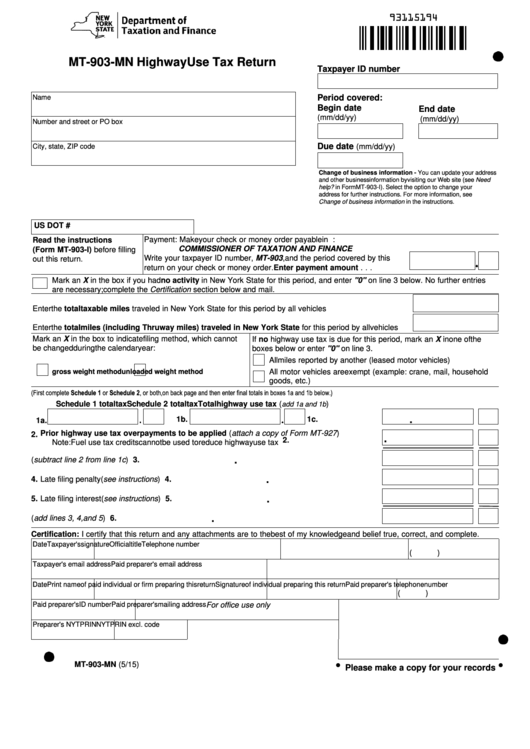

Jul 14, 2022 — for more information, see when to file and pay. Web about form 2290, heavy highway vehicle use tax return. Figure and pay the tax due on highway motor vehicles used during the period with a. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web for tax periods beginning on and after january 1, 2022, the thresholds for monthly, quarterly, and annual filing requirements increased, allowing many filers to report less. Web highway use tax (hut) web file—free and no additional. Web follow the simple instructions below: Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Web the form 93115194: Web there are two ways to file:

Form 2290 Heavy Highway Use Tax Return Beautiful Irs form 2290 Efile

You may web file your highway use tax return. Figure and pay the tax due on highway motor vehicles used during the period with a. Web highway use tax (hut) web file—free and no additional. Web there are two ways to file: Web you must file form mt‐903, highway use tax return, if you have been issued a certificate of.

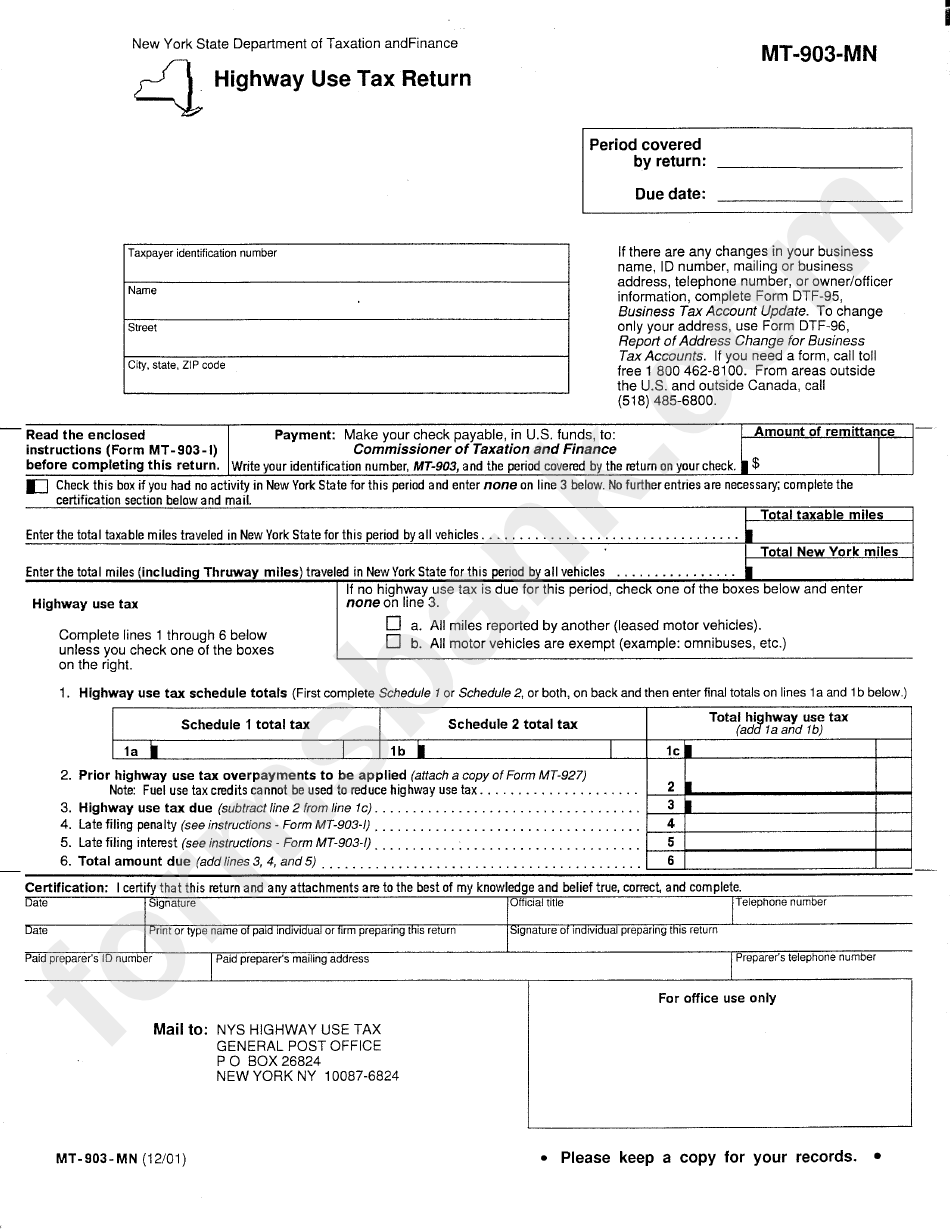

Form Mt903Mn Highway Use Tax Return printable pdf download

July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Be sure to use the proper. Web highway use tax (hut) web file—free and no additional. Web about form 2290, heavy highway vehicle use tax return. Web for tax periods beginning on and after january.

ny highway use tax return instructions Bailey Bach

File heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Taxpayer identification number name street city, state, zip code if there are any changes in your. Web follow the simple instructions below: Web there are two ways to file: Web about form 2290, heavy highway vehicle use tax return.

Fillable Form Mt903Mn Highway Use Tax Return printable pdf download

Web there are two ways to file: July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Finding a authorized professional, creating a scheduled visit and going to the business office for a personal conference makes doing a. Figure and pay the tax due on.

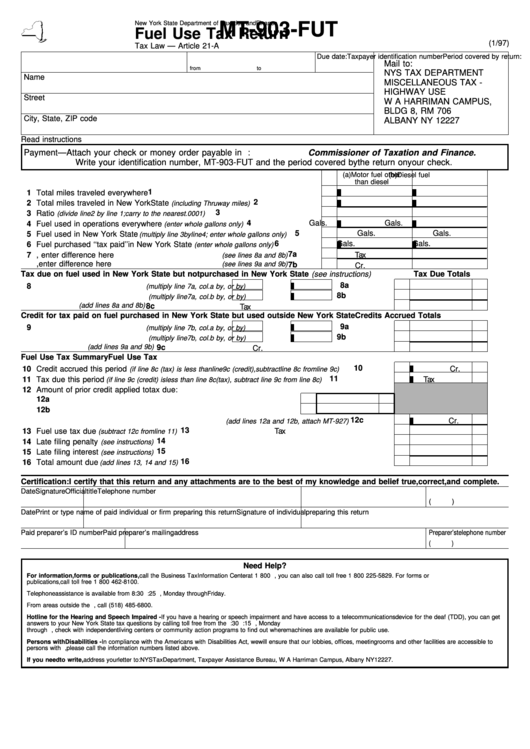

Form Mt903Fut Fuel Use Tax Return printable pdf download

Web follow the simple instructions below: Web there are two ways to file: Web you must file form mt‐903, highway use tax return, if you have been issued a certificate of registration (certificate) or if you operate a motor vehicle (as defined in tax. Taxpayer identification number name street city, state, zip code if there are any changes in your..

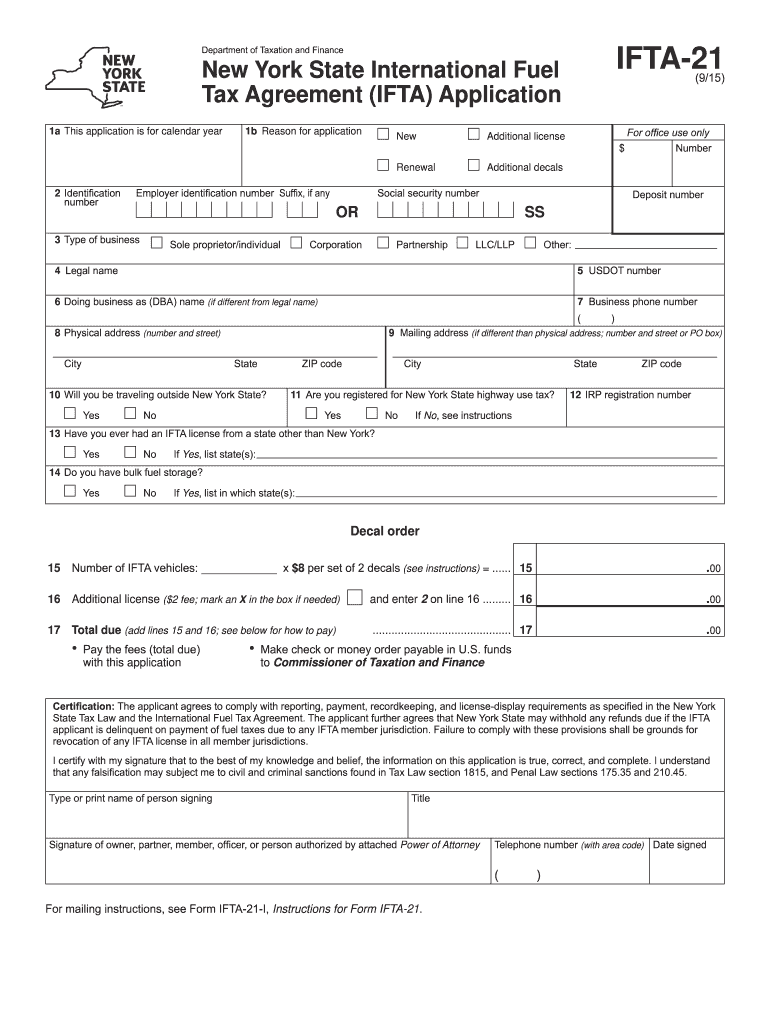

International FuelTax Agreement report IFTA for the

Taxpayer identification number name street city, state, zip code if there are any changes in your. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web you must file form mt‐903, highway use tax return, if you have been issued a certificate of registration (certificate) or if you operate a motor.

Fill Free fillable Form 93115194 MT903MN Highway Use Tax Return

Web about form 2290, heavy highway vehicle use tax return. Web the form 93115194: Web follow the simple instructions below: Web for tax periods beginning on and after january 1, 2022, the thresholds for monthly, quarterly, and annual filing requirements increased, allowing many filers to report less. July 2021) heavy highway vehicle use tax return department of the treasury internal.

Fillable Form Mt903Mn Highway Use Tax Return printable pdf download

Web highway use tax (hut) web file—free and no additional. Web follow the simple instructions below: Jul 14, 2022 — for more information, see when to file and pay. File heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web there are two ways to file:

Mt 903 Mn Form ≡ Fill Out Printable PDF Forms Online

Web there are two ways to file: Taxpayer identification number name street city, state, zip code if there are any changes in your. Figure and pay the tax due on highway motor vehicles used during the period with a. Web you must file form mt‐903, highway use tax return, if you have been issued a certificate of registration (certificate) or.

Download Heavy Highway Vehicle use tax Return Form for Free Page 7

Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web for tax periods beginning on and after january 1, 2022, the thresholds for monthly, quarterly, and annual filing requirements increased, allowing many filers to report less. Taxpayer identification number name street city, state, zip code if there are any changes in.

Web For Tax Periods Beginning On And After January 1, 2022, The Thresholds For Monthly, Quarterly, And Annual Filing Requirements Increased, Allowing Many Filers To Report Less.

Jul 14, 2022 — for more information, see when to file and pay. Web there are two ways to file: Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. File heavy vehicle use tax form for vehicles weighing over 55,000 pounds.

Finding A Authorized Professional, Creating A Scheduled Visit And Going To The Business Office For A Personal Conference Makes Doing A.

Web you must file form mt‐903, highway use tax return, if you have been issued a certificate of registration (certificate) or if you operate a motor vehicle (as defined in tax. Be sure to use the proper. You may web file your highway use tax return. Figure and pay the tax due on highway motor vehicles used during the period with a.

Web About Form 2290, Heavy Highway Vehicle Use Tax Return.

Taxpayer identification number name street city, state, zip code if there are any changes in your. Web the form 93115194: Web highway use tax (hut) web file—free and no additional. Web follow the simple instructions below:

Ad With 2290 Online, You Can File Your Heavy Vehicle Use Tax Form In Just 3 Easy Steps.

July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,.