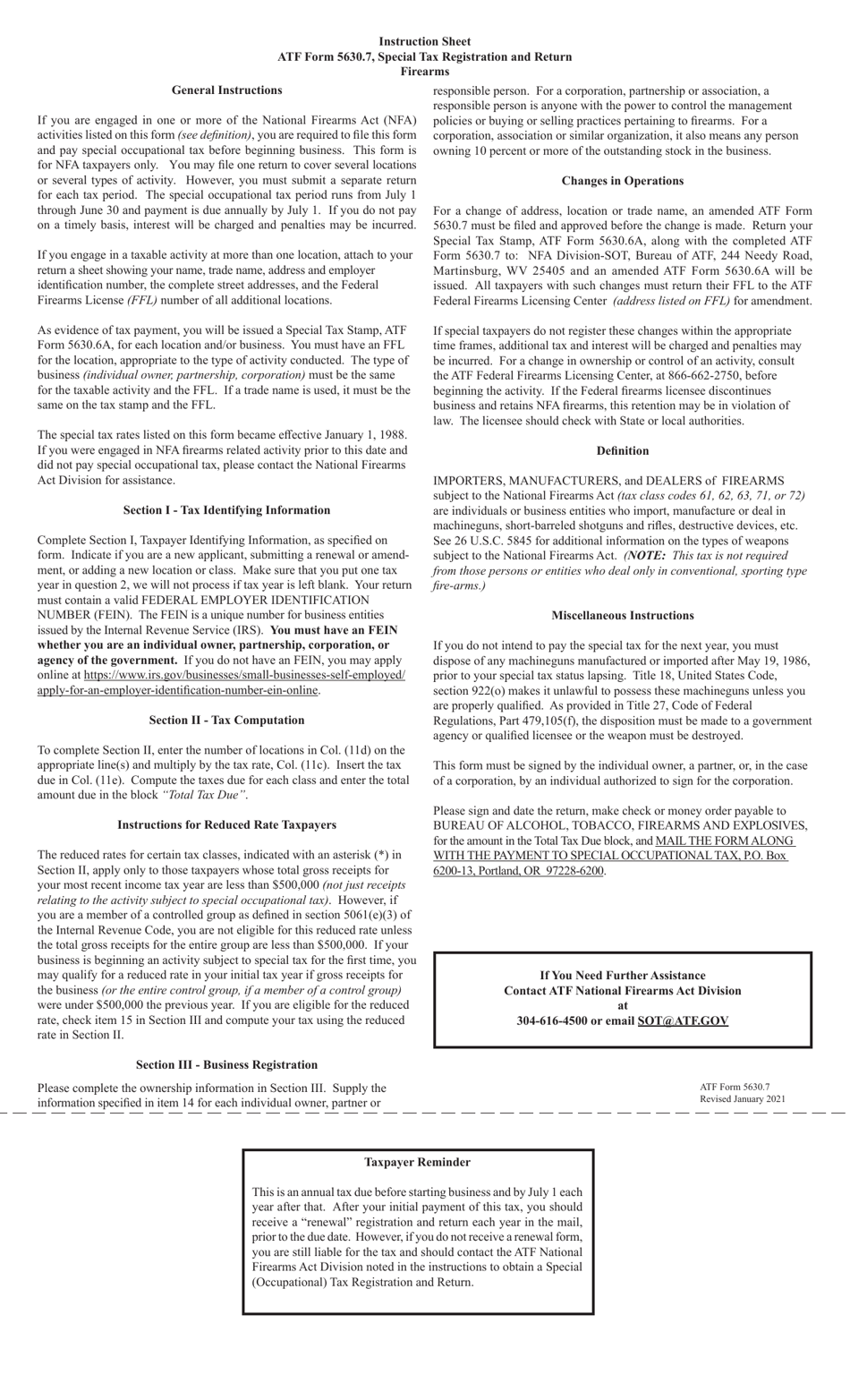

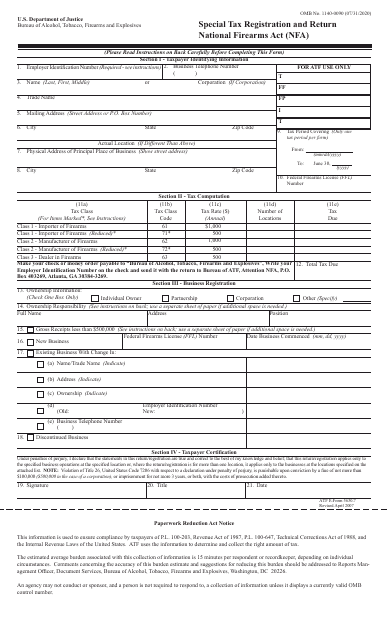

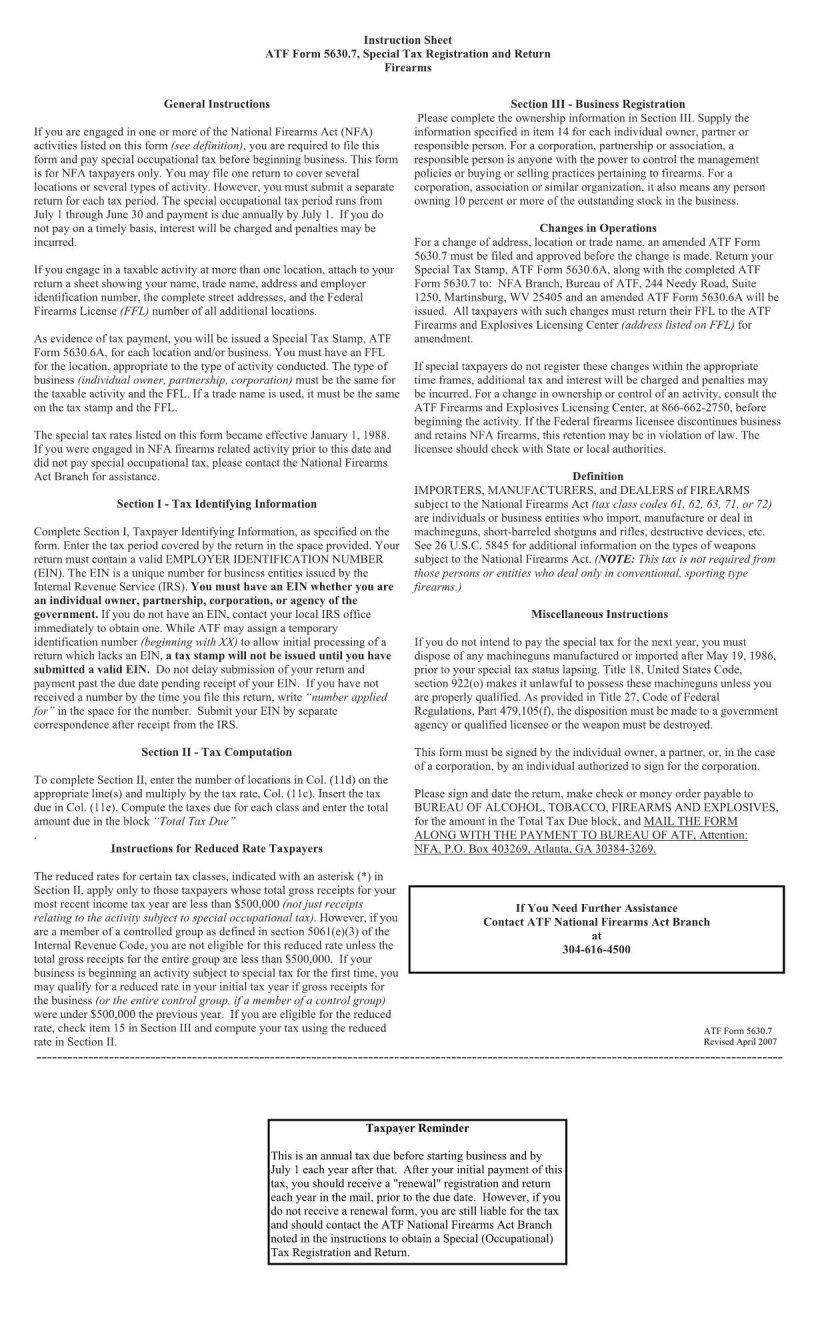

Atf Form 5630.7

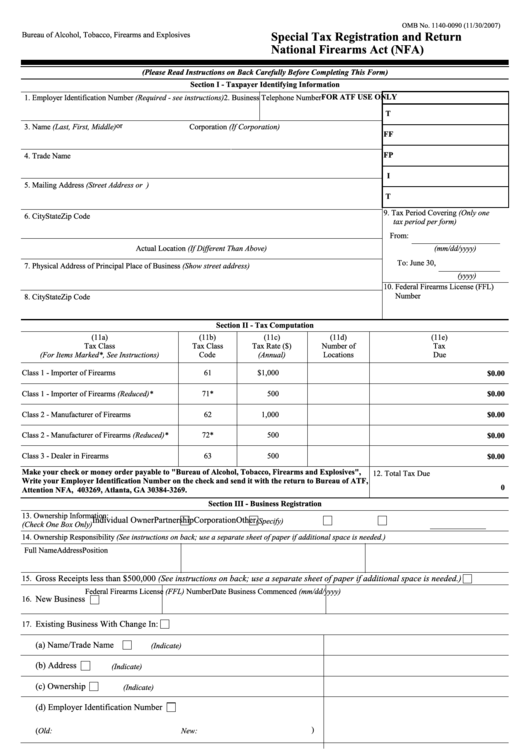

Atf Form 5630.7 - Web federal firearms licensees (ffls) who engage in importing, manufacturing or dealing in national firearms act (nfa) firearms are required to file this form and pay the special occupational tax (sot), an annual tax that begins on july 1 and ends june 30. Web new taxpayers must initially complete the registration and return form (atf f 5630.7); Overview of this information collection: Web after becoming licensed under the gca, the licensee must submit an atf form 5630.7, special tax registration and return national firearms act (nfa) to atf with the appropriate tax payment. Web special tax registration and return national firearms act (nfa) the below link has instructions on how to complete the atf form 5630.7. The special occupational tax period runs from july 1 through june 30 and payment is due annually by july 1. National firearms act (nfa)—special occupational taxes (sot). Web this form is for nfa taxpayers only. However, you must submit a separate return for each tax period. You may file one return to cover several locations or several types of activity.

Atf captures the provided information in the appropriate revenue system and uses that information in subsequent years to populate the renewal forms. Web new taxpayers must initially complete the registration and return form (atf f 5630.7); Web bureau of alcohol, tobacco, firearms and explosives Web federal firearms licensees (ffls) who engage in importing, manufacturing or dealing in national firearms act (nfa) firearms are required to file this form and pay the special occupational tax (sot), an annual tax that begins on july 1 and ends june 30. You may file one return to cover several locations or several types of activity. Web this form is for nfa taxpayers only. Revision of a previously approved collection. However, you must submit a separate return for each tax period. Overview of this information collection: Web special tax stamp, atf form 5630.6a, along with the completed atf form 5630.7 to:

Atf captures the provided information in the appropriate revenue system and uses that information in subsequent years to populate the renewal forms. Web special tax stamp, atf form 5630.6a, along with the completed atf form 5630.7 to: Taxpayers with multiple owners or locations/class, enter only one on this page. The title of the form/collection: Back account (ach) debit or credit card amazon account paypal account review & submit faster filing, convenient and secure! Web atf form 5630.7, special tax registration and return. You may file one return to cover several locations or several types of activity. National firearms act (nfa)—special occupational taxes (sot). All taxpayers with such changes must return their ffl to the atf firearms and explosives licensing center (address listed on ffl) for Web federal firearms licensees (ffls) who engage in importing, manufacturing or dealing in national firearms act (nfa) firearms are required to file this form and pay the special occupational tax (sot), an annual tax that begins on july 1 and ends june 30.

ATF Form 5630.7 Download Fillable PDF or Fill Online Special Tax

Overview of this information collection: Web this form is for nfa taxpayers only. You may file one return to cover several locations or several types of activity. Atf captures the provided information in the appropriate revenue system and uses that information in subsequent years to populate the renewal forms. Web new taxpayers must initially complete the registration and return form.

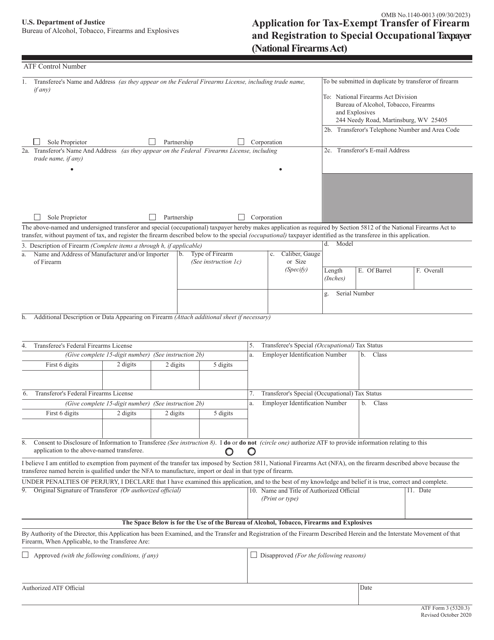

ATF Form 5320.23 Download Fillable PDF or Fill Online National Firearms

Web after becoming licensed under the gca, the licensee must submit an atf form 5630.7, special tax registration and return national firearms act (nfa) to atf with the appropriate tax payment. Nfa branch, bureau of atf, 244 needy road, suite 1250, martinsburg, wv 25405 and an amended atf form 5630.6a will be issued. Web atf form 5630.7 will be the.

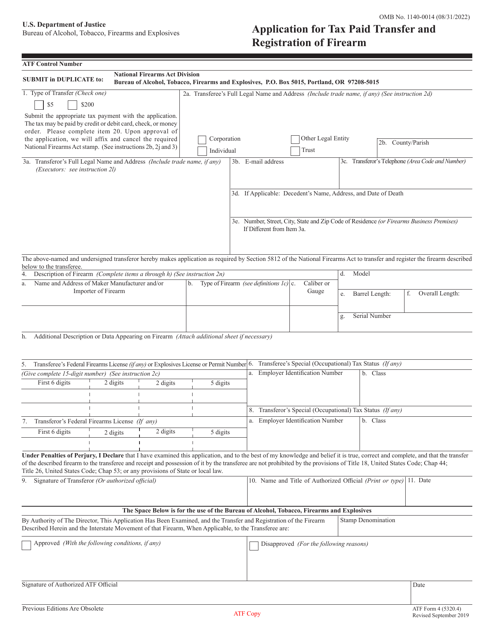

ATF Form 4 (5320.4) Download Fillable PDF or Fill Online Application

Web after becoming licensed under the gca, the licensee must submit an atf form 5630.7, special tax registration and return national firearms act (nfa) to atf with the appropriate tax payment. Back account (ach) debit or credit card amazon account paypal account review & submit faster filing, convenient and secure! The title of the form/collection: Nfa branch, bureau of atf,.

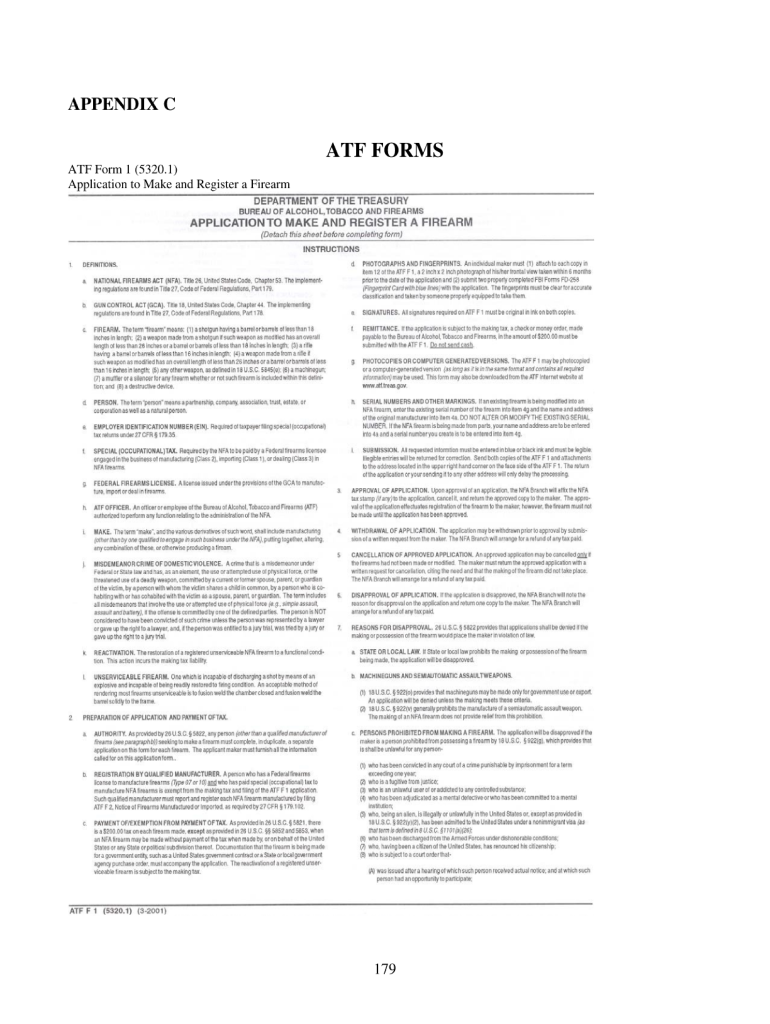

Atf Form 1 Fillable PDF Fill Out and Sign Printable PDF Template

Taxpayers with multiple owners or locations/class, enter only one on this page. Web atf form 5630.7, special tax registration and return. For a corporation, partnership or association, a responsibleperson is anyone with the power to control the management ifyou are engaged in one or more of the national firearms act (nfa) activitieslisted on this form (see definition),you are required to.

ATF Form 3 (5320.3) Download Fillable PDF or Fill Online Application

However, you must submit a separate return for each tax period. Web special tax stamp, atf form 5630.6a, along with the completed atf form 5630.7 to: Web bureau of alcohol, tobacco, firearms and explosives Taxpayers with multiple owners or locations/class, enter only one on this page. The special occupational tax period runs from july 1 through june 30 and payment.

ATF Form 5630.7 Download Fillable PDF or Fill Online Special Tax

Back account (ach) debit or credit card amazon account paypal account review & submit faster filing, convenient and secure! Web atf form 5630.7, special tax registration and return. However, you must submit a separate return for each tax period. Web after becoming licensed under the gca, the licensee must submit an atf form 5630.7, special tax registration and return national.

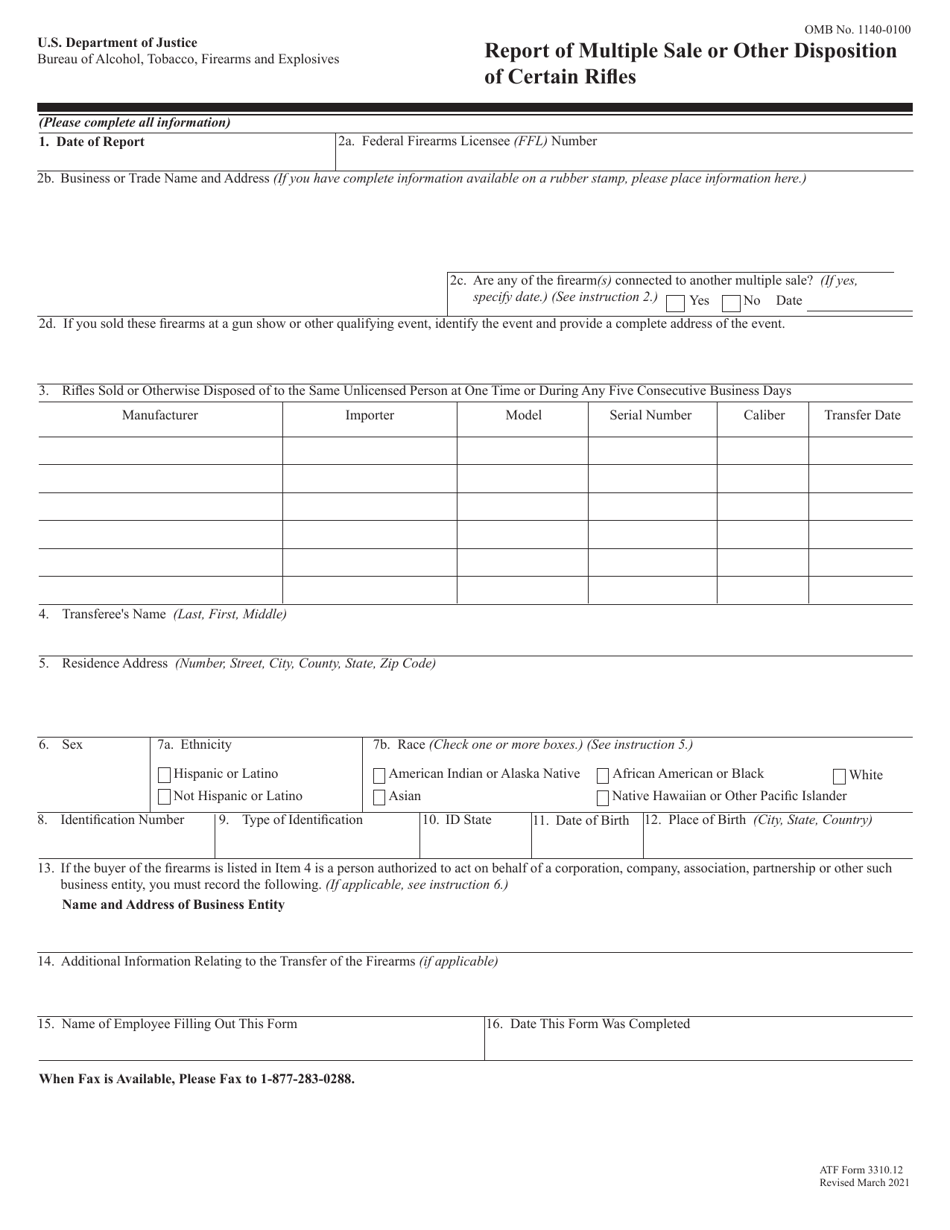

ATF Form 3310.12 Download Fillable PDF or Fill Online Report of

Overview of this information collection: The special occupational tax period runs from july 1 through june 30 and payment is due annually by july 1. Atf captures the provided information in the appropriate revenue system and uses that information in subsequent years to populate the renewal forms. However, you must submit a separate return for each tax period. National firearms.

Atf Form 5630 7 ≡ Fill Out Printable PDF Forms Online

Revision of a previously approved collection. However, you must submit a separate return for each tax period. Back account (ach) debit or credit card amazon account paypal account review & submit faster filing, convenient and secure! Taxpayers with multiple owners or locations/class, enter only one on this page. Web atf form 5630.7, special tax registration and return.

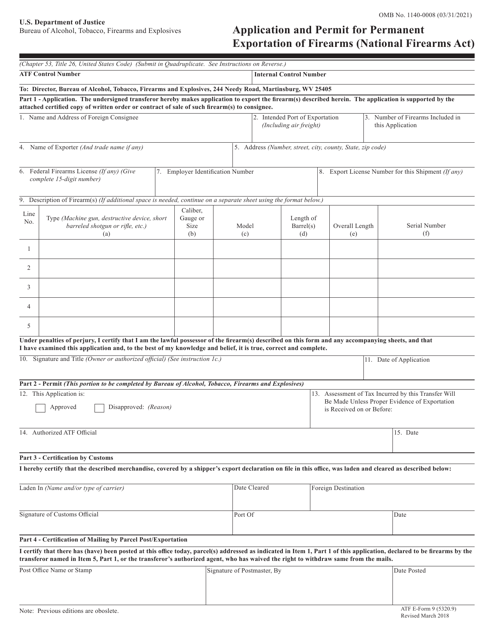

ATF Form 9 (5320.9) Download Fillable PDF or Fill Online Application

Web atf form 5630.7 will be the only form necessary to fulfill the requirement for this ic. Atf captures the provided information in the appropriate revenue system and uses that information in subsequent years to populate the renewal forms. Web new taxpayers must initially complete the registration and return form (atf f 5630.7); The special occupational tax period runs from.

Fillable Atf EForm 5630.7 Special Tax Registration And Return

The special occupational tax period runs from july 1 through june 30 and payment is due annually by july 1. Web atf form 5630.7 will be the only form necessary to fulfill the requirement for this ic. Overview of this information collection: Atf captures the provided information in the appropriate revenue system and uses that information in subsequent years to.

Web Special Tax Stamp, Atf Form 5630.6A, Along With The Completed Atf Form 5630.7 To:

The title of the form/collection: Web atf form 5630.7 will be the only form necessary to fulfill the requirement for this ic. For a corporation, partnership or association, a responsibleperson is anyone with the power to control the management ifyou are engaged in one or more of the national firearms act (nfa) activitieslisted on this form (see definition),you are required to filethis. National firearms act (nfa)—special occupational taxes (sot).

Back Account (Ach) Debit Or Credit Card Amazon Account Paypal Account Review & Submit Faster Filing, Convenient And Secure!

Atf captures the provided information in the appropriate revenue system and uses that information in subsequent years to populate the renewal forms. Web bureau of alcohol, tobacco, firearms and explosives Revision of a previously approved collection. Web special tax registration and return national firearms act (nfa) the below link has instructions on how to complete the atf form 5630.7.

Web This Form Is For Nfa Taxpayers Only.

Web federal firearms licensees (ffls) who engage in importing, manufacturing or dealing in national firearms act (nfa) firearms are required to file this form and pay the special occupational tax (sot), an annual tax that begins on july 1 and ends june 30. You may file one return to cover several locations or several types of activity. The special occupational tax period runs from july 1 through june 30 and payment is due annually by july 1. However, you must submit a separate return for each tax period.

Web After Becoming Licensed Under The Gca, The Licensee Must Submit An Atf Form 5630.7, Special Tax Registration And Return National Firearms Act (Nfa) To Atf With The Appropriate Tax Payment.

Web atf form 5630.7, special tax registration and return. Web new taxpayers must initially complete the registration and return form (atf f 5630.7); Overview of this information collection: Taxpayers with multiple owners or locations/class, enter only one on this page.