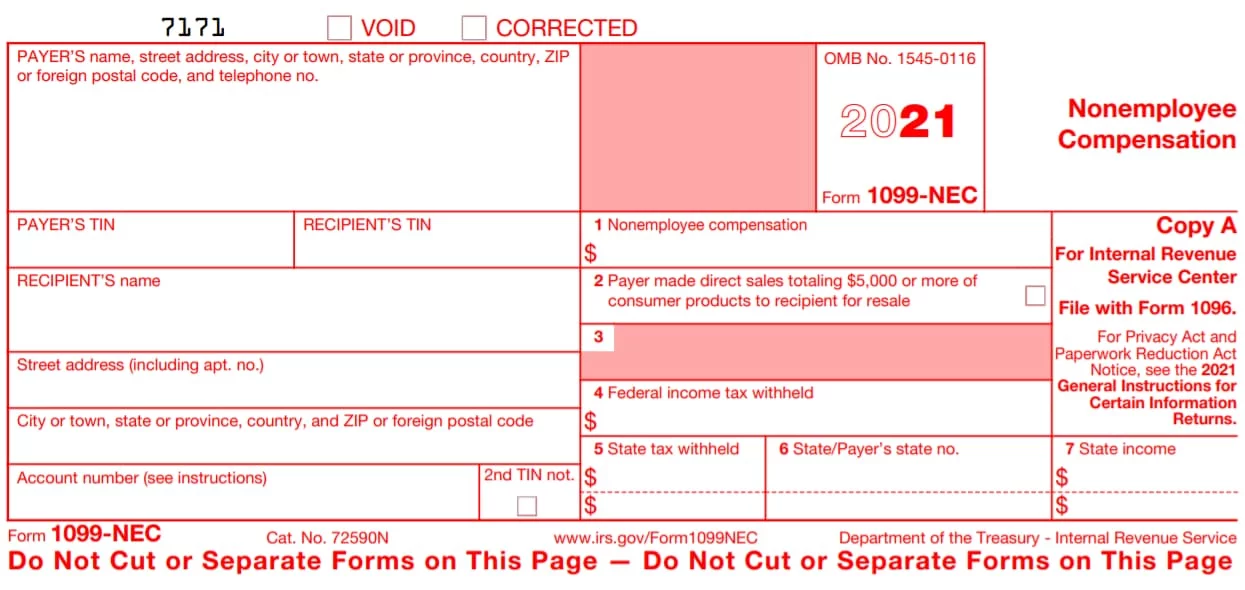

1099- Nec Form 2022

1099- Nec Form 2022 - For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. To file electronically, you must have software that generates a file according to the specifications in pub. Electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). It is for informational purposes and internal revenue service use only. Write your and the recipient's tin. Current general instructions for certain information returns. Web the irs provided taxpayers a new free service on january 23 to help with filing forms 1099 series information returns. Web file copy a of this form with the irs by january 31, 2022. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. For internal revenue service center.

Next write federal income tax that was withheld. Web the 2022 forms: For internal revenue service center. Copy a of the form is in red; Web file copy a of this form with the irs by january 31, 2022. To file electronically, you must have software that generates a file according to the specifications in pub. Web updated for tax year 2022 • june 25, 2023 12:46 pm. Web the irs provided taxpayers a new free service on january 23 to help with filing forms 1099 series information returns. Click the fill out form button. Web get the adams tax form you need to report nonemployee compensation.

To file electronically, you must have software that generates a file according to the specifications in pub. Their business name (if it’s different from the contractor’s name). Web updated for tax year 2022 • june 25, 2023 12:46 pm. Current general instructions for certain information returns. Click the fill out form button. It is for informational purposes and internal revenue service use only. For internal revenue service center. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Both the forms and instructions will be updated as needed. Web get the adams tax form you need to report nonemployee compensation.

What the 1099NEC Coming Back Means for your Business Chortek

Web starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. It is for informational purposes and internal revenue service use only. Web get the adams tax form you need to.

Form 1099NEC Instructions and Tax Reporting Guide

Web file copy a of this form with the irs by january 31, 2022. Web get the adams tax form you need to report nonemployee compensation. Next write federal income tax that was withheld. Copy a of the form is in red; For internal revenue service center.

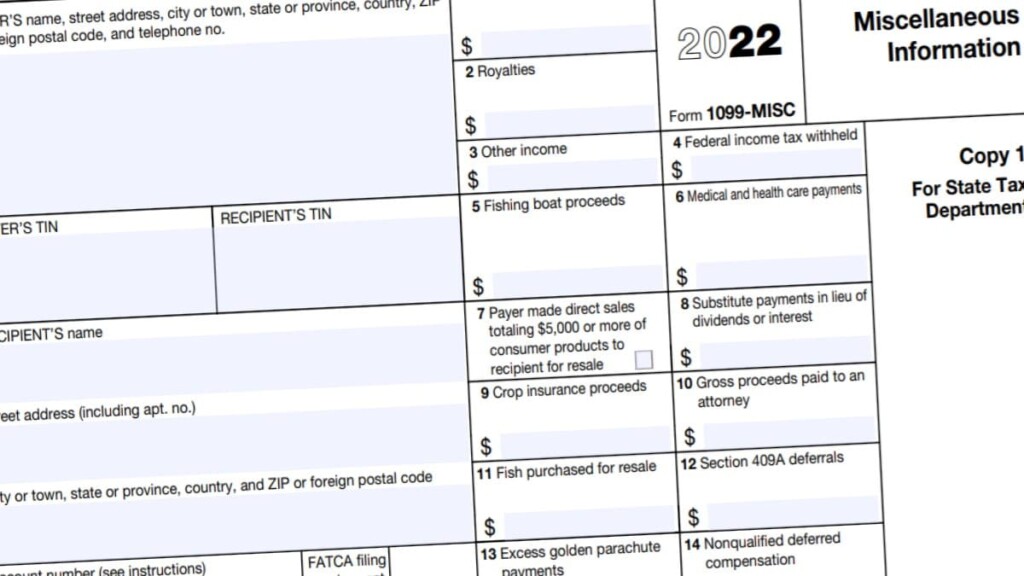

1099 MISC Form 2022 1099 Forms TaxUni

Electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Both the forms and instructions will be updated as needed. To file electronically, you must have software that generates a file according to the specifications in pub. Box 1 will not be used for reporting under section 6050r, regarding cash payments for.

1099 Form Independent Contractor Pdf Form 1099 Nec Form Pros / Some

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Next write federal income tax that was withheld. Web get the adams tax form you need to report nonemployee compensation. It is for informational purposes and internal revenue service use only. Electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris).

1099NEC vs 1099MISC Do You Need to File Both?

Copy a of the form is in red; Web file copy a of this form with the irs by january 31, 2022. The amount of the fine depends on the number of returns and. It is for informational purposes and internal revenue service use only. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

1099 Nec Form 2021 Fill and Sign Printable Template Online US Legal

Electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Next write federal income tax that was withheld. Specify your information in the first field. Web starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Box 1 will not be used for reporting under.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

For internal revenue service center. Web what is the 1099 nec form? For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. The amount of the fine depends on the number of returns and. Web the irs provided taxpayers a new free service on january 23 to help with filing forms 1099 series information returns.

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

Next write federal income tax that was withheld. Write your and the recipient's tin. Both the forms and instructions will be updated as needed. Their business name (if it’s different from the contractor’s name). Current general instructions for certain information returns.

1099NEC Software to Create, Print & EFile IRS Form 1099NEC

Web the irs provided taxpayers a new free service on january 23 to help with filing forms 1099 series information returns. Web starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Web updated for.

1099 NEC Form 2022

For internal revenue service center. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. It is for informational purposes and internal revenue service use only. Copy a of the form is in red; Their business name (if it’s different from the contractor’s name).

Web What Is The 1099 Nec Form?

Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. For internal revenue service center. It is for informational purposes and internal revenue service use only. Write your and the recipient's tin.

Current General Instructions For Certain Information Returns.

Web get the adams tax form you need to report nonemployee compensation. Web the irs provided taxpayers a new free service on january 23 to help with filing forms 1099 series information returns. Both the forms and instructions will be updated as needed. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes.

The Amount Of The Fine Depends On The Number Of Returns And.

Web file copy a of this form with the irs by january 31, 2022. To file electronically, you must have software that generates a file according to the specifications in pub. Their business name (if it’s different from the contractor’s name). Web updated for tax year 2022 • june 25, 2023 12:46 pm.

Specify Your Information In The First Field.

Web starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Click the fill out form button. For internal revenue service center. Web the 2022 forms: